This article covers the rules and qualifications for claiming the credit for small employer pension plan startup costs, as outlined in sections 45E and 45T. Eligible small employers may be able to take advantage of a 50% cost offset by the credit, up to a maximum of $500 or $250 for each employee, and limited to the first 3 tax years.

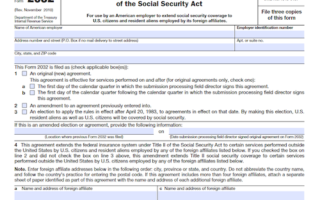

What is Form 8881?

Form 8881 is an IRS form used by eligible small employers to claim credit for qualified startup costs incurred for establishing or administering an eligible employer plan. The credit is part of the general business credit and can be 50% of eligible startup costs up to the greater of $500 or the lesser of $250 per eligible employee or $5,000 for the first tax year and two following years. To be eligible, employers must have no more than 100 employees the preceding tax year and must not have maintained a similar plan with the same employees in the past three tax years.

IRS Form 8881 – Who Needs to Fill It Out?

IRS Form 8881 is meant to be completed by eligible small employers who wish to claim the credit for qualified startup costs incurred in establishing or administering an eligible employer plan. Eligible employers can also use Form 8881 to claim the credit for first including an eligible automatic contribution arrangement in an eligible employer plan. Individuals whose only source of these credits come from a partnership or S corporation are not required to complete the form, but rather report the credits directly to Form 3800.

Step-by-Step: Form 8881 Instructions For Filling Out the Document

To fill out the Form 8881 Part I document, follow these steps: 1) Determine your eligibility as an employer, as defined by section 45E, to claim the credit for qualified startup costs. 2) Establish or administer an eligible employer plan with at least one employee that is not highly compensated as defined in section 414(q). 3) Determine your qualified startup costs paid or incurred during the tax year. 4) Compute the credit as 50% of qualified startup costs, limited to the greater of $500 or the lesser of $250 for each eligible employee and not to exceed $5,000 for the first 3 tax years. 5) Reduce your otherwise allowable deduction for the startup cost by the credit amount on line 5. 6) If applicable, compute your share of the credit as a member of a controlled group, group under common control, or affiliated service group where all members are treated as a single employer. Attach a statement showing how your share of the credit was figured and write “See Attached” next to the entry space for line 5.

Below, we present a table that will help you understand how to fill out Form 8881.

| Form 8881 | Instructions |

|---|---|

| To fill out the Form 8881 Part I document, follow these steps: 1) Determine your eligibility as an employer, as defined by section 45E, to claim the credit for qualified startup costs. 2) Establish or administer an eligible employer plan with at least one employee that is not highly compensated as defined in section 414(q). 3) Determine your qualified startup costs paid or incurred during the tax year. 4) Compute the credit as 50% of qualified startup costs, limited to the greater of $500 or the lesser of $250 for each eligible employee and not to exceed $5,000 for the first 3 tax years. 5) Reduce your otherwise allowable deduction for the startup cost by the credit amount on line 5. 6) If applicable, compute your share of the credit as a member of a controlled group, group under common control, or affiliated service group where all members are treated as a single employer. Attach a statement showing how your share of the credit was figured and write “See Attached” next to the entry space for line 5. |

|

Do You Need to File Form 8881 Each Year?

Do You Need to File FORM 8881 Each Year? Yes, if you are an eligible employer and wish to claim the small employer pension plan startup costs credit, you must file Form 8881 each year in order to claim the credit. The credit is allowed under section 45E and consists of 50% of the qualified startup costs incurred in establishing or administering an eligible employer plan, limited to the greater of $500 or $250 per non-highly-compensated employee, or $5,000 for the first tax year and the following two years. There are rules in place regarding controlled groups and predecessors, and deductions allowed for startup costs must be reduced by the credit amount.

Download the official IRS Form 8881 PDF

On the official IRS website, you will find a link to download Form 8881. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8881

Sources: