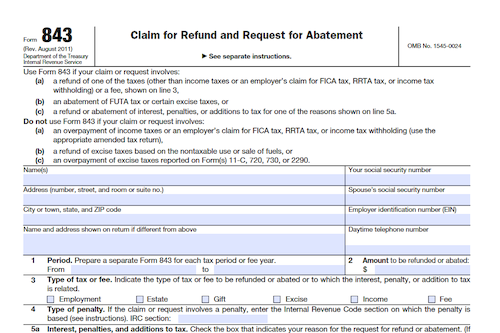

Form 843 is a tax document issued by the Internal Revenue Service (IRS) used by taxpayers to make a claim for a refund of certain assessed taxes or to request abatement of interest or penalties applied in error. It must be filed within two years from the date the taxes were paid or three years from the date the return was filed, whichever is later. Form 843 can be used to ask for abatement of certain taxes such as estate or gift taxes, or Social Security or Medicare taxes that were withheld in error, and for interest or penalties due to IRS error or delays. It cannot be used to amend a return to claim a refund of agreement, offer-in-compromise fees, or lien fees, nor can it be used to claim a refund or abatement of FICA, Railroad Retirement Tax Act, or income tax withholding taxes. To file Form 843, the taxpayer must provide basic information, a statement of the facts and issues as to why they are entitled to refund or abatement, and a reason for the request. If the IRS believes the refund amount is excessive, they can add a 20% penalty on the amount determined to be excessive. If the claim is denied, the taxpayer has the right to petition the U.S. District Court or the U.S. Court of Federal Claims. Alternatively, a protective claim can be filed before the statute of limitations expiration to preserve the right to make a claim for a refund.

What is Form 843?

Form 843 is a multipurpose tax document issued by the Internal Revenue Service (IRS). It allows taxpayers to claim a refund of certain assessed taxes or to request an abatement of interest or penalties applied in error. Reasons to file this form range from excessive taxes withheld from paychecks by employers, to IRS errors or delay in assessing taxes. Taxpayers must provide basic information, as well as a statement of facts, evidence, and computations that support their request. Forms must be submitted within two years from the date taxes were paid or three years from the date the return was filed (whichever is later). Protective claims can also be made to preserve taxpayer’s right to make a claim for a refund.

IRS Form 843 – Who Needs to Fill It Out?

Form 843: Claim for Refund and Request for Abatement must be filled out and filed within two years from the date taxes were paid or three years from the date the return was filed, whichever is later. If you have been over-withheld income, Social Security, or Medicare taxes, or if you received wrong penalties or additions to tax, you can use this form to ask for a refund or abatement from the IRS. In order to do so, the form requires basic information, along with a statement of facts as to why you are entitled to a refund or abatement. If the IRS denies your claim, you can petition the U.S. District Court or the U.S. Court of Federal Claims. Alternatively, you can file a protective claim before the expiration of the statute of limitations to preserve your right to make a claim for a refund.

Step-by-Step: Form 843 Instructions For Filling Out the Document

Filling out Form 843 for a refund or abatement of certain taxes can be a relatively straightforward process. The form requires basic information such as name, address, Social Security number, tax period, tax type and return type. It may also be necessary to provide an explanation of why you are entitled to a refund or abatement, including a statement of facts and issues and the Internal Revenue Code (IRC) section number of the penalty, if applicable. Attachments may be necessary in order to support evidence and computations. It must generally be filed within two years from the date the taxes were paid or three years from the date the return was filed, whichever is later. Appeal options are available if the IRS refuses the claim, including petitioning the U.S. District Court or the U.S. Court of Federal Claims. Protective claims can also be made before the expiration of the statute of limitation in order to preserve the right to seek a refund.

Below, we present a table that will help you understand how to fill out Form 843.

| Information Required for Form 843 | Details |

|---|---|

| Name | Individual’s full name |

| Address | Current mailing address |

| Social Security Number | Unique identification number |

| Tax Period | Period for which the tax refund or abatement is being claimed |

| Tax Type | The specific type of tax for which the refund or abatement is sought |

| Return Type | Type of tax return (e.g., individual, business) |

| Explanation | Reason for the refund or abatement request, including a statement of facts and issues |

| IRC Section Number | Internal Revenue Code section number related to the penalty, if applicable |

| Attachments | Any supporting evidence and computations |

| Filing Deadline | Generally, within two years from the date taxes were paid or three years from the date the return was filed, whichever is later |

| Appeal Options | Options for appealing the IRS’s decision if the claim is refused |

| Protective Claims | Claims made before the statute of limitations expires to preserve the right to seek a refund |

Do You Need to File Form 843 Each Year?

If you have been wrongly assessed taxes, interest, or penalties by the IRS, you may be eligible to receive a refund or abatement by filing Form 843. The form can be used to ask the IRS for abatement of certain taxes other than income, such as estate or gift taxes, as well as penalties due to IRS error or institutional delays. It can also be used for Social Security or Medicare taxes that were withheld in error. The filing of the form must occur within two years of when the taxes were paid or three years of when the return was filed, whichever is later. Remember that separate forms must be filed for each type of tax or fee, and for each tax year. Be sure to include evidence and computations to accompany your statement of facts and issues in order to be eligible for a refund or abatement.

Download the official IRS Form 843 PDF

On the official IRS website, you will find a link to download Form 843. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 843

Sources:

https://www.irs.gov/forms-pubs/about-form-843

https://www.irs.gov/instructions/i843