Eligible taxpayers with income from a trade or business may be entitled to the Qualified Business Income Deduction if they satisfy the requirements of Section 199A of the Internal Revenue Code. This article provides an overview of the criteria for eligibility, including who can qualify, determining qualified trades or businesses, and information on aggregation, SSTBs and suspended losses/deductions.

What is Form 8995?

Form 8995 is used by individual taxpayers, some trusts and estates, to calculate and apply the Qualified Business Income (QBI) deduction. This deduction is a maximum amount of up to 20% of net QBI from a domestic trade or business or income from a pass-through entity such as a partnership or limited liability company. When determining your QBI deduction, you must consider different factors such as the eligible trades or businesses, your SSTBs, and your taxable income. Ineligible businesses include the performance of services as an employee and trades or businesses conducted by C corporations. The rental of real property is eligible with some restrictions. There are exceptions based on your taxable income and there are limits based on your W-2 wages and Unadjusted Basis Immediate after Acquisition of qualified property. Aggregations are also considerations when determining your QBI deduction.

IRS Form 8995 – Who Needs to Fill It Out?

Individuals and some trusts and estates may need to fill out IRS Form 8995 if they have qualified business income, qualified REIT dividends, or qualified PTP income. They may be entitled to a deduction of up to 20% of their net QBI from trades or businesses, or 20% of REIT dividends or PTP income. However, certain parties (C corporations, S corporations, partnerships, and cooperatives) will not be able to use the deduction, and individuals who perform services as employees are also excluded. In addition, the deduction is limited to 20% of taxable income, which must be calculated before applying the QBI deduction.

Step-by-Step: Form 8995 Instructions For Filling Out the Document

Form 8995 is the tool taxpayers may use to calculate their Qualified Business Income (QBI) deduction, available to individuals, certain trusts and estates. The form is used to work out if there is a deduction entitlement, up to 20% of taxabale income, after considering net QBI, qualified REIT dividends, and qualified PTP income. Additionally, Form 8995-A may be used if more than $170,050 if single, married filing separately, head of household, qualifying surviving spouse, or a trust/estate, or $340,100 if married filing jointly taxable income is earned before the QBI deduction. Various criteria, such as income source and individual factors, can determine eligibility and the total QBI deduction. Certain restrictions apply, such as limiting employees to exclude wages but consider pensions; certain service trades/businesses may be excluded, depending on taxable income level; and rental/licensing of real property, including aggregating multiple trades, may qualify as a QBI trade or business.

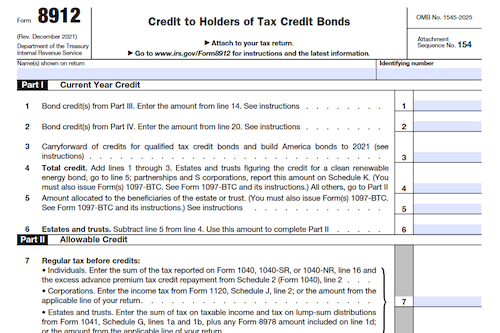

Below, we present a table that will help you understand how to fill out Form 8995.

| Key Information for Form 8995 | Details |

|---|---|

| Purpose | Calculate the Qualified Business Income (QBI) deduction |

| Eligibility | Available to individuals, certain trusts, and estates |

| Criteria | Considerations for income source, restrictions, and deductions |

Do You Need to File Form 8995 Each Year?

Yes, if you are an individual taxpayer, an eligible estate or trust, or an electing small business trust with qualified business income, you must file Form 8995 each year to figure your qualified business income deduction. Generally, the deduction can be claimed for income from a trade or business, including income from a pass-through entity, qualified REIT dividends, and qualified publicly traded partnership income. However, total QBI deduction is limited and your taxable income must fall within certain thresholds. Certain trades or businesses, such as the performance of services as an employee, are not eligible for the deduction. If you have income from multiple trades or businesses, you can choose to aggregate them to determine your deduction.

Download the official IRS Form 8995 PDF

On the official IRS website, you will find a link to download Form 8995. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8995

Sources: