Filing Form 706 is mandatory for some estates, depending on the value. Form 4768 can help those who are worried about being late, as it grants an automatic six-month extension …

Form 3115: Application for Change in Accounting Method

Businesses can choose to use the accrual accounting method or the cash accounting method to track and report financial data and must inform the IRS of their choice. However, if …

Form 4506-A: Request for Public Inspection or Copy of Exempt or Political Organization IRS Form

IRS Form 4506 is the “Request for Copy of Tax Return” used to obtain a copy of a previous year’s tax return or a tax transcript. Several versions of the …

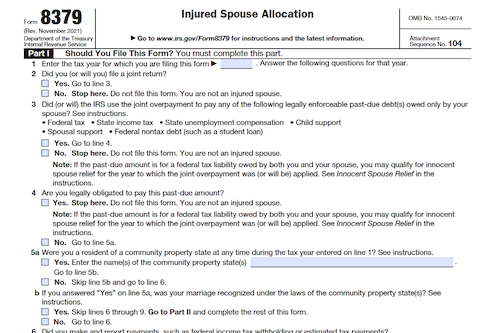

Form 8379: Injured Spouse Allocation

Have you lost your portion of a joint tax refund due to your spouse’s unpaid obligations? Learn how to apply for injured spouse allocation and get back your owed refund …

Form 1040-V: Payment Voucher

Struggling to pay off taxes owed to the IRS? Don’t worry – the IRS has options to help, from installment plans to offers in compromise. Find out how you can …

Form W-3: Transmittal of Wage and Tax Statements

IRS Form W-3 is an important summary transmittal tax form businesses must file with federal agencies along with annual wage and tax forms for employees. It compiles employee salaries and …

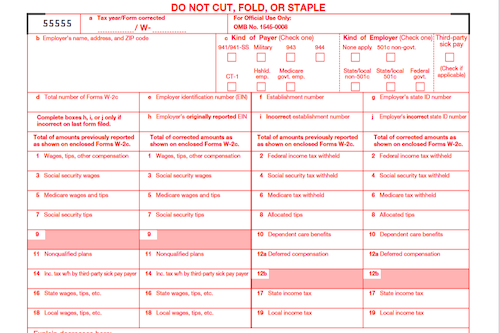

Form W-3-C: Transmittal of Corrected Wage and Tax Statements

Learn how to correct errors on filed W-2 forms, how to get the forms you need, and the penalties imposed for incorrect information on those forms. What is Form W-3-C? …

Form 8822-B: Change of Address or Responsible Party – Business

With various methods to update a mailing address with the Internal Revenue Service (IRS) such as Form 8822, your tax return, by phone, in person, or by mail, it’s important …

Form 8822: Change of Address

With various methods to update a mailing address with the Internal Revenue Service (IRS) such as Form 8822, your tax return, by phone, in person, or by mail, it’s important …

Form 8832: Entity Classification Election

Have you been considering changing the tax status of your Limited Liability Company (LLC) to a corporation or an S corporation? Learn the process of filing IRS Form 8832 or …

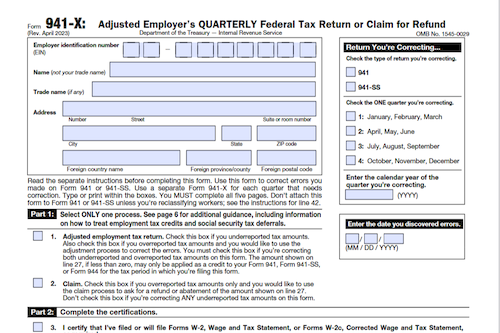

Form 941-X: Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund

Learn the intricacies of IRS Form 941 and proper filing and correction procedures for COVID-19-related tax credits using Form 941-X, including when to file and what can be corrected. What …

Form 945: Annual Return of Withheld Federal Income Tax

Employers must file IRS Form 945 if they have withheld taxes from certain non-payroll payments, such as qualifying pensions, gambling profits, and military retirement and pay. Form 945 is used …

Form 943: Employer’s Annual Federal Tax Return for Agricultural Employees

Learn how to complete Form 943, the Employer’s Annual Federal Tax Return for Agricultural Employees, including requirements for filing, step-by-step instructions, and payment methods. This form is due annually on …

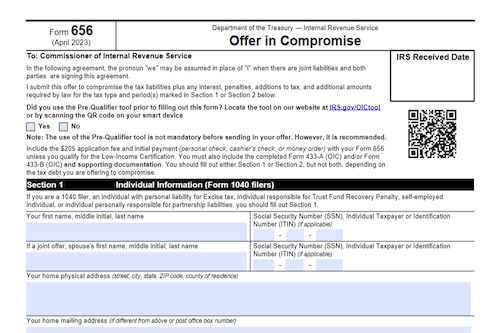

Form 656: Offer in Compromise

Struggling to pay off debt to the IRS? An IRS Offer in Compromise (Form 656) may provide citizens with the relief they need. Read on to learn more about the …

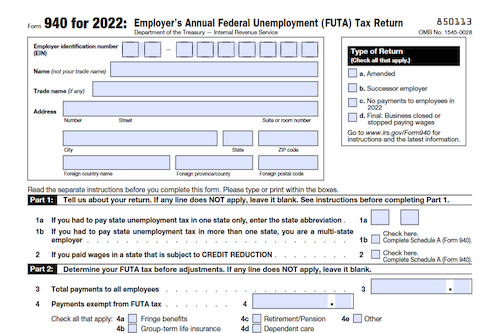

Form 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return

Employers must file IRS Form 940 if they paid $1,500 or more in wages to employees during a calendar quarter or had one or more employees for part of the …

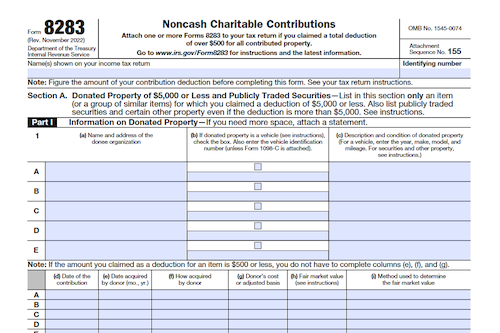

Form 8283: Noncash Charitable Contributions

Counting on the IRS to help minimize taxes for charitable giving? Filing IRS Form 8283 can help individuals, corporations, and partnerships take advantage of tax deductions for noncash donations—but make …

Form 1120: U.S. Corporation Income Tax Return

Filing taxes for a corporation or LLC? Whether it’s your first time completing 1120 or you just need a refresher, learn what IRS Form 1120 is and how to complete …

Form 1040-SS: U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

For U.S. Territory residents not required to file a U.S. income tax return, filing IRS Form 1040-SS (U.S. Self-Employment Tax Return) reports earnings and allows claiming of certain credits, payment …

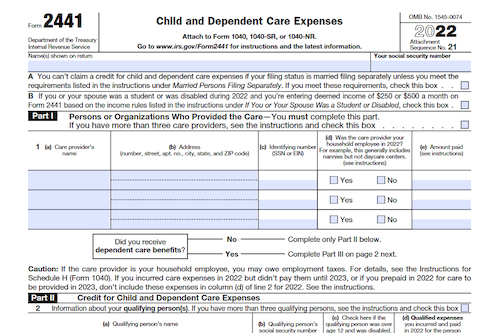

Form 2441: Child and Dependent Care Expenses

If you pay for childcare services or a professional caretaker for your child or disabled loved one, you may be able to take advantage of a child and dependent care …

Form 4506-T-EZ: Short Form Request for Individual Tax Return Transcript

IRS Form 4506-T-EZ is used to gain access to financial records from the IRS, either for yourself or to send to a third party. It is often required when applying …