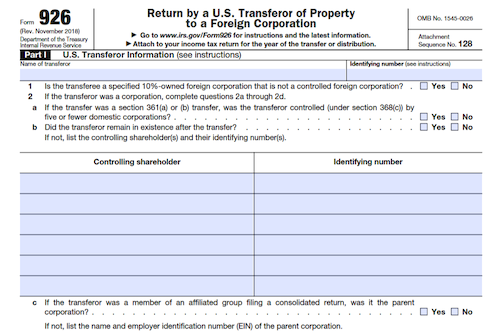

U.S. citizens, domestic corporations, and domestic estates or trusts must complete and file Form 926 with the IRS to report certain transfers of tangible or intangible property to a foreign corporation, as described in section 6038B. Special rules apply for transfers by partnerships, spouses, cash, stock or securities, distributions by domestic liquidating corporations, and exchanges described in sections 354 or 356. Penalties may be imposed for failure to comply with section 6038B.

What is Form 926?

Form 926 is a form used by U.S. citizens, residents, domestic corporations, and trusts to report certain transfers of property to foreign corporations as required by section 6038B. These transfers include those made by partnerships, spouses, and through exchanges described by section 354 and 356. Certain exceptions may apply, such as if less than 5% of the transferee foreign corporation is owned after the transfer, or the fair market value of the property transferred did not exceed $100,000. The form must be filed with the U.S. transferor’s income tax return, and must include additional information as required by Regulations sections 1.6038B-1(c) through (e) and Temporary Regulations sections 1.6038B-1T(c) and (d). Penalties for failure to file may be imposed, so it is important that taxpayers comply with section 6038B.

IRS Form 926 – Who Needs to Fill It Out?

IRS Form 926 must be completed and filed by U.S. citizens or residents, domestic corporations, domestic estates or trusts, for certain transfers of tangible or intangible property to a foreign corporation. For instance, the domestic partners of a partnership (domestic or foreign), spouses who file a joint income tax return, those transferring cash to a foreign corporation and certain stock or security transfers all require the completion of this form. Some situations, such as transfers for exchanges described in section 354 or 356, or by a domestic liquidating corporation, may be exempt from filing Form 926. Penalties for failure to file may be imposed and extensions to the statute of limitations for assessment may apply.

Step-by-Step: Form 926 Instructions For Filling Out the Document

Form 926 is used to report certain transfers of tangible or intangible property to a foreign corporation, as required by section 6038B. Generally, a U.S. citizen or resident, a domestic corporation, or a domestic estate or trust must complete this document; however, there are special rules applicable to transfers by a partnership, spouses filing jointly, cash transfers, transfers of stock or securities for which a gain recognition agreement (GRA) is filed, distributions by domestic liquidating corporations, as well as exceptions to filing. When filing Form 926, the IRS must be provided with the required additional information in Regulations sections 1.6038B-1(c) through (e) and Temporary Regulations sections 1.6038B-1T(c) and (d). This form must be filed with the U.S. transferor’s income tax return, and failure to comply can result in a 10% penalty of the fair market value of the property at the time of the transfer. Additionally, section 6662(j) imposes a 40% penalty on any underpayment resulting from an undisclosed foreign financial asset understatement.

Below, we present a table that will help you understand how to fill out Form 926.

| Information Required for Form 926 | Details |

|---|---|

| Purpose | Report transfers of tangible or intangible property to a foreign corporation |

| Filing Requirement | Required by U.S. citizens, residents, and domestic entities with special rules for certain transfers |

| Additional Information | Provide required additional information as per IRS regulations |

| Penalties | Penalties for failure to comply, including 10% penalty on property’s fair market value |

Do You Need to File Form 926 Each Year?

Generally, Form 926 must be filed by U.S. citizens or residents, domestic corporations, or domestic estates or trusts that transfer property to a foreign corporation, as required by section 6038B. There may be an exception for certain transfers, such as those that qualify for nonrecognition treatment, exchanges, or distributions in complete liquidation. It is important to note that failure to file Form 926 may result in a penalty of 10% of the fair market value of the property, with a maximum of up to $100,000 unless the failure was due to intentional disregard.

Download the official IRS Form 926 PDF

On the official IRS website, you will find a link to download Form 926. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 926

Sources: