This article explores Form 8844 and how to use it to claim the empowerment zone employment credit, including instructions on who may be a qualified zone employee and what types of wages do not qualify.

What is Form 8844?

Form 8844 is used to claim the Empowerment Zone Employment Credit, a credit worth up to $15,000 for services performed by qualified zone employees while living in an empowerment zone. The form is completed by individuals, as well as partnerships and S corporations, with the exceptions of estates and trusts that can allocate credit to beneficiaries and cooperatives that can allocate credit to patrons. The March 2020 revision is used for tax years beginning in 2021 or later and the December 2021 revision of the instructions is used for tax years beginning in 2021 or later. Qualified zone employees can be individuals, but must not own more than 5% of the employer, or individuals employed by the employer for less than 90 days, among other exemptions. In addition, wages subject to FUTA are generally considered qualified zone wages, as well as educational assistance payments and payments made as part of a youth training program.

IRS Form 8844 – Who Needs to Fill It Out?

IRS Form 8844 is used to claim the empowerment zone employment credit. Partnerships and S corporations are required to file Form 8844 while all other taxpayers typically do not need to complete or file the form if the only source of the credit is a partnership, S corporation, estate, trust, or cooperative. Exceptions apply for estates, trusts, cooperatives, and other entities. To be considered a qualified zone employee, the individual must perform substantially all of the services for the employer within the zone, have their principal residence within the zone, and they cannot be a 5 percent owner, be employed for less than 90 days, work at certain establishments, or be a dependent of the taxpayer or a relative of a 5 percent owner. Qualified zone wages can include educational assistance payments, youth training program payments, and other certain payments, though it does not include wages used to claim other credits.

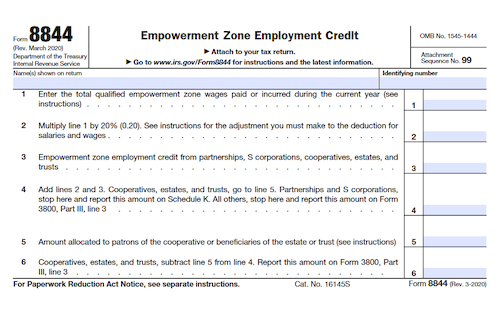

Step-by-Step: Form 8844 Instructions For Filling Out the Document

Form 8844 (Rev. March 2020) is used to claim the Empowerment Zone Employment Credit. Different revisions of the form and instructions are used for different tax years, with the March 2020 revision intended for tax years beginning in 2021 or later until a later revision is issued. To be a qualified zone employee for the purpose of the Credit, the employee must meet certain residency and residence requirements and cannot be a 5% owner, employed for less than 90 days, employed in certain industries, or related to the taxpayer in certain ways. Qualified wages include those subject to FUTA and other forms of remuneration as determined by applicable IRS rules. Wages used in combination with other credits, such as the employee retention credit, are not eligible. For more information, please refer to the Form 8844 instructions, available at IRS.gov/Form8844.

Below, we present a table that will help you understand how to fill out Form 8844.

| Form 8844 | Instructions |

|---|---|

| Form 8844 (Rev. March 2020) is used to claim the Empowerment Zone Employment Credit. Different revisions of the form and instructions are used for different tax years, with the March 2020 revision intended for tax years beginning in 2021 or later until a later revision is issued. To be a qualified zone employee for the purpose of the Credit, the employee must meet certain residency and residence requirements and cannot be a 5% owner, employed for less than 90 days, employed in certain industries, or related to the taxpayer in certain ways. Qualified wages include those subject to FUTA and other forms of remuneration as determined by applicable IRS rules. Wages used in combination with other credits, such as the employee retention credit, are not eligible. For more information, please refer to the Form 8844 instructions, available at IRS.gov/Form8844. |

|

Do You Need to File Form 8844 Each Year?

You must file Form 8844 (Rev. March 2020) each year to claim the empowerment zone employment credit. Partnerships and S corporations must file this form, while generally all other parties are not required to file this form if their only source of this credit is from a partnership, S corporation, estate, trust, or cooperative; they can report this credit directly on Form 3800. Exceptions apply if you are an estate or trust with source credit that can be allocated to beneficiaries, or a cooperative with source credit that can or must be allocated to patrons. Use the March 2020 revision for tax years 2021 or later, and the December 2021 revision of instructions for tax years 2021 or later. For prior tax years, use the appropriate prior revision of the form and instructions, all of which are available at IRS.gov/Form8844.

Download the official IRS Form 8844 PDF

On the official IRS website, you will find a link to download Form 8844. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8844

Sources: