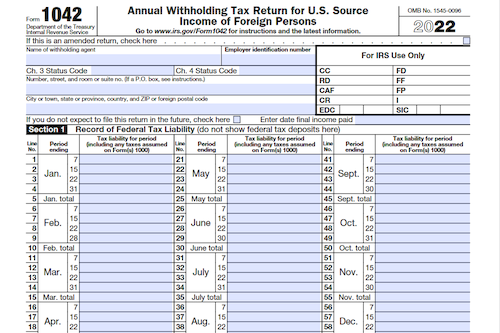

This article provides an overview of Form 1042 which is necessary to report tax withholding and payments from foreign persons, entities and trusts. Additionally, information is provided on the withholding requirements for chapter 4, section 5000C, section 877A and other related taxes.

What is Form 1042?

Form 1042 is an important form for reporting various types of taxes, including those withheld under Chapter 3 (excluding withholding under sections 1445 and 1446, except as indicated) on certain incomes of foreign persons, Chapter 4 on withholdable payments, and section 5000C on specified federal procurement payments. It is also used for section 877A withholding on payments to covered expatriates, payments reported on Form 1042-S under Chapters 3 or 4, certain distributions subject to section 1445, and publicly traded partnerships subject to section 1446 withholding tax.

IRS Form 1042 – Who Needs to Fill It Out?

IRS Form 1042 must be filed by those responsible for paying income to nonresident aliens, foreign partnerships, corporate entities, estates, and trusts. Tax must be withheld from payments of these entities on Form 1042 as per regulations for withholding requirements under chapters 3, 4, and 5000C. In some cases, publicly traded trusts, real estate investment trusts, and regulated investment companies must withhold section 1445 tax, and publicly traded partnerships must withhold section 1446 tax. These tax withholding amounts must also be reported on Form 1042.

Step-by-Step: Form 1042 Instructions For Filling Out the Document

Form 1042 is used to report and document taxes that have been withheld from certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. It is also used to document taxes withheld from withholdable payments under chapter 4, pursuant to section 5000C on specified federal procurement payments, under section 877A on certain eligible deferred compensation, and on certain distributions subject to section 1445 and 1446 withholding taxes. To further understand the filing requirements, be sure to consult Regulations sections 1.1471-2(a), 1.1471-4(b), 1.1472-1(a), 1.1474-1(d)(2)(i), 1.1461-1(c)(2), 1.1445-8, and 1.1446-4, as well as Pub. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

Below, we present a table that will help you understand how to fill out Form 1042.

| Information for Form 1042 | Details |

|---|---|

| Type of Income | Taxes withheld from certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. |

| Chapter 4 Withholdable Payments | Taxes withheld from withholdable payments under chapter 4, pursuant to section 5000C on specified federal procurement payments. |

| Section 877A | Taxes withheld on certain eligible deferred compensation under section 877A. |

| Sections 1445 and 1446 | Taxes withheld on certain distributions subject to section 1445 and 1446 withholding taxes. |

| Filing Requirements | Consult Regulations sections 1.1471-2(a), 1.1471-4(b), 1.1472-1(a), 1.1474-1(d)(2)(i), 1.1461-1(c)(2), 1.1445-8, and 1.1446-4, as well as Pub. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities. |

Do You Need to File Form 1042 Each Year?

Whether you are a foreign person, a foreign corporation, a foreign estate, a foreign trust, a nominee, a publicly traded trust, a real estate investment trust, or a regulated investment company, you may need to file Form 1042 each year to report any taxes withheld under various chapters and regulations, including chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated), chapter 4, section 5000C on specified federal procurement payments, section 877A on payments of eligible deferred compensation items or distributions from nongrantor trusts to a covered expatriate, and sections 1445 and 1446 tax on certain distributions. See the Instructions for Form 1042-S and Pub. 515 for more information.

Download the official IRS Form 1042 PDF

On the official IRS website, you will find a link to download Form 1042. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1042

Sources: