Claim the Indian Employment Credit with Form 8845! Partnerships, S corporations, cooperatives, estates, and trusts must file the form to claim the credit. Wages paid must meet all the requirements for qualified employees, and the employer must retain proof of enrollment status. Wages used to claim other credits are not eligible.

What is Form 8845?

Form 8845 is used by partnerships, S corporations, cooperatives, estates, and trusts to claim the Indian employment credit if they have paid or incurred qualified wages and/or qualified employee health insurance costs to/for a qualified employee. The credit is comprised of qualified wages, which must be paid or incurred for services performed by a qualified employee, and qualified employee health insurance costs, which must be paid or incurred for health insurance coverage for a qualified employee. To qualify as an employee, the individual must be an enrolled member of an Indian tribe and perform services within an Indian reservation. Additional criteria also apply.

IRS Form 8845 – Who Needs to Fill It Out?

Form 8845 is intended for use by individuals and organizations who paid or incurred qualified wages and/or qualified employee health insurance costs to/for a qualified employee during their tax year. Partnerships, S corporations, cooperatives, estates, and trusts must file this form to claim the Indian employment credit, and all other forms of organization are only required to do so if they receive the credit from one of these sources. To qualify as a qualified employee, they must be an enrolled member of an Indian tribe, perform substantially all of their services within an Indian reservation, and have more than 50% of their wages paid or incurred by the employer for services performed in their trade or business.

Step-by-Step: Form 8845 Instructions For Filling Out the Document

Form 8845 is used to claim the Indian employment credit for wages and/or qualified employee health insurance costs paid or incurred to qualified employees who are enrolled members or the spouses of enrolled members of an Indian tribe. There are specific information and qualifications regarding the wages, employee health insurance costs, and employees that must be met in order to qualify for this Indian employment credit and all of this information is outlined in this document. For proper qualification for the credit, employers are reminded to keep proof of enrollment from each employee. Additionally, employers that are part of a controlled group or under common control must take extra steps to ensure that the paperwork is completed properly to claim their share of the credit.

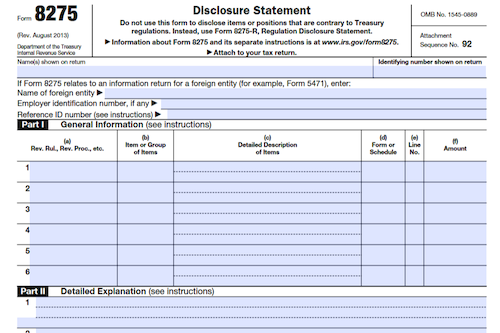

Below, we present a table that will help you understand how to fill out Form 8845.

| Form 8845 | Instructions |

|---|---|

| Form 8845 is used to claim the Indian employment credit for wages and/or qualified employee health insurance costs paid or incurred to qualified employees who are enrolled members or the spouses of enrolled members of an Indian tribe. There are specific information and qualifications regarding the wages, employee health insurance costs, and employees that must be met in order to qualify for this Indian employment credit and all of this information is outlined in this document. For proper qualification for the credit, employers are reminded to keep proof of enrollment from each employee. Additionally, employers that are part of a controlled group or under common control must take extra steps to ensure that the paperwork is completed properly to claim their share of the credit. |

|

Do You Need to File Form 8845 Each Year?

Do You Need to File FORM Each Year? Yes, partnerships, S corporations, cooperatives, estates, and trusts must file FORM 8845 to claim the Indian employment credit. All other entities aren’t required to complete or file FORM 8845, and instead can report the credit directly on Form 3800. Qualified wages means wages paid or incurred for services performed by an employee who is an enrolled member or the spouse of an enrolled member of an Indian tribe and who perform substantially all services within an Indian reservation. Qualified employee health insurance costs also need to be taken into account. If any of these requirements are not met, entities must not claim the credit.

Download the official IRS Form 8845 PDF

On the official IRS website, you will find a link to download Form 8845. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: the official Form 8845

Sources: