Reduce your utility bills and lower your tax obligation with federal tax credit Form 5695 – “Residential Energy Credits”. Learn more about which energy efficiency upgrades qualify, how to claim for tax credit, and how to calculate your credit limit.

What is Form 5695?

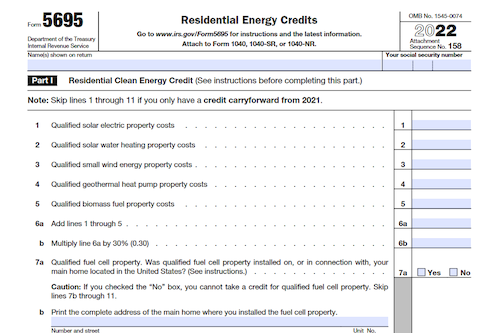

IRS Form 5695, “Residential Energy Credits,” is a tax form used to claim the residential energy credits offered by the United States federal government. It is divided into two parts based on the two different tax incentive programs, and contains instructions for calculating and claiming tax credits for energy-efficient home improvements. Depending on the nature of the upgrade, taxpayers may be eligible to receive up to 30% savings off their tax bill for upgrades that qualify. Non-business energy property credits may include air-source heat pumps, central air conditioning, furnaces, water heaters, and biomass stoves; while residential energy-efficient property credits may include geothermal heat pumps, small wind turbines, solar water heaters, and solar panels. To receive the best possible savings on the tax return, it is recommended to seek help from tax preparation services.

IRS Form 5695 – Who Needs to Fill It Out?

IRS Form 5695, also known as Residential Energy Credits, needs to be filled out in order to calculate the tax credit for energy-efficient home upgrades and other qualifying items. Everyone who purchases eligible items and makes energy improvements in their home should complete Form 5695 in order to take advantage of the energy tax credit. It is divided into two parts, so make sure to consult the Form 5695 Instructions and the instruction worksheet, and be aware of the credit limits and the exact cost of the items. Filing this form is important, as errors may lead to penalties or an audit. To make the best of your return, professional income tax prep services may help.

Step-by-Step: Form 5695 Instructions For Filling Out the Document

IRS Form 5695 “Residential Energy Credits” is used to claim energy-related tax credits and deductions for eligible home improvements. Step-by-Step instructions in two parts can be found within the form. Part I covers residential energy-efficient property credits, which involve inputting your credit limit and adding up all qualifying items’ costs. Part II guides you through the non-business energy property credit, and Energy Star must be achieved in order to receive a tax credit for most items. For accuracy’s sake, consider consulting professional tax preparation services when completing Form 5695.

Below, we present a table that will help you understand how to fill out Form 5695.

| Information Required for IRS Form 5695 | Details |

|---|---|

| Form Name | IRS Form 5695 “Residential Energy Credits” |

| Purpose | Claim energy-related tax credits and deductions for eligible home improvements |

| Form Sections | Part I: Residential energy-efficient property credits

Part II: Non-business energy property credit (Energy Star requirement) |

| Part I | Input credit limit and total qualifying items’ costs |

| Part II | Guidelines for non-business energy property credit (Energy Star requirement) |

| Tax Professional | Consider consulting a professional tax preparation service for accuracy |

Do You Need to File Form 5695 Each Year?

If you are looking to take advantage of the federal government’s tax credits for making energy efficient home upgrades, you will need to submit IRS Form 5695, also known as “Residential Energy Credits”. This form is divided into two parts, one for the residential energy-efficient property credit and one for the non-business energy property credit. To file correctly, you will need to provide specifics, and it is advised to seek help from a tax preparation services to ensure accuracy. The tax credits are retroactively available for purchases made through December 31, 2017 and the current credits are available through December 31, 2021. Take note of the specific requirements for each form of energy efficiency improvement and be sure to save your receipts and Manufacturer’s statements for your records. With the help of a professional service, you can rest assured you’ll receive the maximum benefit from your return.

Download the official IRS Form 5695 PDF

On the official IRS website, you will find a link to download Form 5695 – Residential Energy Credits. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 5695

Sources:

https://www.irs.gov/forms-pubs/about-form-5695

https://www.irs.gov/instructions/i5695