Form 4563 is a tax form created by the IRS to determine the amount of income earned in American Samoa that should be excluded from a taxpayer’s gross income. It …

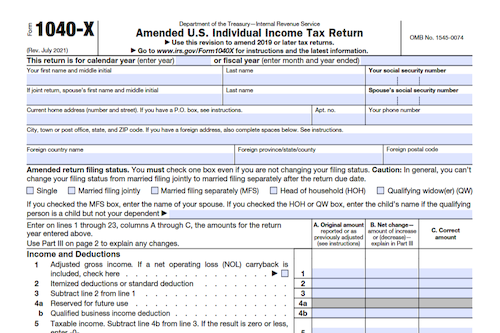

Form 1040-X: Amended U.S. Individual Income Tax Return

Filing an amended tax return with Form 1040-X is used by taxpayers to correct errors made on previously filed federal tax returns. Common corrections on 1040-X forms include filing status, …

Form 4506-T: Request for Transcript of Tax Return

Form 4506, Request For Copy of Tax Return, is an IRS form used by taxpayers to request exact copies of previously filed tax returns and tax information. It can be …

Form 2106: Employee Business Expenses

Form 2106: Employee Business Expenses is a tax form distributed by the Internal Revenue Service (IRS) used by employees to deduct ordinary and necessary expenses related to their jobs. Starting …

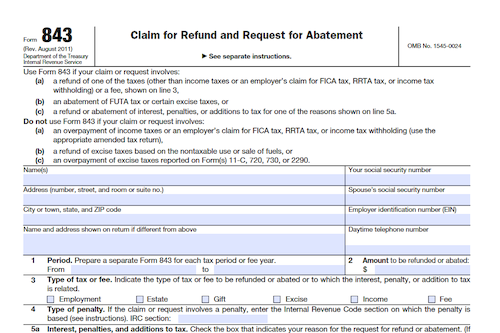

Form 843: Claim for Refund and Request for Abatement

Form 843 is a tax document issued by the Internal Revenue Service (IRS) used by taxpayers to make a claim for a refund of certain assessed taxes or to request …

Form 1040-SR: U.S. Tax Return for Seniors

Form 1040-SR is a tax return form designed specifically for taxpayers over the age of 65. It is virtually identical to the standard 1040 form, except it is easier on …

Form 1310: Statement of Person Claiming Refund Due a Deceased Taxpayer

Form 1310 is an IRS form used to claim a federal tax refund for beneficiaries of a recently deceased taxpayer. It can be filed by the surviving spouse, another beneficiary, …

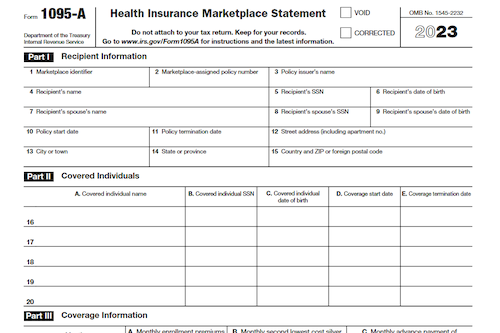

Form 1095-A: Health Insurance Marketplace Statement

It is important to be aware of Form 1095-A: Health Insurance Marketplace Statement and its role in your life. This form is sent to Americans who obtained health insurance coverage …

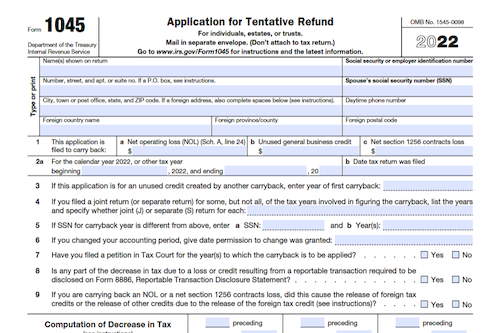

Form 1045: Application for Tentative Refund

Are there any questions about what Form 1045: Application for Tentative Refund is or how to file it? What is Form 1045? Form 1045: Application for Tentative Refund is an …

Form 4506: Request for Copy of Tax Return

Form 4506, Request for Copy of Tax Return, is a form filed by taxpayers to request exact copies of one or more previously filed tax returns and other tax information …

Form 9465: Installment Agreement Request

Form 9465: Installment Agreement Request is an official document provided by the Internal Revenue Service (IRS) for taxpayers who find themselves unable to make a lump sum payment for their …

Form 2848: Power of Attorney and Declaration of Representative

Form 2848: Power of Attorney and Declaration of Representative is an Internal Revenue Service (IRS) document that authorizes an individual or organization to represent a taxpayer by appearing before the …

Form 8962: Premium Tax Credit

IRS Form 8962 is a form used to calculate the amount of premium tax credit you’re eligible to receive, or determine if you owe money to the Internal Revenue Service …

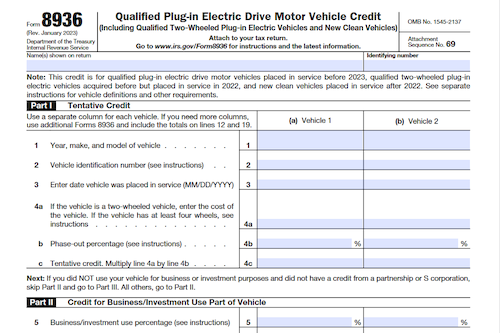

Form 8936: Qualified Plug-In Electric Drive Motor Vehicle Credit

Are you thinking of purchasing an electric vehicle in 2022? If so, you may be eligible for a tax credit! The Internal Revenue Service (IRS) offers tax credits up to …

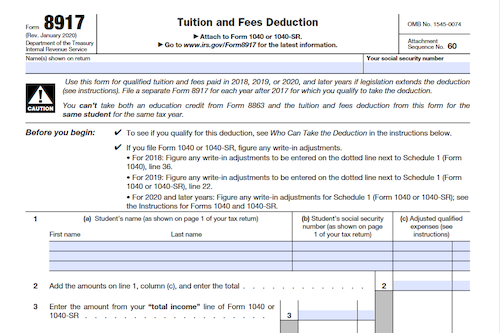

Form 8917: Tuition and Fees Deduction

Form 8917 is an Internal Revenue Service (IRS) tax form that accompanies Form 1040 and is used to claim the tuition and fees deduction. The deduction is available for qualified …

Form W-4: Employee’s Withholding Certificate

A W-4, Employees Withholding Certificate, is an important form to fill out when you begin a new job. This form indicates how much tax your employer will need to withhold …

Form W-2: Wage and Tax Statement

Form W-2 (also known as the Wage and Tax Statement) is a document that employers must provide to their employees and to the Internal Revenue Service (IRS). It reflects an …

Form 5498: IRA Contribution Information (Info Copy Only)

IRS Form 5498: IRA Contribution Information is a document sent to the IRS and you by your IRA trustee or custodian. It reports contributions, Roth IRA conversions, rollovers, and required …

Form 1099-SA: Distributions From an HSA, Archer MSA, or Medicare Advantage MSA

Thank you for your question. Form 1099-SA, commonly known as the Distributions from an HSA, Archer MSA, or Medicare Advantage MSA form, is an Internal Revenue Service form that reports …

Form 1099-R: Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Form 1099-R: Distributions From Pensions, Annuities, Retirement, or Profit-Sharing Plans is an Internal Revenue System (IRS) tax form used for reporting passive income and distributions from retirement plans. The form …