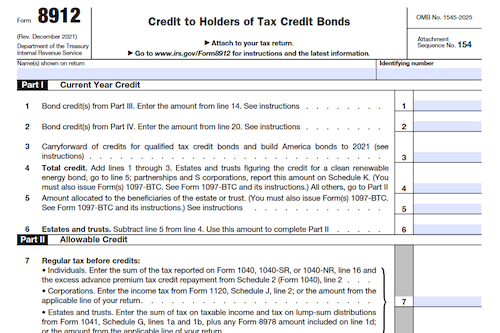

Form 8912 can be used to claim a tax credit from six different types of tax credit bonds – Clean Renewable Energy Bonds, New Clean Renewable Energy Bonds, Qualified Energy Conservation Bonds, Qualified Zone Academy Bonds, Qualified School Construction Bonds, and Build America Bonds. This credit compensates holders for lending money to the issuer and acts as interest paid on the bond.

What is Form 8912?

Form 8912 is used by taxpayers to claim the credit for a variety of tax credit bonds, including Clean renewable energy bonds, New clean renewable energy bonds, Qualified energy conservation bonds, Qualified zone academy bonds, Qualified school construction bonds, and Build America bonds. These bonds allow holders to receive either an income tax credit or taxable interest from the issuer as a form of interest payment. Depending on which type of bond is held, the credit allowance dates can be either March 15, June 15, September 15, December 15 or the last day the qualified tax credit bond is outstanding. However, for QZABs issued before October 4, 2008, only eligible taxpayers like banks, insurance companies, or money lending corporations can claim the credit and the allowance date is the last day of certain one-year periods.

IRS Form 8912 – Who Needs to Fill It Out?

IRS Form 8912 must be filled out by taxpayers who hold Clean Renewable Energy Bonds (CREBs), New Clean Renewable Energy Bonds (NCREBs), Qualified Energy Conservation Bonds (QECBs), Qualified Zone Academy Bonds (QZABs), Qualified School Construction Bonds (QSCBs), or Build America Bonds (BABs). Generally, the credit allowance dates are March 15, June 15, September 15, and December 15. In addition, QZAB holders issued prior to October 4, 2008 must be a bank, insurance company, or other lending corporation to be eligible to claim the credit. The credit allowance date for these bonds is the last day of the 1-year period beginning on the date the bond was issued, as well as each successive 1-year period thereafter.

Step-by-Step: Form 8912 Instructions For Filling Out the Document

Filling out form 8912 is a necessary step for claiming a credit for owning any of the tax credit bonds listed: Clean renewable energy bond (CREB), New clean renewable energy bond (NCREB), Qualified energy conservation bond (QECB), Qualified zone academy bond (QZAB), Qualified school construction bond (QSCB), and Build America bond (BAB). The credit compensates the holder for lending money to the issuer and functions as interest paid on the bond. Those with QZABs issued before October 4, 2008 will generally claim their credit allowance on the last day of the 1-year period after the bond is issued. Generally, credit allowance dates are March 15, June 15, September 15, and December 15, but the last day the bond is outstanding is also an allowance date. Form 8912 must be filed each tax year in which the bond is held on a credit allowance date. Any holder, or shareholder of an S-Corporation, may claim the credit.

Below, we present a table that will help you understand how to fill out Form 8912.

| Information Required for Form 8912 | Details |

|---|---|

| Filing Requirement | Necessary for claiming a credit for owning specific tax credit bonds |

| Credit Allowance Dates | Claim the credit allowance on specific dates |

| Form Filing | Must be filed each tax year in which the bond is held on a credit allowance date |

| Credit Claimant | Any holder or shareholder of an S-Corporation may claim the credit |

Do You Need to File Form 8912 Each Year?

Yes! If you are the holder of a Clean Renewable Energy Bond (CREB), New Clean Renewable Energy Bond (NCREB), Qualified Energy Conservation Bond (QECB), qualified Zone Academy Bond (QZAB), Qualified School Construction Bond (QSCB), or Build America Bond (BAB), you will need to file Form 8912 each year in order to claim the credit associated with these bonds. Generally, the credit allowance dates are March 15, June 15, September 15, December 15, and the last day of the bond’s term. Holders of QZABs issued before October 4, 2008 will not be eligible to claim the credit unless they are a bank, insurance company, or other lending institution. Shareholders of an S-Corporation may claim the credit from a QZAB held by an S-Corp if the S-Corp is an eligible taxpayer.

Download the official IRS Form 8912 PDF

On the official IRS website, you will find a link to download Form 8912. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8912

Sources: