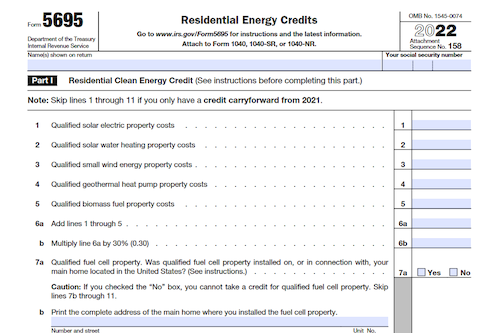

Reduce your utility bills and lower your tax obligation with federal tax credit Form 5695 – “Residential Energy Credits”. Learn more about which energy efficiency upgrades qualify, how to claim …

Form 56: Notice Concerning Fiduciary Relationship

From the time of death to the end of a fiduciary relationship, IRS Form 56 must be filed to notify the IRS of changes and to list a fiduciary as …

Form 8821: Tax Information Authorization

IRS Form 8821, Tax Information Authorization, is a single page document used to grant permission for any type of tax filing for any given year to a person or company, …

Form 2210: Underpayment of Estimated Tax by Individuals, Estates and Trusts

Failing to pay estimated taxes to the IRS correctly can result in penalties – but what if you can’t afford them? Find out how IRS Form 2210, Abatement Services, and …

Form 944: Employer’s Annual Federal Tax Return

For small business owners who pay less than $1,000 in payroll taxes annually, understanding IRS Form 944 could be the key to simplifying the process and saving money. Learn more …

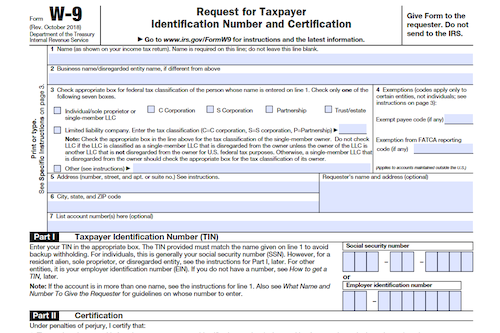

Form W-9: Request for Taxpayer Identification Number and Certification

Understand your responsibilities as an independent contractor or freelancer when filling out the IRS Form W-9. From what type of information is requested to red flags to watch out for, …

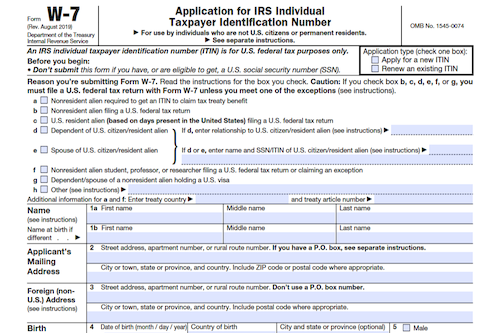

Form W-7: Application for IRS Individual Taxpayer Identification Number

Applying for an Individual Taxpayer Identification Number (ITIN) can be necessary for non-U.S. citizens or unauthorized residents who can’t otherwise get a Social Security Number. Learn more about the process, …

Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)

W-8 forms are IRS forms used by foreign individuals or businesses to reduce or exempt their tax withholdings on income from U.S. sources. Different forms are required for various circumstances, …

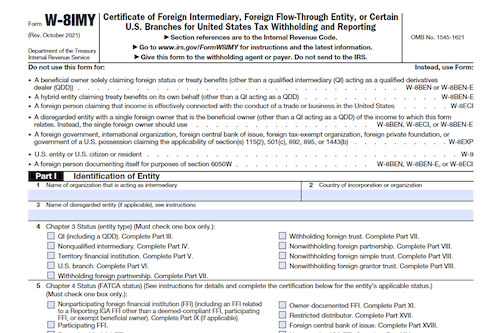

Form W-8IMY: Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting

For foreign individuals and entities that receive income in the U.S., W-8 forms are IRS forms used to verify their country of residence for tax purposes, and to claim exempt …

Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting

For foreign individuals and entities that receive income in the U.S., W-8 forms are IRS forms used to verify their country of residence for tax purposes, and to claim exempt …

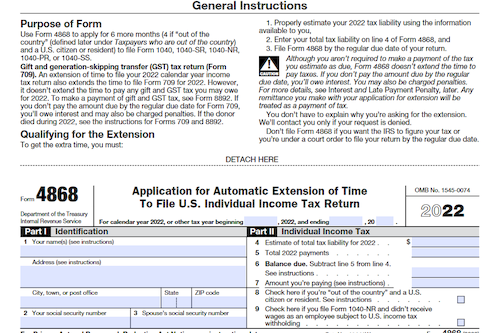

Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

Taxpayers who need more time to file a federal income tax return can use Form 4868 to get a 6-month extension – however, it does not extend the time to …

Form SS-4: Application for Employer Identification Number

Every business entity needs an employer identification number (EIN) to operate and keep personal finances separate from business ones. The EIN is issued by the IRS for free and can …

Form 1098: Mortgage Interest Statement

Form 1098 is an IRS form that shows how much interest you have paid in one year on a qualified home mortgage. It can be used to figure out a …

Form 4952: Investment Interest Expense Deduction

Form 4952: Investment Interest Expense Deduction is a tax form used by the IRS to determine the amount of investment interest expense that can be deducted and any interest expense …

Form 4684: Casualties and Thefts

Form 4684 is an IRS form used to report losses from casualties and thefts that may be deductible for taxpayers who itemize deductions, such as disasters and thefts resulting from …

Form W-2G: Certain Gambling Winnings

Gambling winnings must be reported as income to the IRS, and Form W-2G is the document that gambling establishments send to customers who had winnings during the prior year. This …

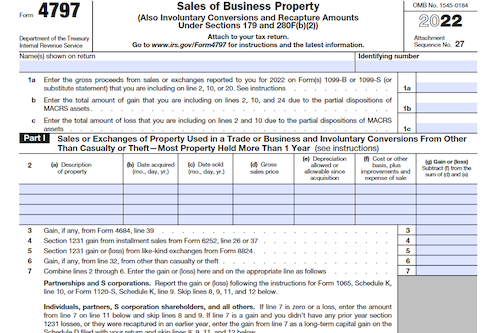

Form 4797: Sales of Business Property

Form 4797 is a tax form issued by the IRS and used to report financial gains made from the sale or exchange of business property, including property used to generate …

Form 1095-C: Employer-Provided Health Insurance Offer and Coverage

Form 1095-C: Employer-Provided Health Insurance Offer and Coverage is an IRS tax form used to report information about an employee’s health coverage offered by an Applicable Large Employer (ALE). It’s …

Form 1095-B: Health Coverage

Form 1095-B is an IRS document that shows taxpayers, their spouses, and dependents if covered, information about their health care coverage under the Affordable Care Act (ACA). Its purpose is …

Form 4562: Depreciation and Amortization

Form 4562: Depreciation and Amortization is an Internal Revenue Service (IRS) form used to claim deductions for the depreciation or amortization of an asset, expense certain property, and more. Anyone …