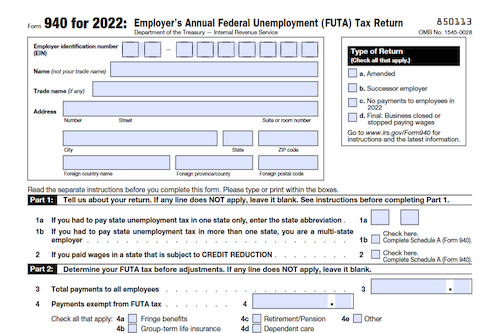

Employers must file IRS Form 940 if they paid $1,500 or more in wages to employees during a calendar quarter or had one or more employees for part of the day or the entire day for 20 or more weeks in a year. The revenue generated from the FUTA tax helps cover unemployment payments for workers who have lost their jobs. Filing late, not filing, or making late payments will result in penalties at a predetermined rate.

What is Form 940?

IRS Form 940 is used by employers to report and make payments for the Federal Unemployment Tax Act (FUTA) tax when they have paid more than $1,500 in wages to employees in the calendar quarter. Employers that have had one or more employees for more than 20 weeks in the calendar year have to file IRS Form 940, with a deadline of January 31st. This form, and the FUTA tax payments collected, help cover the unemployment payments to workers who have lost their jobs. To complete the form, employers must fill in the required information, estimate FUTA tax payments, and make the payment by January 31st. Failure to file or make payments on time will result in certain penalties. The form can be amended by filling out another IRS Form 940.

IRS Form 940 – Who Needs to Fill It Out?

Employers who pay more than $1,500 of wages to employees in a calendar quarter or who had one or more employees for part of the day or the entire day for 20 or more weeks in the year are required to fill out IRS Form 940. FUTA tax payments are due quarterly and revenue generated from this tax helps pay for unemployment payments for those who have lost their job. If you did not make payments to employees or if your business closed, you will still need to file Form 940. Penalties may be assessed for failing to file or for making late payments, so make sure to fill out the form accurately.

Step-by-Step: Form 940 Instructions For Filling Out the Document

Completing Form 940 is required by employers who paid more than $1,500 to employees during a calendar quarter or had one or more employees for part of the day, or the the entire day, for 20 or more weeks in the year. All part and full-time employees should be included in this consideration. To submit the form, all required sections must be filled out according to the instructions listed by the IRS, including reporting the total payments made to employees throughout the year and calculating the FUTA tax rate (0.006). After completing the form, it must be submitted by either mail (to the IRS office nearest you) or online via IRS.gov/EmploymentEfile. Failure to file on time, or make late payments, can cause penalties of predetermined rate to be imposed. It is important to note that, if needed, the form can be amended by filing another IRS Form 940.

Below, we present a table that will help you understand how to fill out Form 940.

| Information Required for Form 940 | Details |

|---|---|

| Employer Eligibility | Employers who paid more than $1,500 to employees during a calendar quarter or had one or more employees for part of the day, or the entire day, for 20 or more weeks in the year. |

| Included Employees | All part and full-time employees should be included in this consideration. |

| Form Submission | To submit the form, all required sections must be filled out according to the instructions listed by the IRS, including reporting the total payments made to employees throughout the year and calculating the FUTA tax rate (0.006). |

| Submission Options | After completing the form, it must be submitted by either mail (to the IRS office nearest you) or online via IRS.gov/EmploymentEfile. |

| Penalties | Failure to file on time, or make late payments, can cause penalties of a predetermined rate to be imposed. |

| Amendment | It is important to note that, if needed, the form can be amended by filing another IRS Form 940. |

Do You Need to File Form 940 Each Year?

Employers must file Form 940 annually if they paid more than $1,500 in wages or had employees work at least 20 total weeks during a calendar year. FUTA taxes are collected to help cover unemployment payments for unemployed workers. The form must be completed carefully following given instructions and then either be filed online or mailed to an IRS office. Not filing the form or filing late can result in penalties, so accuracy is important when submitting Form 940. Amending a previously filed form can also be done with Form 940.

Download the official IRS Form 940 PDF

On the official IRS website, you will find a link to download IRS Form 940. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 940

Sources:

https://www.irs.gov/forms-pubs/about-form-940

https://www.irs.gov/instructions/i940