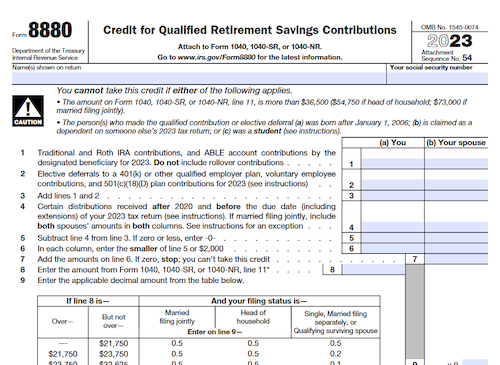

Form 8880 is used to claim the Retirement Savings Contributions Credit, which can be up to $2,000 for eligible taxpayers who make contributions to a qualified retirement plan or IRA. The credit is equal to a percentage of the amount of contributions made.

What is Form 8880?

Form 8880 allows eligible taxpayers to claim the Retirement Savings Contributions Credit. This credit is awarded to those who make contributions to a qualified retirement plan or IRA. The credit is calculated as a percentage of the amount of contributions made, with a limit of $2,000. To determine one’s eligibility for this credit, several income and filing status requirements must be met.

IRS Form 8880 – Who Needs to Fill It Out?

Form 8880 must be filled out by eligible taxpayers who meet certain income and filing status requirements and who have made contributions to a qualified retirement plan or IRA. The form is used to calculate the credit, which is equal to a percentage of the amount of contributions made to the plan or IRA, up to a maximum of $2,000.

Step-by-Step: Form 8880 Instructions For Filling Out the Document

To claim the Retirement Savings Contributions Credit, taxpayers must complete Form 8880. Taxpayers must meet certain requirements and make contributions to a qualified retirement plan or IRA in order to be eligible for the credit. The completed form is used to calculate the eligible credit amount, equal to a percentage of the amount of contributions made to the plan or IRA, up to a maximum of $2,000.

Below, we present a table that will help you understand how to fill out Form 8880.

| Information Required for Form 8880 | Details |

|---|---|

| Eligibility Requirements | Meet certain requirements and make contributions to a qualified retirement plan or IRA |

| Credit Calculation | Calculate the eligible credit amount based on contributions made, up to a maximum of $2,000 |

Do You Need to File Form 8880 Each Year?

Yes. Form 8880 must be filed each year to claim the Retirement Savings Contributions Credit. To be eligible for the credit, taxpayers must meet certain income and filing status requirements. Additionally, they must have made contributions to a qualified retirement plan or IRA. The form is used to calculate the amount of the credit that can be claimed, which is equal to a percentage of the contributions made up to $2,000.

Download the official IRS Form 8880 PDF

On the official IRS website, you will find a link to download Form 8880. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8880

Sources: