Learn the intricacies of IRS Form 941 and proper filing and correction procedures for COVID-19-related tax credits using Form 941-X, including when to file and what can be corrected.

What is Form 941-X?

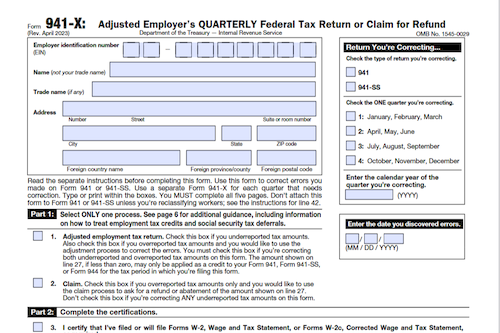

Form 941 is an Employer’s Quarterly Federal Tax Return submitted to the Internal Revenue Service every quarter. It reports FICA and income taxes withheld from employee pay, FICA taxes payable by the employer, and can also report wages for the Employee Retention Credit, Sick Leave/Family Leave Credit, and other COVID-19-related tax credits. To make corrections to Form 941, employers must use Form 941-X. This form is used to correct wages, FICA taxes, and other information reported on Form 941. Depending on when and why Form 941 is being corrected, different filing procedures are required. Businesses must ensure they use the correct version of Form 941 and Form 941-X. It is important to get help from a professional if you do not feel comfortable making corrections yourself.

IRS Form 941-X – Who Needs to Fill It Out?

IRS Form 941 is the Employer’s Quarterly Federal Tax Return and must be completed by employers each quarter to report on wages, taxes, and other aspects of their payroll. Form 941 has been changed for 2020 to include items relating to the employee retention credit (ERC), sick leave/family leave credits, and other COVID-19-related credits. To correct any mistakes made on the form, use Form 941-X. This form can be used to correct wages, tips, and other compensation, and income tax, along with FICA taxes and Additional Medicare tax withheld, for one quarter only. To make an interest-free adjustment on a future quarter’s 941 form, submit Form 843. If any employee withholding was affected, written consent must be obtained from each affected employee.

Step-by-Step: Form 941-X Instructions For Filling Out the Document

Filing IRS Form 941 is required of all employers quarterly to report income taxes and FICA taxes withheld from employees’ pay, and to report FICA taxes that the employer must pay. To correct mistakes on Form 941, one must use Form 941-X. This form includes copies of the original form with additional line items and spaces for corrections. It is divided into five parts, which ask for different pieces of information including if it is a claim or an adjusted return, a detailed explanation of why the corrections are being made, and signatures of the filer and preparer. Depending on whether taxes were under- or over-reported, one must file Form 941-X by different deadlines – typically within 30 days of the original 941 being filed. It is important to follow the instructions on the form and seek professional advice as needed.

Below, we present a table that will help you understand how to fill out Form 941-X.

| Information Required for Form 941-X | Details |

|---|---|

| Form Type | Form 941-X |

| Frequency | Quarterly |

| Purpose | Correcting mistakes on Form 941 |

| Contents | Copies of original Form 941 with additional line items and correction spaces |

| Parts | Five parts for different pieces of information |

| Claim or Adjusted Return | Specify if it’s a claim or an adjusted return |

| Explanation | Detailed explanation of correction reasons |

| Signatures | Signatures of filer and preparer |

| Deadlines | Varies depending on under- or over-reported taxes, typically within 30 days |

| Instructions | Follow form instructions and seek professional advice if needed |

Do You Need to File Form 941-X Each Year?

Yes, employers must file IRS Form 941 every quarter to report income taxes withheld from employees’ pay and FICA taxes paid by the employer. Employers must also use Form 941-X to correct mistakes on Form 941 for COVID-19-Related Tax Credits such as the employee retention credit, the sick leave/family leave credits, and other COVID-19-related tax credits. The due date for filing Form 941-X can vary depending on when mistakes were discovered. Employers must follow the instructions on Form 941-X, which has five parts covering additional information required when filing corrections. Professional advice is recommended when making corrections on Form 941 and Form 941-X.

Download the official IRS Form 941-X PDF

On the official IRS website, you will find a link to download Form 941. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 941-X

Sources:

https://www.irs.gov/forms-pubs/about-form-941-x

https://www.irs.gov/instructions/i941x