Use Form 5884 to claim the work opportunity credit for wages you paid to or incurred for targeted group employees – regardless of whether your business is located in an empowerment zone or rural renewal county. Taxpayers not required to file this form may report this credit on Form 3800. Certain tax-exempt organizations can also use Form 5884-C to claim the credit for certain wages paid to qualified veterans.

What is Form 5884?

Form 5884 is used to claim the Work Opportunity Credit for qualified first and/or second year wages paid to or incurred for targeted group employees. This credit is available for businesses of all sizes and locations, with partnerships, S corporations, cooperatives, estates, and trusts needing to file the form to claim the credit. Other taxpayers can opt to report the credit directly on Form 3800. Furthermore, certain tax-exempt organizations may use Form 5884-C to qualify for the Work Opportunity Credit for wages paid to qualified veterans. This credit can be claimed or declined any time within 3 years of the original return or amended return due date.

IRS Form 5884 – Who Needs to Fill It Out?

The IRS Form 5884 is required to be filled out by businesses looking to utilize the work opportunity credit for the wages they paid to or incurred for qualified first-and/or second-year employees. This credit applies regardless of the location of the business. All partnerships, S corporations, cooperatives, estates, and trusts must file this form to do this. Other non-filing individuals may report this credit on their Form 3800. Additionally, certain tax-exempt entities may use Form 5884-C to claim the work opportunity credit for certain wages paid to qualified veterans.

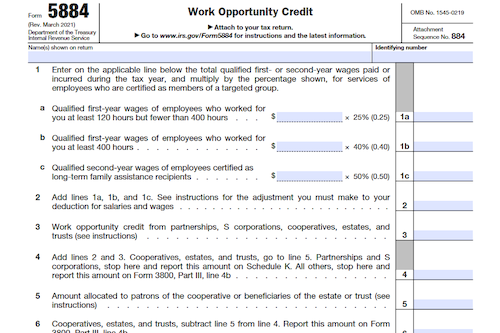

Step-by-Step: Form 5884 Instructions For Filling Out the Document

To get started, fill out the Form 5884 and complete the relevant sections with the purpose of claiming the work opportunity credit for qualified first-and/or second-year wages you have paid to or incurred for targeted group employees over the tax year. Partnerships, S corporations, cooperatives, estates, trusts, and some tax-exempt organizations need to file this form while other taxpayers can report the credit directly on Form 3800. Note that you have 3 years from the due date of your return to claim and/or elect not to claim the work opportunity credit. Refer to Form 5884-C if you are a tax-exempt organization claiming the work opportunity credit for certain qualified wages.

Below, we present a table that will help you understand how to fill out Form 5884.

| Information Required for Form 5884 | Details |

|---|---|

| Form Name | Form 5884 |

| Purpose | Claiming the work opportunity credit for qualified first-and/or second-year wages paid to or incurred for targeted group employees |

| Eligible Entities | Partnerships, S corporations, cooperatives, estates, trusts, and some tax-exempt organizations |

| Alternative Reporting | Other taxpayers can report the credit directly on Form 3800 |

| Claim Deadline | 3 years from the due date of your return |

| Special Case | Refer to Form 5884-C for tax-exempt organizations claiming the work opportunity credit for certain qualified wages |

Do You Need to File Form 5884 Each Year?

All businesses can use Form 5884 to claim the work opportunity credit for qualified first- and/or second-year wages paid to or incurred for targeted group employees. Partnerships, S corporations, cooperatives, estates, and trusts must file Form 5884 to claim the credit, while other taxpayers can report the credit directly on Form 3800. Additionally, certain tax-exempt organizations can use Form 5884-C to claim the work opportunity credit for certain wages paid to qualified veterans. You can claim or elect not to claim the credit at any time within 3 years from the due date of your return.

Download the official IRS Form 5884 PDF

On the official IRS website, you will find a link to download Form 5884. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 5884

Sources: