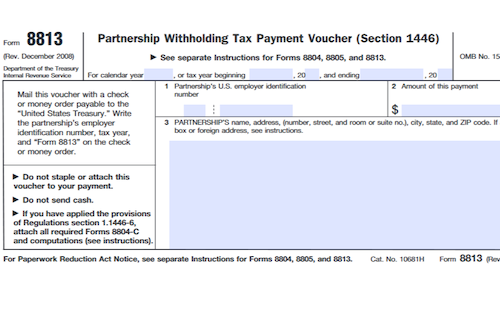

With Form 8804, 8805, and 8813, partnerships must pay and report the section 1446 withholding tax based on effectively connected taxable income (ECTI) allocated to foreign partners per U.S. regulations. …

Form 8813: Partnership Withholding Tax Payment Voucher (Section 1446)

Ever wondered what forms to use to report and pay withholding tax under section 1446? This article will cover General Instructions, Purpose of Forms, Taxpayer Identification Numbers (TINs), Applying for …

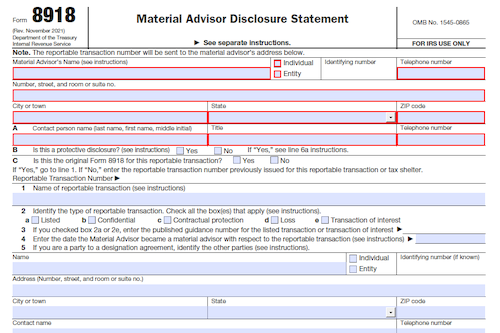

Form 8918: Material Advisor Disclosure Statement

Filing Form 8918 with the IRS is now required by material advisors to any reportable transaction in order to disclose certain information related to the transaction and receive a reportable …

Form 8937: Report of Organizational Actions Affecting Basis of Securities

Organizations that issue specified securities must file Form 8937 with the IRS if an organizational action affects the basis of a security or class of the security. Examples include cash …

Form W-12: IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal

Paid tax return preparers and enrolled agents (EAs) must obtain and renew a Preparer Tax Identification Number (PTIN) annually. This form outlines who must file, and the information required to …

Form 982: Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment)

Form 982 allows individuals to report and exclude certain discharged debts from their gross income. It also allows individuals to make the election to reduce the basis of depreciable property …

Form 1024-A: Application for Recognition of Exemption Under Section 501(c)(4) of the Internal Revenue Code

Organizations wishing to apply for recognition of exemption from federal income tax under section 501(c)(4) must complete Form 1024-A. Learn about the requirements and attachments needed to file this form, …

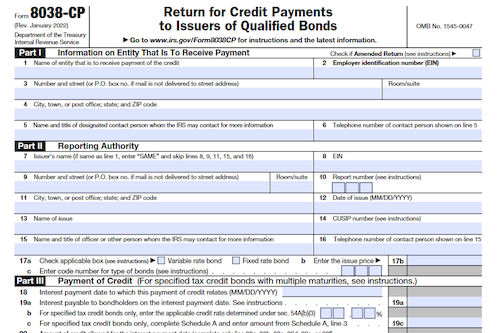

Form 8038-CP: Return for Credit Payments to Issuers of Qualified Bonds

Issuers of American Recovery and Reinvestment Act (ARRA) bonds, recovery zone economic development bonds (RZEDBs), and tax credit bonds must submit Form 8038-CP to the IRS to receive a refundable …

Form 8038: Information Return for Tax-Exempt Private Activity Bond Issues

Issuers of tax-exempt private activity bonds (such as qualified mortgage bonds and exempt facility bonds) must file Form 8038 by the 15th day of the 2nd month after the close …

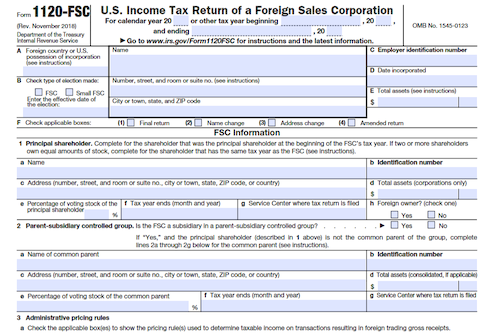

Form 1120-FSC: U.S. Income Tax Return of a Foreign Sales Corporation

Corporations that are required to file Form 1120-FSC must do so by the 15th day of the 4th month after the end of its tax year. If the due date …

