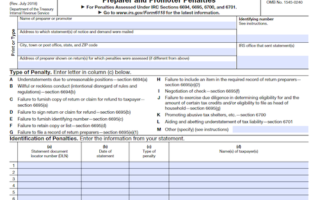

Form 8275-R is used to disclose positions taken on a tax return that are contrary to Treasury regulations in order to avoid the accuracy-related penalty. Common uses of the form include disclosures related to the economic substance penalty and preparer penalties.

What is Form 8275-R?

Form 8275-R is an IRS document used to disclose positions taken on a tax return that are contrary to Treasury regulations. It is filed to avoid portions of the accuracy-related penalty due to disregard of regulations or to a substantial understatement of income tax, while Form 8275, Disclosure Statement, is used for disclosures that are not contrary to regulations. Both forms are required to be filed by individuals, corporations, pass-through entities, and tax return preparers. Filing them with a timely filed original or qualified amended return will help taxpayers to avoid the accuracy-related penalty. Nevertheless, adequate disclosure must be made in order to avoid the penalty, and the reasonable basis standard must be met. Substantial understatement can be reduced by showing substantial authority and reasonable disclosure. Tax return preparers who take positions that are not justified or are a tax shelter are subject to penalties.

IRS Form 8275-R – Who Needs to Fill It Out?

IRS Form 8275-R must be filled out by individuals, corporations, pass-through entities, and tax return preparers when a return position is taken that is contrary to Treasury regulations. The penalty for reckless or intentional disregard of a regulation can be avoided by disclosure by filing this form if the position is adequately disclosed and represents a good-faith challenge to the validity of the regulation and that has a reasonable basis. A preparer is also subject to a penalty if they take a position that understates any part of the tax liability which they knew or should have known was not substantially authorized. The disclosure is adequate only if it is made separately on Form 8275-R.

Step-by-Step: Form 8275-R Instructions For Filling Out the Document

Step-by-Step: Form 8275-R Instructions For Filling Out the Document Form 8275-R is used to disclose positions taken on a tax return that contravene Treasury regulations in order to avoid the accuracy-related penalty. It is filed by individuals, corporations, pass-through entities, as well as tax return preparers, and must include any applicable penalties. Penalties can be avoided, however, if the position represents a good-faith challenge to the validity of the regulation and has a reasonable basis. Additionally, the reasonable cause and good faith exception can exempt taxpayers from a portion of the penalty if it is due to negligence, disregard of rules, a substantial understatement of income tax, a substantial or gross valuation misstatement, or a claim of tax benefits from a transaction lacking economic substance.

Below, we present a table that will help you understand how to fill out Form 8275-R.

| Key Information for Form 8275-R | Details |

|---|---|

| Purpose | Used to disclose positions contravening Treasury regulations |

| Eligibility | Individuals, corporations, pass-through entities, tax return preparers |

| Penalties | May be avoided with a good-faith challenge and a reasonable basis |

| Exceptions | Reasonable cause, good faith, and exemptions for certain errors |

Do You Need to File Form 8275-R Each Year?

Form 8275-R must be filed in order to disclose positions taken on a tax return that are contrary to Treasury regulations and to avoid portions of the accuracy-related penalty due to the disregard of regulations or to a substantial understatement of income tax for non-tax shelter items. Disclosure must meet specific requirements in order to be considered adequate and a penalty can be avoided by demonstrating reasonable cause and acting in good faith. A preparer is expected to adequately disclose a position with a reasonable basis to avoid the penalty. Form 8275-R is filed when individuals, corporations, pass-through-entities, and tax return preparers file their original tax returns, amended returns, or to make disclosure for items reported by the pass-through entity. To avoid penalties, carryover and carryback items must be disclosed in the tax year of origin and, for items of a recurring nature, the form must be filed for each tax year in which the item occurs. In addition, a return may have to also file Form 8886, Reportable Transaction Disclosure Statement, depending on the transaction’s definition.

Download the official IRS Form 8275-R PDF

On the official IRS website, you will find a link to download Form 8275-R. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8275-R

Sources: