Taxpayers (individuals, partnerships, corporations, etc.) must file Form 8990 to calculate the deductible business interest expenses and carry forward any disallowed expenses to the next tax year. Exclusions from filing apply to small business taxpayers, as defined by a gross receipts test, and trades or businesses providing services as an employee, electing real property trades or businesses, electing farming businesses, and certain regulated utility businesses.

What is Form 8990?

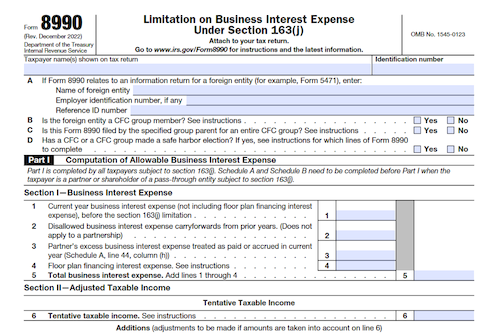

Form 8990 is a form generated by the Internal Revenue Service (IRS) to estimate the amount of business interest expense that an individual, corporation, partnership, or S corporation may deduct within an annual tax year. It is also used to determine the amount of business interest expense to be carried forward to the following year. A taxpayer must complete Form 8990 if: they have business interest expense, have a prior year excess business interest expense, are a U.S. shareholder of an applicable controlled foreign corporation (CFC), or makes a safe-harbor election for a CFC. Not all taxpayers are required to file Form 8990 – those with average annual gross receipts of $27 million or less or those from excepted trades or businesses like services provided as an employee are excluded. The form must also be completed with coordination with other limitations such as the section 704(d) loss limitation and the at-risk, passive activity loss, or excess business loss limitation.

IRS Form 8990 – Who Needs to Fill It Out?

IRS Form 8990 requires taxpayers (including individuals, corporations, partnerships, and S Corporations) with business interest expense, disallowed business interest expense carryforward, or current/previous year excess business interest expense to fill it out, unless the taxpayer qualifies for an exclusion. Such exclusions may include small businesses that don’t have excess business interest from a partnership, or trades or businesses from providing services as an employee, electing real property trades or business, electing farming business or certain regulated utility businesses.

Step-by-Step: Form 8990 Instructions For Filling Out the Document

For taxpayers with any kind of business interest expense, including carryforward from the prior year, Form 8990 may need to be filled out. Small businesses, providing services as an employee, real property trades or businesses, electing farming businesses, and certain regulated utility businesses are excluded from filing this Form. In addition, based on gross receipts over the prior 3 years, some taxpayers may meet the requirements of the small business exemption for the purposes of section 163(j). This form must be coordinated with other limitations such as basis limitations, at-risk limitations, passive activity loss limitations, and the allocation of interest expense between excepted and non-excepted trades or businesses. To assist in understanding the instructions for filling out Form 8990, review the definitions provided of small business taxpayer, gross receipt test, excepted trade or business, and the aggregation of receipts for members of a controlled group or affiliated group.

Below, we present a table that will help you understand how to fill out Form 8990.

| Form 8990 | Instructions |

|---|---|

| For taxpayers with any kind of business interest expense, including carryforward from the prior year, Form 8990 may need to be filled out. Small businesses, providing services as an employee, real property trades or businesses, electing farming businesses, and certain regulated utility businesses are excluded from filing this Form. In addition, based on gross receipts over the prior 3 years, some taxpayers may meet the requirements of the small business exemption for the purposes of section 163(j). This form must be coordinated with other limitations such as basis limitations, at-risk limitations, passive activity loss limitations, and the allocation of interest expense between excepted and non-excepted trades or businesses. To assist in understanding the instructions for filling out Form 8990, review the definitions provided of small business taxpayer, gross receipt test, excepted trade or business, and the aggregation of receipts for members of a controlled group or affiliated group. |

|

Do You Need to File Form 8990 Each Year?

Generally, taxpayers with business interest expenses, disallowed business interest expense carryforward, or current year/prior year excess business interest expenses need to file Form 8990. However, small business taxpayers with annual gross receipts of $27 million or less, and taxpayers in specified trades or businesses, such as those related to providing services as an employee, real property, farming, and certain regulated utilities, are typically exempt from filing this form. Additionally, partnership pass-through entities whose owners do not need to file Form 8990 may still need to provide certain information to their owners upon request.

Download the official IRS Form 8990 PDF

On the official IRS website, you will find a link to download Form 8990. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8990

Sources: