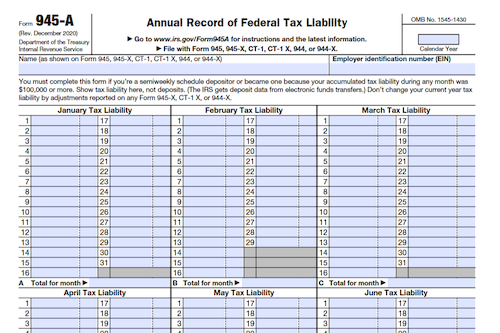

With the help of Form 945-A, employers can report their federal tax liability based on the following tax returns: Forms 945 and 945-X, Forms CT-1 and CT-1 X, or Forms …

Form 2210-F: Underpayment of Estimated Tax By Farmers and Fishermen

Individuals, estates, and trusts who derive two-thirds or more of their gross income from farming or fishing can use Form 2210-F to determine if they owe a penalty for underpaying …

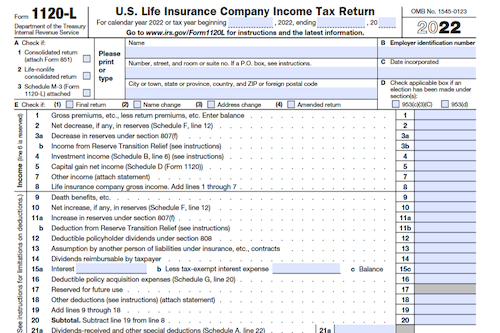

Form 1120-L: U.S. Life Insurance Company Income Tax Return

Need to file taxes for a life insurance company? Form 1120-L can help you report income, gains, losses, deductions, and credits, and calculate any associated tax liability. What is Form …

Form 3520-A: Annual Information Return of Foreign Trust With a U.S. Owner

Form 3520-A is an annual information return of a foreign trust that must be filed by the foreign trust, and subsequently the U.S. owner, to satisfy its annual information reporting …

Form 941-SS: Employer’s Quarterly Federal Tax Return – American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

Employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands (CNMI), and the U.S. Virgin Islands must use Form 941-SS to report the social security and Medicare taxes …

Form 941-PR: Employer’s Quarterly Federal Tax Return (Puerto Rican Version)

Form 940-PR is used to report an employer’s contribution to the Federal Unemployment Tax Act (FUTA). Most employers pay both state and federal unemployment contributions, and must file the form …

Form 990-EZ: Short Form Return of Organization Exempt from Income Tax

Form 990-EZ is an annual information return required by the IRS from many organizations exempt from income tax and certain political organizations. The form requires reporting on exempt activities, finances, …

Form 940-PR: Employer’s Annual Federal Unemployment (FUTA) Tax Return (Puerto Rican Version)

Filing Form 940-PR is necessary for employers to report their contribution to the Federal Unemployment Tax Act (FUTA). Most employers have to pay both federal & state unemployment contributions, but …

Form 965-A: Individual Report of Net 965 Tax Liability

This article provides an overview of Form 965-A, detailing the purpose of the form, definitions associated with it, who must file it, and when and where it is to be …

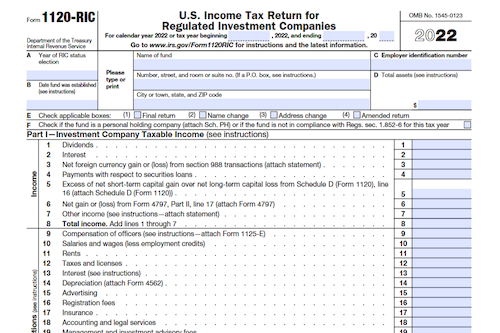

Form 1120-RIC: U.S. Income Tax Return for Regulated Investment Companies

Regulated Investment Companies (RICs) must fill out Form 1120-RIC to report their income, gains, losses, deductions, and credits to determine their income tax liability. What is Form 1120-RIC? Form 1120-RIC, …

Form 2290: Heavy Highway Vehicle Use Tax Return

Form 2290 is an IRS form required for the tax payment of highway motor vehicles with a taxable gross weight of 55,000 pounds or more. It can also be used …

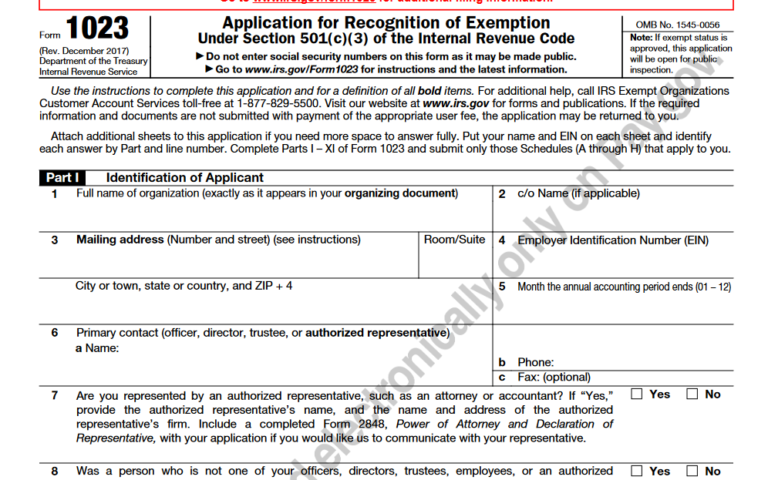

Form 1023: Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code

Applying for tax-exempt status with the IRS? To help you meet the requirements, use Form 1023-EZ to streamline the process or complete Form 1023, including providing financial data and past, …

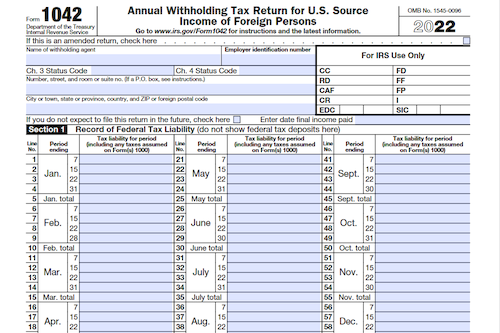

Form 1042: Tax Liability of Qualified Derivatives Dealer (QDD)

This article provides an overview of Form 1042 which is necessary to report tax withholding and payments from foreign persons, entities and trusts. Additionally, information is provided on the withholding …

Form 943-X: Adjusted Employer’s Annual Federal Tax Return for Agricultural Employees or Claim for Refund

Are you looking to fix mistakes on a previously filed Form 943? Use Form 943-X to adjust wages subject to social security tax, Medicare tax, and more, plus complete additional …

Form 5713: International Boycott Report

Form 5713 is a crucial document for businesses and organizations that conduct operations in or related to boycotting countries, as well as for those who receive boycott requests and agreements. …

Form 5735: American Samoa Economic Development Credit

Form 5735 is a document used to calculate the American Samoa economic development credit available for use against income taxes. This credit has restrictions in place, which will be discussed …

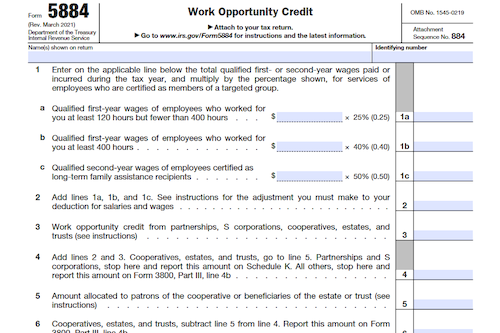

Form 5884: Work Opportunity Credit

Use Form 5884 to claim the work opportunity credit for wages you paid to or incurred for targeted group employees – regardless of whether your business is located in an …

Form 8233: Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual

Form 8233 is an IRS form used to claim income exemption from US tax based on tax treaties with another country. To properly complete the form, one must know the …

Form 8288: U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests

Form 8288 is an important document used by withholding agents to report and pay over amounts withheld for certain dispositions and distributions of U.S. real property interests, transfers of partnership …

Form 3903: Moving Expenses

As taxpayers continue to file their taxes, it is important to keep up-to-date with any changes to IRS forms like Form 3903. For the latest information related to the form …