Form 8082: Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)

Are you a partner in a TEFRA or BBA partnership, S corporation shareholder, beneficiary of an estate or trust, owner of a foreign trust, or residual interest holder in a …

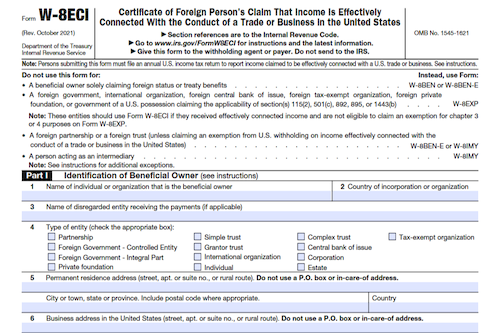

Form W-8ECI: Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States

Foreign persons are generally required to provide Form W-8ECI to establish that they are not U.S. persons and to claim that their income from U.S. sources is effectively connected with …

Form 1120-C: U.S. Income Tax Return for Cooperative Associations

Form 1120-C, U.S. Income Tax Return for Cooperative Associations, must be filed by corporations operating on a cooperative basis, allocating amounts to patrons, except for certain exempt organizations. The filing …

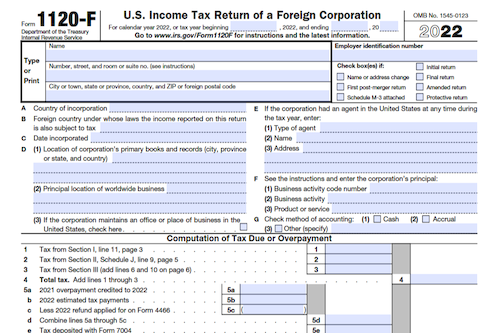

Form 1120-F: U.S. Income Tax Return of a Foreign Corporation

For foreign corporations conducting business in the United States, Form 1120-F must be filed to report income, deductions, credits, and figure U.S. tax liability. Unless one of the exceptions applies, …

Form 990-PF: Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation

Organizations that operate private foundations or claim private foundation status (including charitable trusts treated as private foundations) must file Form 990-PF to figure their tax based on investment income and …

Form 3800: General Business Credit

Business credits can be claimed by filing Form 3800. Partnerships, S Corporations, Estates, Trusts, and Cooperatives have special filing exceptions depending on the type of credit being claimed. All other …

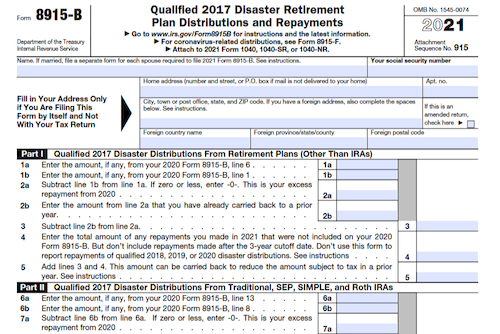

Form 8915-B: Qualified 2017 Disaster Retirement Plan Distributions and Repayments

Individuals adversely affected by a 2017 disaster who received a qualifying distribution may need to file Form 8915-B to report repayments of qualified 2017 disaster distributions made in 2021. What …

Form 5310-A: Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified Separate Lines of Business

Form 5310-A must be filed by any sponsor or plan administrator of a pension, profit-sharing or deferred compensation plan if they are involved in a merger, spinoff or transfer of …

Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return

Form 1066 is required to be filed by entities that elect to be treated as a Real Estate Mortgage Investment Conduit (REMIC) for their first tax year, meeting certain criteria. …

Form 1096: Annual Summary and Transmittal of U.S. Information Returns

Form 1096 is used to send to the IRS certain paper forms such as the 1097, 1098, 1099, 3921, 3922, 5498, and W-2G, and is accompanied by relevant instructions on …