Married people who live in community property states can be held liable for tax attributable to an item of community income if they file a joint return – but now they can petition the IRS to be relieved of this liability through Form 8857. Learn more about the process of requesting relief and the types of relief available for joint tax liability.

What is Form 8857?

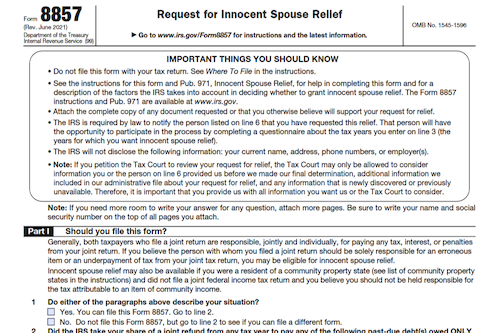

Form 8857 is a form available to taxpayers who filed a joint return, in order to request relief from the responsibility for an entire tax liability in cases where only one spouse or former spouse should be held responsible. Types of relief include Innocent Spouse Relief, Separation of Liability Relief, Equitable Relief, or Relief from Liability for Tax Attributable to an Item of Community Income, with each type of relief subject to its own rules and conditions. The form should be mailed or faxed to the IRS, and the IRS must contact the other spouse or former spouse to allow them to participate in the process. Generally, Taxpayers must file Form 8857 no later than two years after the first IRS attempt to collect the tax, though some exceptions may apply.

IRS Form 8857 – Who Needs to Fill It Out?

Form 8857 is used to request relief from liability for taxes when people who filed a joint return are jointly and severally responsible for the entire tax liability. Victims of abuse can find relief with this form, as an expansion of eligibility at IRS.gov/irb/2013-43_IRB#RP-2013-34 exists. Generally, individuals should file Form 8857 as soon as they become aware of a tax liability they think their spouse or former spouse should be held responsible for. Those in community property states must adhere to the specific filing rules for relief from liability for taxes attributable to an item of community income. There are four types of relief available, including innocent spouse relief, separation of liability relief, equitable relief, and more.

Step-by-Step: Form 8857 Instructions For Filling Out the Document

Filing Form 8857 is an important step for those who believe that they should not be held accountable for a tax liability that is owed. This form, available at IRS.gov/Form8857, can be used to request relief from joint and several liability, equitable relief, innocent spouse relief, and relief from liability for tax attributable to an item of community income. It should be noted that a filing deadline of 2 years from the date of the first IRS collection attempt applies, unless seeking equitable relief from a balance due, a credit or refund, or both. Married people living in community property states should also follow community property laws when filing a tax return. For more detailed instructions on correctly filing Form 8857, visit IRS.gov/Form8857.

Below, we present a table that will help you understand how to fill out Form 8857.

| Information | Details |

|---|---|

| Filing Form 8857 | An important step for those who believe they should not be held accountable for a tax liability owed. |

| Purpose | Request relief from joint and several liability, equitable relief, innocent spouse relief, and relief from liability for tax attributable to an item of community income. |

| Filing Deadline | 2 years from the date of the first IRS collection attempt, unless seeking equitable relief from a balance due, a credit or refund, or both. |

| Community Property States | Married individuals living in community property states should also follow community property laws when filing a tax return. |

Do You Need to File Form 8857 Each Year?

If you and your spouse or former spouse filed a joint return, and you believe that either you or your spouse should not be held responsible for the entire tax liability, you must file Form 8857. Situations apply in which you should not file – the IRS has issued Rev. Proc. 2013-34, expanding how the IRS will take into account abuse and financial control by the nonrequesting spouse. Generally, you must file Form 8857 no later than two years after the date the tax was assessed, although different filing deadlines may apply. Victims of abuse should still note that the IRS must contact both parties regardless. There are four types of relief available – innocent spouse relief, separation of liability relief, equitable relief, and relief from liability for tax attributable to an item of community income. The time to request relief varies depending on the type of relief. Contact the IRS to find out more about the filing process and your rights for relief.

Download the official IRS Form 8857 PDF

On the official IRS website, you will find a link to download Form 8857. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8857

Sources: