Form 8898 is used by US taxpayers to notify the IRS when they have become or stopped being a bona fide resident of a US possession according to Section 937(c). …

Form 6251: Alternative Minimum Tax – Individuals

Learn how to correctly file Form 6251 to calculate the alternative minimum tax (AMT) liability for taxpayers with higher economic incomes. Find out the latest on exemption amounts, tax brackets, …

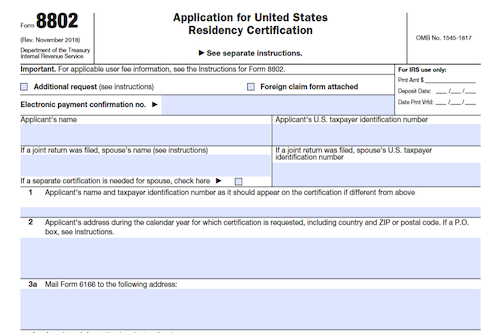

Form 8802: Application for United States Residency Certification

Individuals and entities looking to claim benefits under income tax treaties or VAT exemption must submit Form 8802 to the IRS to request Form 6166, a letter of U.S. residency …

Form 8828: Recapture of Federal Mortgage Subsidy

This article explains the recapture tax on the mortgage subsidy for federally subsidized home buyers who have sold or otherwise disposed of their home. It outlines who must file, when …

Form 8824: Like-Kind Exchanges

In this article, we explore like-kind exchanges and special rules for capital gains invested in Qualified Opportunity Funds (QOFs). Discover the eligibility of certain government officials for a section 1031 …

Form 8810: Corporate Passive Activity Loss and Credit Limitations

For personal service corporations and closely held corporations, Form 8810 is used to figure the amount of passive activity loss or credit for the current tax year as well as …

Form 8845: Indian Employment Credit

Claim the Indian Employment Credit with Form 8845! Partnerships, S corporations, cooperatives, estates, and trusts must file the form to claim the credit. Wages paid must meet all the requirements …

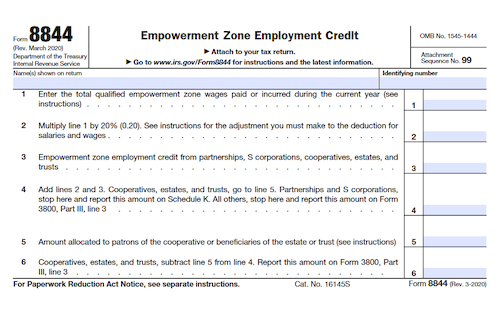

Form 8844: Empowerment Zone Employment Credit

This article explores Form 8844 and how to use it to claim the empowerment zone employment credit, including instructions on who may be a qualified zone employee and what types …

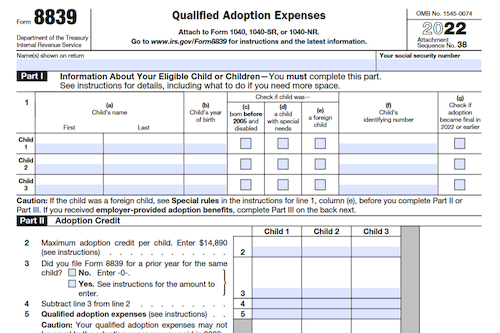

Form 8839: Qualified Adoption Expenses

Taking an adoption credit or exclusion for employer-provided adoption benefits can help reduce your tax liability. Learn the requirements for taking an adoption credit or exclusion, as well as how …

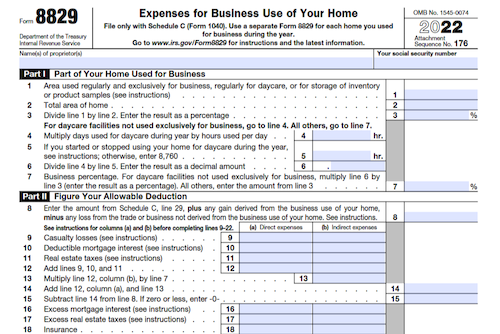

Form 8829: Expenses for Business Use of Your Home

Use Form 8829 when filing your taxes to determine the full extent of the allowable expenses for business use of your home, and any carryover to the next tax year. …

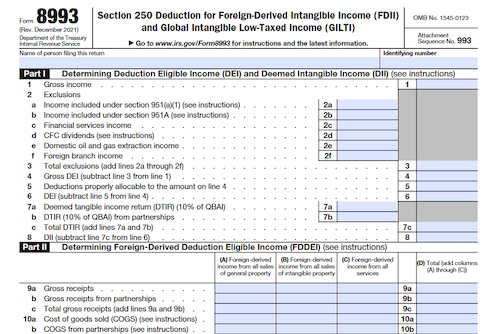

Form 8993: Section 250 Deduction for Foreign Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI)

Domestic corporations and individual shareholders of controlled foreign corporations making a section 962 election must use Form 8993 to determine the deduction under section 250 of the Tax Cuts and …

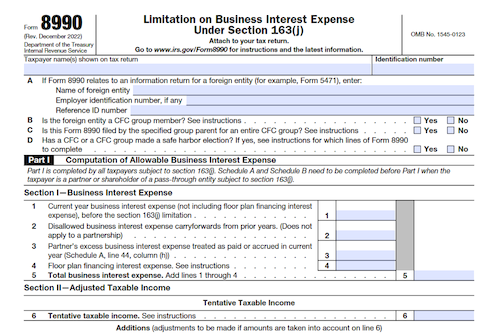

Form 8990: Limitation on Business Interest Expense Under Section 163(j)

Taxpayers (individuals, partnerships, corporations, etc.) must file Form 8990 to calculate the deductible business interest expenses and carry forward any disallowed expenses to the next tax year. Exclusions from filing …

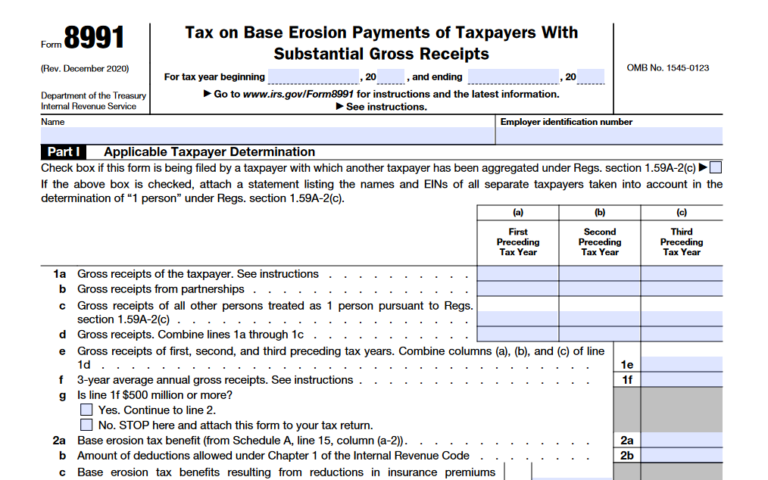

Form 8991: Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts

Form 8991 is used to determine an applicable taxpayer’s base erosion minimum tax amount based on their base erosion percentage, modified taxable income, and regular tax liability. Taxpayers must consider …

Form 8994: Employer Credit for Paid Family and Medical Leave

This article discusses the requirements for an employer to qualify for the employer credit for paid family and medical leave, including what constitutes a qualifying employee, written policy documentary requirements, …

Form 8900: Qualified Railroad Track Maintenance Credit

Eligible taxpayers can now claim the Railroad Track Maintenance Credit (RTMC) for Qualified Railroad Track Maintenance Expenditures (QRTME), which have been retroactively extended to cover qualified railroad track maintenance expenditures …

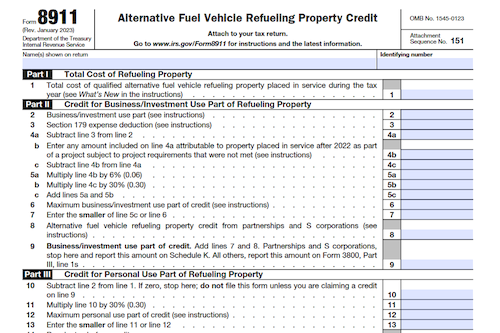

Form 8911: Alternative Fuel Vehicle Refueling Property Credit

Form 8911 is used by taxpayers to claim credits for the purchase of alternative fuel vehicle refueling property, either as a general business credit or personal credit. Depending on the …

Form 8910: Alternative Motor Vehicle Credit

Use Form 8910 to figure your credit for alternative motor vehicles placed in service during your tax year, which is treated as either a general business or personal credit. Partnerships …

Form 8941: Credit for Small Employer Health Insurance Premiums

This article will discuss the Form 8941, used by eligible small employers to figure the credit for small employer health insurance premiums. It will also cover the requirements for eligibility, …

Form 8940: Request for Miscellaneous Determination

Organizations seeking a miscellaneous determination from the IRS must file Form 8940, which includes providing information about the organization’s past, present, and planned activities, and attaching documents such as a …

Form 8949: Sales and Other Dispositions of Capital Assets

Form 8949 is used to report sales and exchanges of capital assets, and to reconcile amounts reported to the IRS on Forms 1099-B or 1099-S (or substitute statements). It is …