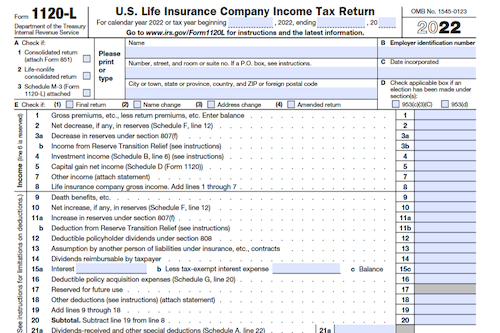

Need to file taxes for a life insurance company? Form 1120-L can help you report income, gains, losses, deductions, and credits, and calculate any associated tax liability.

What is Form 1120-L?

Form 1120-L is the Internal Revenue Service (IRS) form required to file taxes for life insurance companies. This form is used to report income, gains, losses, deductions, credits, and to determine the company’s tax liability. It is important to note that all life insurance companies must file Form 1120-L regardless of the amount of income the company has. Filing this form accurately and on time is essential to avoid unwanted costs and penalties.

IRS Form 1120-L – Who Needs to Fill It Out?

Every life insurance company needs to fill out the IRS Form 1120-L in order to report their income, gains, losses, deductions, and credits, and to calculate the corresponding income tax liability. This form is essential for ensuring life insurance companies comply with the IRS regulations and provide accurate tax records.

Step-by-Step: Form 1120-L Instructions For Filling Out the Document

To complete Form 1120-L, start by preparing a balance sheet showing all of the life insurance company’s assets, liabilities, and capital; the insurance business’s book income; and taxable income. Then, report income, gains, losses, deductions, credits, and calculate tax liability for the company. Once all necessary information is entered, process the form and submit it to the Internal Revenue Service for review. Finally, review the form to ensure accuracy and completeness.

Below, we present a table that will help you understand how to fill out Form 1120-L.

| Information Required for Form 1120-L | Details |

|---|---|

| Balance Sheet | Assets, liabilities, and capital of the life insurance company |

| Book Income | Income generated by the insurance business |

| Taxable Income | Income subject to taxation |

| Income, Gains, Losses | Reported income, gains, and losses |

| Deductions | Applicable deductions |

| Tax Credits | Credits that reduce tax liability |

| Tax Liability | Calculate tax liability for the company |

Do You Need to File Form 1120-L Each Year?

It is important to understand if filing Form 1120-L is necessary on an annual basis. This form is specifically intended for use by life insurance companies to report their income, gains, losses, and deductions, as well as to calculate their income tax liability. Therefore, if a life insurance company must submit income taxes, this form must also be submitted each year.

Download the official IRS Form 1120-L PDF

On the official IRS website, you will find a link to download Form 1120-L. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1120-L

Sources: