Form 1095-B is an IRS document that shows taxpayers, their spouses, and dependents if covered, information about their health care coverage under the Affordable Care Act (ACA). Its purpose is to indicate minimum essential coverage or exemption on a tax return, or to determine state penalties.

What is Form 1095-B?

Form 1095-B is an IRS form that can be sent to taxpayers to provide information regarding health insurance coverage as defined by the Affordable Care Act (ACA). It outlines information such as coverage, effective coverage dates, individuals covered, and the coverage provider. It does not need to be submitted with the tax return, but the taxpayer does need to check off a box indicating months of health insurance coverage during the tax year. 1095-B is sent to individuals from health insurance providers, while 1095-C may be sent from employers with 50 or more employees. Although 1095-B itself is not required for taxes, it is important to provide the required information from the form to follow the ACA’s individual shared responsibility provision.

IRS Form 1095-B – Who Needs to Fill It Out?

Who Needs to Fill Out IRS Form 1095-B? Individuals who receive minimum essential health insurance coverage as defined by the Affordable Care Act (ACA), such as those with coverage from most employer health plans or government-sponsored plans like Medicare and Medicaid, need to fill out Form 1095-B. This form will show information such as the health insurance coverage, effective dates of the coverage, individuals covered, and the provider of the coverage. While this form does not need to be sent to the IRS, you must indicate on your tax return that you had health insurance for each month of the year or have a coverage exemption. Check with your state and local government to see if they have any additional penalties for not having minimum essential health insurance coverage throughout the tax year.

Step-by-Step: Form 1095-B Instructions For Filling Out the Document

Form 1095-B, Health Coverage, is an IRS document that may be sent to taxpayers who receive minimum essential health insurance as required by the Affordable Care Act. This form provides information such as the coverage, providers, and individuals covered. Taxpayers do not need to submit Form 1095-B to the IRS–they will indicate the months of coverage on their returns. Additionally, employers with 50 or more employees may send Form 1095-C instead. All forms must be requested from the provider, and they must then furnish it within 30 days of the request. It is important to remember that some US states have penalties for those without health insurance coverage for the year, and income-based exemptions may apply. Therefore, be sure to check state and local governments to determine if these penalties apply.

Below, we present a table that will help you understand how to fill out Form 1095-B.

| Information Required for Form 1095-B | Details |

|---|---|

| Form Name | Form 1095-B, Health Coverage |

| Purpose | Provides information about minimum essential health insurance coverage |

| Recipient | Taxpayers who receive the form as required by the Affordable Care Act |

| Information Provided | Coverage details, providers, and individuals covered |

| Submission to IRS | Not required; coverage months indicated on tax returns |

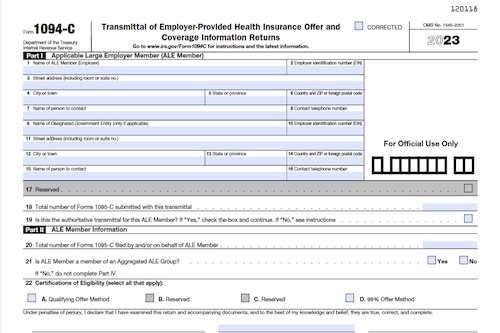

| Alternative for Large Employers | Employers with 50 or more employees may send Form 1095-C |

| Request and Furnishing | Must be requested from the provider, furnished within 30 days |

| Penalties | Some US states have penalties for lack of health insurance coverage; income-based exemptions may apply |

Do You Need to File Form 1095-B Each Year?

Do You Need to File Form 1095-B Each Year? Depending on who provided your health insurance coverage, you should receive either Form 1095-A, Form 1095-B, or Form 1095-C, and you have to provide information from these forms or acknowledge receiving one on your federal tax return. You don’t have to submit the form itself, but you should tick off a box on your returns indicating how long you were covered throughout the tax year. Additionally, you may be subject to a penalty under your state’s individual health insurance mandate, so check with your state and local governments for related information.

Download the official IRS Form 1095-B PDF

On the official IRS website, you will find a link to download Form 1095-B: Health Coverage. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1095-B

Sources:

https://www.irs.gov/forms-pubs/about-form-1095-b

https://www.irs.gov/instructions/i109495b