Businesses can choose to use the accrual accounting method or the cash accounting method to track and report financial data and must inform the IRS of their choice. However, if owners wish to change their accounting method after their first year of business, they must file Form 3115 with the IRS to do so.

What is Form 3115?

Form 3115 is the Internal Revenue Service (IRS) document used to request a change in accounting methods, from a cash to accrual basis or vice-versa, and for changes in the accounting treatment of any item. Your business must choose one of the two primary methods (cash or accrual) when it files its first tax return, and those details are then sent to the IRS. To switch methods after the first year, a Form 3115 must be filed to request the change. Each request must be made with details about why the change is necessary, and the IRS will then provide approval for the accounting method change. Failing to file this document could result in penalties, so it’s important to take proactive steps to submit the form.

IRS Form 3115 – Who Needs to Fill It Out?

Business owners with IRS-registered businesses have the flexibility to choose from the accrual accounting method, the cash accounting method, or a combination of both for financial data tracking and reporting. However, the IRS must be informed of an election of accounting method before the business’s first year of operation. Changes may be requested, but must be done via Form 3115. If such a request is not made, there may be penalties imposed by the IRS. Submitting the form must be done on time and you must assess your particular change request – either automatic or non-automatic – to check further requirements and fees. Failing to submit Form 3115 may mean that your business doesn’t pay sufficient taxes, leading to additional tax bills.

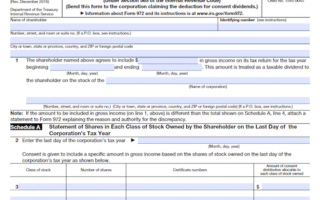

Step-by-Step: Form 3115 Instructions For Filling Out the Document

Filling out and filing Form 3115 to change your business’s accounting method requires careful attention to detail. After electing to use either the accrual method or the cash method for your business, you must informing the IRS of your choice and continue to use it for your first year of operation. Nevertheless, you are allowed the flexibility to change accounting methods as long as you request it from the IRS first. The form must be filled out in both duplicate copies, one to attach to your business’s income tax return and one to send to the IRS. Depending on eligible requirements, you may need to pay a fee for non-automatic change requests. Failing to file the form in time or incorrectly will result in penalties, so consulting a business tax professional is strongly recommended.

Below, we present a table that will help you understand how to fill out Form 3115.

| Information Required for Form 3115 | Details |

|---|---|

| Accounting Method Election | Choose between accrual or cash method |

| Notification to IRS | Informing the IRS of your chosen method |

| First Year of Operation | Using the chosen method for the first year |

| Method Change Request | Request for changing accounting methods |

| Duplicate Copies | Filling out the form in duplicate copies |

| Attachment to Tax Return | One copy to attach to the income tax return |

| Submission to IRS | One copy to send to the IRS |

| Change Request Fee | Possible fee for non-automatic change requests |

| Penalties | Penalties for late or incorrect filing |

| Professional Consultation | Recommendation to consult a tax professional |

Do You Need to File Form 3115 Each Year?

Depending on the type of business you have, you may be required to use either the accrual or cash accounting method to track and report financial data. It is important to note that once you have chosen a method, you need to inform the IRS of your decision and continue to use that same method each year. If you wish to change your accounting method, you need to request this from the IRS by filing Form 3115. Failing to do so can result in penalties and taxes imposed by the IRS. Requesting the change requires you to file two copies of Form 3115 and attach one to your federal income tax return. Depending on your situation, a fee may also be required. It is important to submit the form as soon as possible to avoid any unwanted penalties.

Download the official IRS Form 3115 PDF

On the official IRS website, you will find a link to download Form 3115. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 3115

Sources:

https://www.irs.gov/forms-pubs/about-form-3115

https://www.irs.gov/pub/irs-pdf/i3115.pdf