Form 8864 (Rev. January 2023) is used to claim the section 40A biodiesel and renewable diesel fuels credit or the section 40B sustainable aviation fuel credit. Partnerships, S corporations, cooperatives, estates, and trusts must file the form to claim the credit, and all taxpayers must adhere to the definitions, special rules, certifications, aggregations, recaptures, and registration requirement to claim their credit.

What is Form 8864?

Form 8864, also known as the Biodiesel and Renewable Diesel Fuels Credits and Sustainable Aviation Fuel Credit form, is used to claim credits associated with biodiesel, renewable diesel, and sustainable aviation fuel. Generally, partnerships, S corporations, cooperatives, estates, and trusts must file this form to claim one of these credits. Using Form 8864, qualifications like Certificate of Biodiesel and Statement of Biodiesel Reseller must be included for lines 1-6. Line 8 requirements include additional information, such as Certificate for SAF Synthetic Blending Component, Statement of SAF Synthetic Blending Component Reseller, and Declaration for SAF Qualified Mixture. Credits can also be reported directly on Form 3800, General Business Credit, for taxpayers with only partnership, S corporation, cooperative, estate, or trust sources. Lastly, certain quantities are limited, and applicants must be registered with the IRS.

IRS Form 8864 – Who Needs to Fill It Out?

Form 8864 needs to be filled out by partnerships, S corporations, cooperatives, estates, and trusts to claim the Section 40A biodiesel and renewable diesel fuel credits and the Section 40B sustainable aviation fuel credit. All other taxpayers do not need to complete or file this form if their only source of credit is a partnership, S corporation, cooperative, estate, or trust, instead reporting it directly on Form 3800, Part 3, Line 1l. Certain certificates and statements must also be attached depending on the type of credit being claimed. See the Notice and Pub.510/ExciseTaxes for more details.

Step-by-Step: Form 8864 Instructions For Filling Out the Document

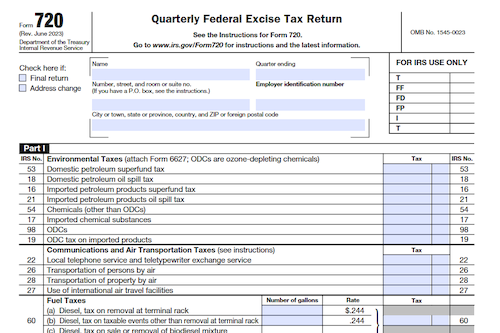

Form 8864 (Rev. January 2023) is used to claim section 40A biodiesel and renewable diesel fuels credits or the section 40B sustainable aviation fuel credit for the tax year in which the sale or use occurs. For biodiesel or renewable diesel, the credit is available for fuel used or sold for use in a trade or business, or sold at retail. For qualified mixtures or qualifying agri-biodiesel production, the credit is available to the producer of the mixture who used or sold it in a trade or business. Those claiming the credit must attach the necessary certificates, statements, declarations, and other documents. Depending on the particular credit, taxes may be due on the fuel, and the liability must be reported on Form 720. All producers and importers must be registered with the IRS prior to claiming the credit. Read the full instructions and see Notices 2005-62, 2023-6, and Pub.510/ExciseTaxes for more information.

Below, we present a table that will help you understand how to fill out Form 8864.

| Information Required for Form 8864 | Details |

|---|---|

| Credit Types | Types of credits and their eligibility |

| Documentation and Registration | Required certificates, statements, and registration |

| Taxes and Reporting | Taxes due and reporting on Form 720 |

| Additional Information | Resources and notices for more information |

Do You Need to File Form 8864 Each Year?

Form 8864 must be filed each year in order to claim the biodiesel, renewable diesel, and sustainable aviation fuel credits. The credit is for biodiesel or renewable diesel that is used as a fuel in a trade or business or sold at retail to another person during the tax year, as well as qualified mixtures produced with a SAF synthetic blending component. Partnerships, S corporations, cooperatives, estates, and trusts must file this form, while all other taxpayers can report their credits directly on the appropriate line of Form 3800. For further information, consult Notice 2005-62, Notice 2023-6, or Pub.510/ExciseTaxes.

Download the official IRS Form 8864 PDF

On the official IRS website, you will find a link to download Form 8864. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8864

Sources: