Taking an adoption credit or exclusion for employer-provided adoption benefits can help reduce your tax liability. Learn the requirements for taking an adoption credit or exclusion, as well as how to calculate the credit or exclusion, with this guide.

What is Form 8839?

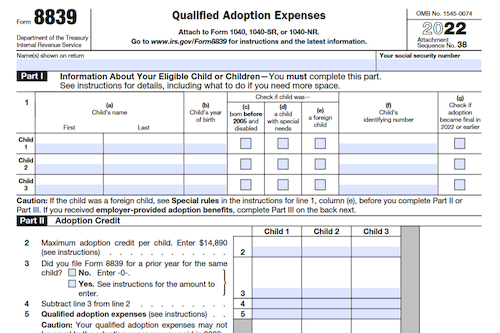

Form 8839 is the form used to calculate the adoption credit and exclusion of employer-provided adoption benefits for taxpayers looking to adopt a child. It can be used to figure the adoption credit of up to $14,890 for expenses in connection with the adoption of an eligible child. Additionally, you can use Form 8839 Part III to exclude employer-provided adoption benefits from your income if your employer had a written qualified adoption assistance program. The income limit based on modified adjusted gross income (MAGI) and filing status determines whether the credit or exclusion will be affected. It’s also important to note that qualified adoption expenses do not include expenses reimbursed by an employer and amounts allowed as a credit or deduction under other provisions of federal income tax law.

IRS Form 8839 – Who Needs to Fill It Out?

IRS Form 8839 is used by those who have paid qualifying expenses in connection with the adoption of an eligible U.S. or foreign child. This includes potentially claiming an exclusion for up to $14,890 of employer-provided adoption benefits, and/or a tax credit of up to $14,890 for qualified adoption expenses, depending on the cost of the adoption. This form must be completed before claiming the credit, and an income limit may affect the amount of credit or exclusion that is allowed. Furthermore, persons filing separately may only claim a carryforward of the credit from a prior year if they filed a joint return for that year.

Step-by-Step: Form 8839 Instructions For Filling Out the Document

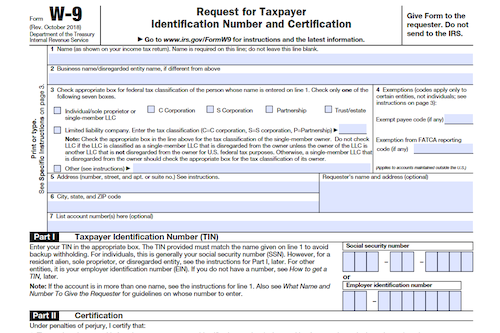

Filling out form 8839 can feel like an overwhelming task. However, if you take it step-by-step, it can be manageable. Firstly, you must determine the purpose of the form: to figure your adoption credit and any employer-provided adoption benefits you can exclude from your income. You can claim a credit and exclusion for expenses of adopting an eligible child, up to a maximum claim of $14,890. Employer-provided adoption benefits should be shown as code T in box 12 of your W-2 form, or may be able to be excluded from income even if not shown if certain criteria are met. You must complete Part III to figure the credit in Part II. MAGI must be less than $263,410 to claim the credit or exclusion, or carryforward a credit from 2021. When the eligible child is a U.S. citizen or resident, the credit or exclusion may be taken even if the adoption doesn’t become final. For a foreign child, the adoption must be final to take the credit or exclusion. Lastly, if married and filing separately, certain criteria must be met to take the credit or exclusion. By following these step-by-step instructions, you can confidently and correctly fill out Form 8839.

Below, we present a table that will help you understand how to fill out Form 8839.

| Form 8839 | Instructions |

|---|---|

| Form 8839 is used to figure the adoption credit and any employer-provided adoption benefits that can be excluded from income. You can claim a credit and exclusion for expenses of adopting an eligible child, up to a maximum claim of $14,890. Employer-provided adoption benefits should be shown as code T in box 12 of your W-2 form, or may be able to be excluded from income even if not shown if certain criteria are met. You must complete Part III to figure the credit in Part II. MAGI must be less than $263,410 to claim the credit or exclusion, or carryforward a credit from 2021. When the eligible child is a U.S. citizen or resident, the credit or exclusion may be taken even if the adoption doesn’t become final. For a foreign child, the adoption must be final to take the credit or exclusion. Lastly, if married and filing separately, certain criteria must be met to take the credit or exclusion. By following these step-by-step instructions, you can confidently and correctly fill out Form 8839. |

|

Do You Need to File Form 8839 Each Year?

Yes! Form 8839 is used to figure your adoption credit and any employer-provided adoption benefits you can exclude from your income. Depending on the cost of the adoption, you may be able to exclude up to $14,890 from your income and also claim the same amount in credit. If you received employer-provided adoption benefits, your modified adjusted gross income cannot exceed $263,410 to qualify. Married persons who are not filing jointly may also be eligible for the credit or exclusion with special considerations. For more information, refer to IRS publication 15-B.

Download the official IRS Form 8839 PDF

On the official IRS website, you will find a link to download Form 8839. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8839

Sources: