Employers affected by qualified disasters may be eligible to claim the employee retention credit for 2018 through 2019 using Form 5884-A. This form allows employers to claim a credit equal …

Form 990-BL: Information and Initial Excise Tax Return for Black Lung Benefit Trusts and Certain Related Persons

This article provides an overview of the Black Lung Benefits Revenue Act of 1977, explaining who must file Form 990-BL and the corresponding reporting requirements, the filing process, public inspection …

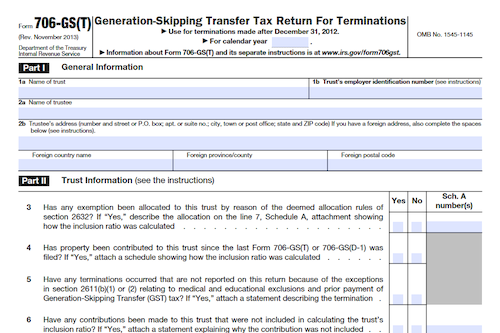

Form 706-GS(T): Generation Skipping Transfer Tax Return for Terminations

Trustees of trusts with taxable terminations must file Form 706-GS(T) by April 15 of the year following the calendar year of termination. The form is subject to the Generation-Skipping Transfer …

Form 706-GS(D): Generation-Skipping Transfer Tax Return for Distributions

Form 706-GS(D) is used by skip persons who receive a taxable distribution from a trust to calculate and report the GST tax due on the distribution. Who is responsible for …

Form 5884-D: Employee Retention Credit for Certain Tax-Exempt Organizations Affected by Qualified Disasters

Qualified tax-exempt organizations can use Form 5884-D to claim the 2020 qualified disaster employee retention credit against certain payroll taxes. This credit is equal to 40% of up to $6,000 …

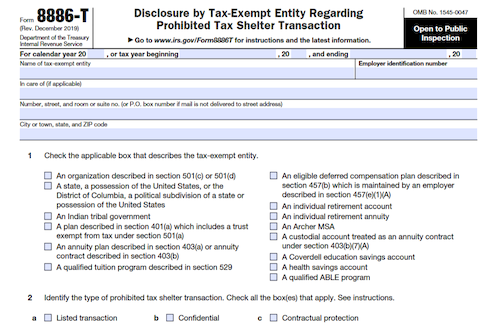

Form 8886-T: Disclosure by Tax Exempt Entity Regarding Prohibited Tax Shelter Transaction

Tax-exempt entities may be required to file Form 8886-T to disclose certain information related to prohibited tax shelter transactions, as well as potentially face penalties for failure to comply. This …

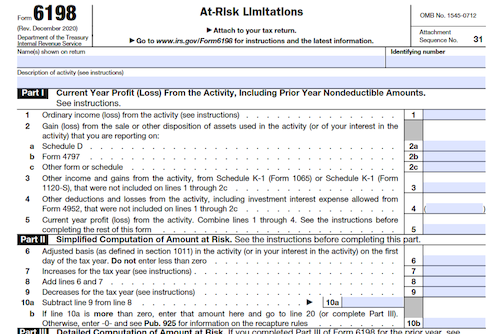

Form 6198: At-Risk Limitations

Form 6198 should be filed by those engaged in an activity listed in the At-Risk Activities section of the source text. The form helps individuals, estates, trusts, and certain closely …

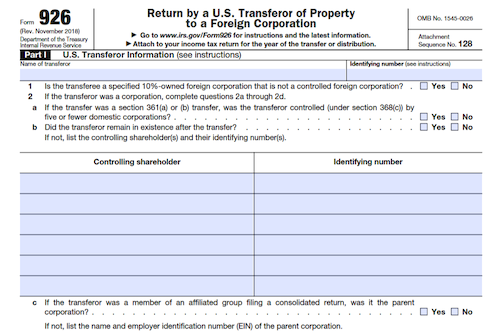

Form 926: Return by a U.S. Transferor of Property to a Foreign Corporation

U.S. citizens, domestic corporations, and domestic estates or trusts must complete and file Form 926 with the IRS to report certain transfers of tangible or intangible property to a foreign …

Form 461: Limitation on Business Losses

The Tax Cuts and Jobs Act has limited the amount of annual losses from the trades or businesses of noncorporate taxpayers that can be claimed. Form 461 aims to calculate …

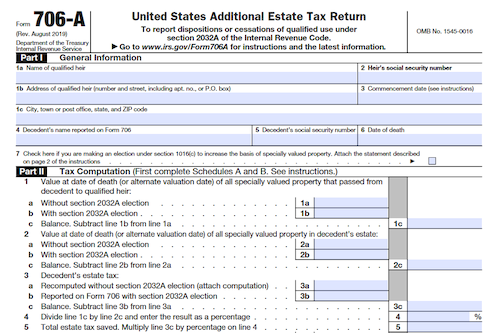

Form 706-A: United States Additional Estate Tax Return

Qualified heirs must file Form 706-A to report the additional estate tax imposed for an early disposition of specially valued property or for an early cessation of a qualified use. …

Form 2555: Foreign Earned Income

U.S. citizens or residents living or working abroad must adhere to the same U.S. income tax laws that apply to citizens and residents living in the U.S. Foreign earned income, …

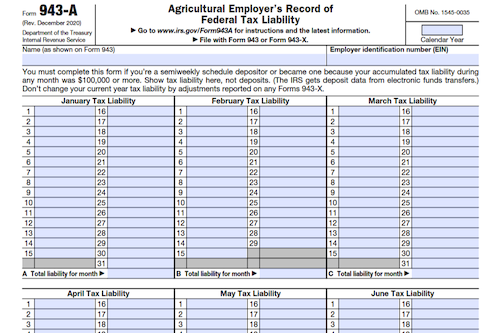

Form 943-A: Agricultural Employer’s Record of Federal Tax Liability

Form 943-A is used to report the federal tax liability of semiweekly schedule depositors based on the dates wages were paid. It must be filed along with Form 943, and …

Form 1120-PC: U.S. Property and Casualty Insurance Company Income Tax Return

Form 1120-PC is used to file the income, deductions, and credits of nonlife insurance companies, other than life insurance companies. Failure to file Form 1120-PC on time may result in …

Form 1120-SF: U.S. Income Tax Return for Settlement Funds

Form 1120-SF must be completed by all section 468B designated and qualified settlement funds to report transfers received, income earned, deductions claimed, and distributions made while figuring the fund’s income …

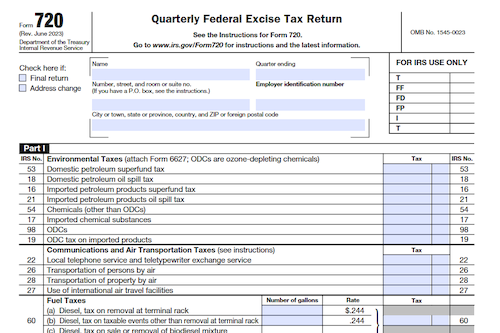

Form 720: Quarterly Federal Excise Tax Return

Form 720 is used by individuals liable for federal excise taxes to report quarterly obligations, who also have the option of claiming a credit via Schedule C. Those who receive …

Form 1040-C: U.S. Departing Alien Income Tax Return

Flying or departing from the US this year? Learn about the final return, certificate of compliance, and alien status rules you need to consider before taking off. What is Form …

Form 706-NA: United States Estate (and Generation-Skipping Transfer) Tax Return

Form 706-NA is an Internal Revenue Service form used to compute the estate and generation-skipping transfer (GST) tax liability for nonresident not a citizen (NRNC) decedents. This article covers information …

Form 5500-EZ: Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan

Form 5500-EZ is used to fulfill federal filing obligations for one-participant plans and foreign plans that do not file Form 5500-SF electronically. It is important to know if filing Form …

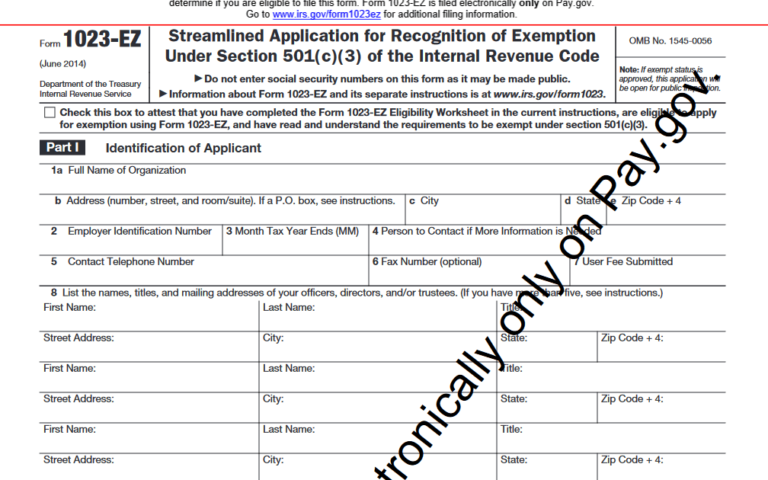

Form 1023-EZ: Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code

Form 1023-EZ is the streamlined version of Form 1023, allowing certain organizations to apply for recognition of federal tax exemption under Section 501(c)(3). This article breaks down who is eligible …

Form 5310: Application for Determination Upon Termination (Info Copy Only)

This article explains the purpose of Form 5310 and who may and may not use it to request an IRS determination of the qualified status of a pension, profit-sharing, or …