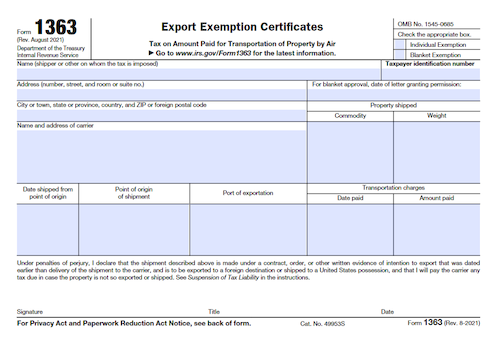

Filing Form 1363 with a carrier may help taxpayers suspend the liability of the 6.25% tax on transportation of property by air that begins and ends in the United States. Taxpayers may request permission for a blanket exemption to cover multiple shipments over an indefinite period of time. Evidence of exportation must be provided within the 6-month suspension period or else the temporary suspension of the tax liability ends.

What is Form 1363?

Form 1363 is a document used to suspend the liability for the section 4271 6.25% tax on transportation of property by air when the transportation begins and ends in the United States. It can be used for individual shipments or, with permission from the IRS, can be used as a blanket exemption. To be granted a blanket exemption, evidence of exportation must be provided, such as a copy of export bill of lading, a memorandum from the captain of the vessel, or a shipper’s export declaration. Once granted, the exemption applies to all exported products. The carrier must keep the original blanket certificate with all records of payment for the transportation charges, while the taxpayer must keep a copy for at least 3 years. Suspension of this tax liability starts from the date of shipment from point of origin and lasts for 6 months.

IRS Form 1363 – Who Needs to Fill It Out?

Form 1363 must be filed with the carrier to suspend the liability for the 6.25% tax on transportation of property by air within the United States. Any individual making payments for numerous export shipments over an indefinite period of time may request permission to use a blanket exemption on Form 1363 and must demonstrate why it isn’t practical to complete a separate Form 1363 for each payment. This permission must be granted by the IRS, and, if given, the same blanket certificate must be used for all air carriers for all export shipments. The person liable for the tax must also provide evidence of exportation and keep all records showing payment of transportation charges for at least 3 years after the final shipment covered by the certificate.

Step-by-Step: Form 1363 Instructions For Filling Out the Document

Form 1363 is used by carriers to suspend the liability of the 6.25% tax on transportation of property by air, imposed during transportation in the US. The form can also be used with a blanket exemption, granted by the IRS, which applies to all products shipped over an indefinite period of time, if one feels it isn’t practical to fill out a separate Form 1363 for each payment. To apply for the blanket exemption, one must submit a letter to the IRS, and if permission is granted, they should then file a separate blanket certificate with the air carrier before payment for the transportation. Evidence of exportation must also be included along with the Form 1363. This evidence may consist of a shipping bill of lading or a memorandum from the captain, and the description of the property must be brief. Lastly, the form must be used either as an individual or blanket exemption and the appropriate box must be checked.

Below, we present a table that will help you understand how to fill out Form 1363.

| Information Required for Form 1363 | Details |

|---|---|

| Blanket Exemption | Information about applying for a blanket exemption |

| Evidence of Exportation | Include evidence of exportation |

| Individual vs. Blanket Exemption | Choose between individual and blanket exemption |

| Appropriate Box | Check the appropriate box |

Do You Need to File Form 1363 Each Year?

Yes, if you are liable for the 6.25% tax on transportation of property by air that originates and ends in the United States, you will need to file Form 1363 each year. You can either provide a separate form in conjunction with each payment, or request a blanket exemption from the IRS for multiple export shipments over an indefinite period of time. If granted, you will need to complete a separate certificate for each air carrier, keep a copy and file the original with the carrier. Recordkeeping is also necessary – you must keep the blanket certificate for 3 years from the last day of the month the final shipment covered by the certificate was made, along with other applicable shipping and payment records. Additionally, proof of exportation must be provided to the carrier along with Form 1363.

Download the official IRS Form 1363 PDF

On the official IRS website, you will find a link to download Form 1363. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1363

Sources: