Paid tax return preparers and enrolled agents (EAs) must obtain and renew a Preparer Tax Identification Number (PTIN) annually. This form outlines who must file, and the information required to submit an application. It also provides instructions on how to file online or by mail.

What is Form W-12?

Form W-12, or the Preparer Tax Identification Number (PTIN), is an application for any individual who is compensated for preparing, or assisting in the preparation of, all or substantially all of a tax return or claim for refund of tax. The PTIN must be renewed annually and can be applied for or renewed online through IRS.gov/PTIN, or through mailing Form W-12 with payment to the Tax Professional PTIN Processing Center. Information from this application, including but not limited to name, business name, business address, business phone number, business website address, and professional credentials, is available to the general public through the Freedom of Information Act. Allow 4 to 6 weeks for a mail-in application’s processing.

IRS Form W-12 – Who Needs to Fill It Out?

IRS Form W-12 is to be filled out by anyone who is a paid tax return preparer or Enrolled Agent (EA) and is required to get a Preparer Tax Identification Number (PTIN). This form is also to be filled out annually for PTIN renewal and is publically available information. This form can be filed online or by mail, with 4-6 weeks required for processing should it be sent by mail. For more information and instructions for submission, visit the IRS website at IRS.gov/PTIN.

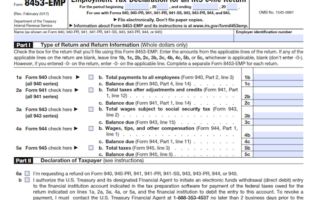

Step-by-Step: Form W-12 Instructions For Filling Out the Document

Filling out Form W-12 can help you apply for or renew your PTIN. Certain information on the form must be available to the public under the Freedom of Information Act, such as your name, business name, business address, business phone number, business website address, and professional credentials. Professional Tax Return Preparers and Enrolled Agents must get a PTIN. You can submit your Form W-12 online at IRS.gov/PTIN and receive your PTIN immediately, or you can submit the form by mail to the given address, but keep in mind that this will take 4-6 weeks to process.

Below, we present a table that will help you understand how to fill out Form W-12.

| Instructions for Form W-12 | Details |

|---|---|

| Purpose | Apply for or renew your PTIN (Preparer Tax Identification Number) |

| Public information | Certain information on the form must be public under the Freedom of Information Act |

| Submission methods | Submit online at IRS.gov/PTIN for immediate processing or by mail (4-6 weeks processing) |

Do You Need to File Form W-12 Each Year?

Yes, if you are a paid tax return preparer or an Enrolled Agent, you must apply for and renew a Preparer Tax Identification Number (PTIN) annually. You can apply for or renew your PTIN online at IRS.gov/PTIN, or you can print and mail Form W-12 along with payment to the IRS Tax Professional PTIN Processing Center. If you apply online, you will generally receive your PTIN immediately, but if you mail the form allow 4-6 weeks for processing.

Download the official IRS Form W-12 PDF

On the official IRS website, you will find a link to download Form W-12. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: the official Form W-12

Sources: