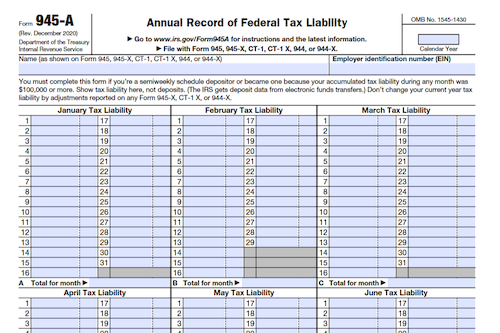

With the help of Form 945-A, employers can report their federal tax liability based on the following tax returns: Forms 945 and 945-X, Forms CT-1 and CT-1 X, or Forms 944 and 944-X. This form assists in establishing if taxes were paid on time and determining the deposit rules.

What is Form 945-A?

Form 945-A is used to report the federal tax liability based on dates payments were made or wages were paid for Forms 945 and 945-X, CT-1 and CT-1X, 944 and 944-X, and 944(SP) and 944-X(SP). The form is also used to match the reported tax liability with deposits and to determine timely deposits, and can help avoid penalties. It is required to be filed annually if returns such as Forms 945, CT-1, or 944 are due, and is mandatory for semiweekly schedule depositors and monthly schedule depositors who reach $100,000 of tax liability. Notice 2021-65 relief regarding the early termination of the employee retention credit is also taken into account when filing Form 945-A.

IRS Form 945-A – Who Needs to Fill It Out?

Form 945-A needs to be completed and filed by semiweekly Schedule Depositors who pay forms 945, 945-X, CT-1, CT-1X, 944, 944-X, 944(SP), or 944-X(SP). Monthly Schedule Depositors may also be required to complete Form 945-A if they accumulate $100,000 or more of tax liability in any month. Form 945-A is used by the IRS to match the reported tax liability on the indicated forms with deposits, and to ensure taxes have been paid on time. Those who do not complete and file Form 945-A or deposit their taxes on time may incur an FTD penalty.

Step-by-Step: Form 945-A Instructions For Filling Out the Document

Filling out Form 945-A is an important step in reporting and tracking your federal tax liability across multiple returns and payments. Used for Forms 945, 945-X, CT-1, CT-1X, 944, 944-X, and 944(SP), Form 945-A is required for semiweekly schedule depositors, who must complete Form 945-A when their Form 945, CT-1, or 944 is due each year. Minimum tax liabilities of $2,500 per return period, and $100,000 per month for monthly schedule depositors, are necessary for inclusion on Form 945-A. Refer to the Instructions For Form 945-A, Pub. 15, and Notice 2021-65 for further information.

Below, we present a table that will help you understand how to fill out Form 945-A.

| Information Required for Form 945-A | Details |

|---|---|

| Forms Covered | Forms 945, 945-X, CT-1, CT-1X, 944, 944-X, 944(SP) |

| Filing Requirement | Required for semiweekly schedule depositors |

| Filing Frequency | When Form 945, CT-1, or 944 is due each year |

| Minimum Tax Liability | $2,500 per return period (semiweekly depositors) $100,000 per month (monthly depositors) |

| Additional Information | Refer to the Instructions For Form 945-A, Pub. 15, and Notice 2021-65 for further details |

Do You Need to File Form 945-A Each Year?

Form 945-A serves to report annual federal tax liability based on dates payments were made or wages paid and is used for Forms 945, 945-X, CT-1, CT-1 X, 944, and 944-X. Semiweekly schedule depositors must complete and file Form 945-A while monthly schedule depositors may become eligible to file Form 945-A if they accumulate a tax liability of $100,000 in any month. Form 945-A is not required if the net tax liability for the return period is less than $2,500 or if you are a monthly schedule depositor with no $100,000 accumulation. Form 945-A is due on the same day as the related form returns and must be submitted every year.

Download the official IRS Form 945-A PDF

On the official IRS website, you will find a link to download Form 945-A. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 945-A

Sources: