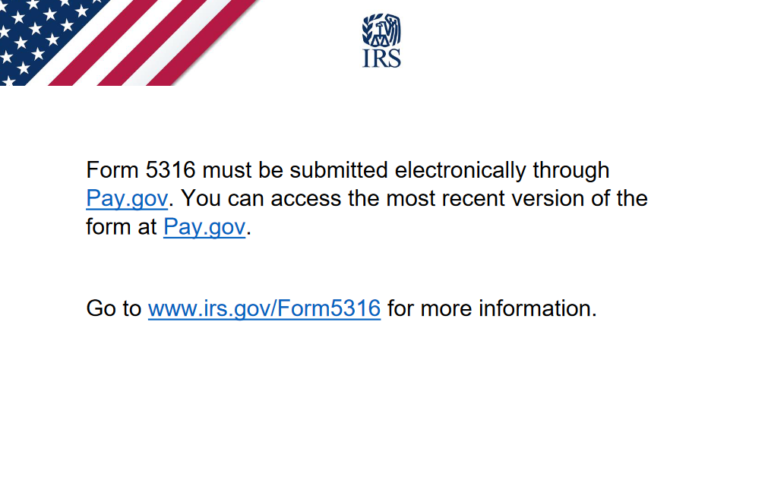

This article covers information about when to file Form 5316 with the IRS in order to request a determination letter proving that a trust is a group trust arrangement that …

Form 1041-N: U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

Trustees of Alaska Native Settlement Trusts (ANSTs) need to file Form 1041-N to elect special income tax treatment for the trust and its beneficiaries in the first tax year. The …

Form 5307: Application for Determination for Adopters of Master or Prototype or Volume Submitter Plans

This article introduces the various plan documents required by the IRS when completing applications for Retirement Determination Letters, such as Form 5307 or Form 5300, depending on the type of …

Form 5330: Return of Excise Taxes Related to Employee Benefit Plans

With Form 5330, individuals and employers are responsible for reporting certain excise taxes, such as the tax-exempt entity’s involvement in a prohibited tax shelter transaction, the employer’s failure to meet …

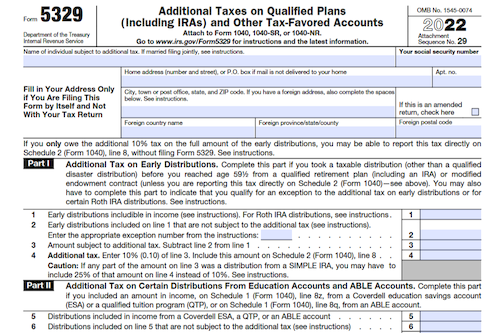

Form 5329: Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts

IRS has expanded the exception to the 10% additional tax for early distributions of certain retirement accounts, including for qualified public safety employees, correctional officers, and those with terminal illnesses. …

Form 5471: Information Return of U.S. Persons With Respect To Certain Foreign Corporations

U.S. persons with officer, director, or shareholder roles in certain foreign corporations are required to file the Form 5471 and related schedules to satisfy internal revenue service requirements. What is …

Form 5472: Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business

Reporting corporations must file Form 5472 to provide required information for reportable transactions with foreign or domestic related parties—but exceptions may apply. What is Form 5472? Form 5472 is an …

Form 4136: Credit For Federal Tax Paid On Fuels

Form 4136 is used to claim several credits related to the use or sale of fuel, such as the biodiesel or renewable diesel mixture credit, the alternative fuel credit, and …

Form 5405: Repayment of the First-Time Homebuyer Credit

Form 5405 is used to notify the IRS and figure the amount of the credit you must repay if you purchased a home in 2008 and met certain conditions in …

Form 6765: Credit for Increasing Research Activities

This article covers Form 6765, which is used to figure and claim the credit for increasing research activities, to elected the reduced credit under section 280C, and to elect to …

Form 6478: Biofuel Producer Credit

Form 6478 (Rev. January 2020) can be used to figure your section 40 biofuel producer credit for tax years beginning after 2017. Qualified second generation biofuel production includes liquid fuel …

Form 5227: Split-Interest Trust Information Return

For tax purposes, the IRS uses Form 5227 for split-interest trusts to report financial activities, charitable deductions, distributions, and to determine if the trust is treated as a private foundation …

Form 8864: Biodiesel and Renewable Diesel Fuels Credit

Form 8864 (Rev. January 2023) is used to claim the section 40A biodiesel and renewable diesel fuels credit or the section 40B sustainable aviation fuel credit. Partnerships, S corporations, cooperatives, …

Form 8862: Information To Claim Earned Income Credit After Disallowance

If you are looking to claim the EIC, CTC, RCTC, ACTC, ODC, or AOTC on your tax return, you must complete Form 8862 and attach it to your return to …

Form 8850: Pre-Screening Notice and Certification Request for the Work Opportunity Credit

Form 8850 is used by employers to pre-screen and request certification of individuals as a member of a targeted group for the purpose of qualifying for the work opportunity credit. …

Form 8858: Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs)

U.S. persons that own foreign disregarded entities (FDEs) and/or operate foreign branches (FBs) must file Form 8858 to satisfy the reporting requirements of various U.S. tax laws. This article overviews …

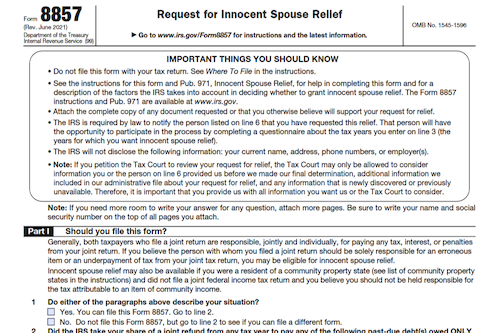

Form 8857: Request for Innocent Spouse Relief

Married people who live in community property states can be held liable for tax attributable to an item of community income if they file a joint return – but now …

Form 8881: Credit for Small Employer Pension Plan Startup Costs

This article covers the rules and qualifications for claiming the credit for small employer pension plan startup costs, as outlined in sections 45E and 45T. Eligible small employers may be …

Form 8889: Health Savings Accounts

Form 8889 is used to report Health Savings Account (HSA) contributions, figure out tax deductions, report distributions, and figure out income you must include and additional tax you may owe …

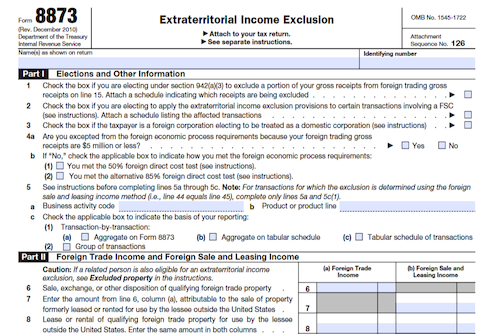

Form 8873: Extraterritorial Income Exclusion

With the repeal of the American Jobs Creation Act of 2004, taxpayers may still claim an ETI exclusion for certain transactions under a binding contract before 2005. This article provides …