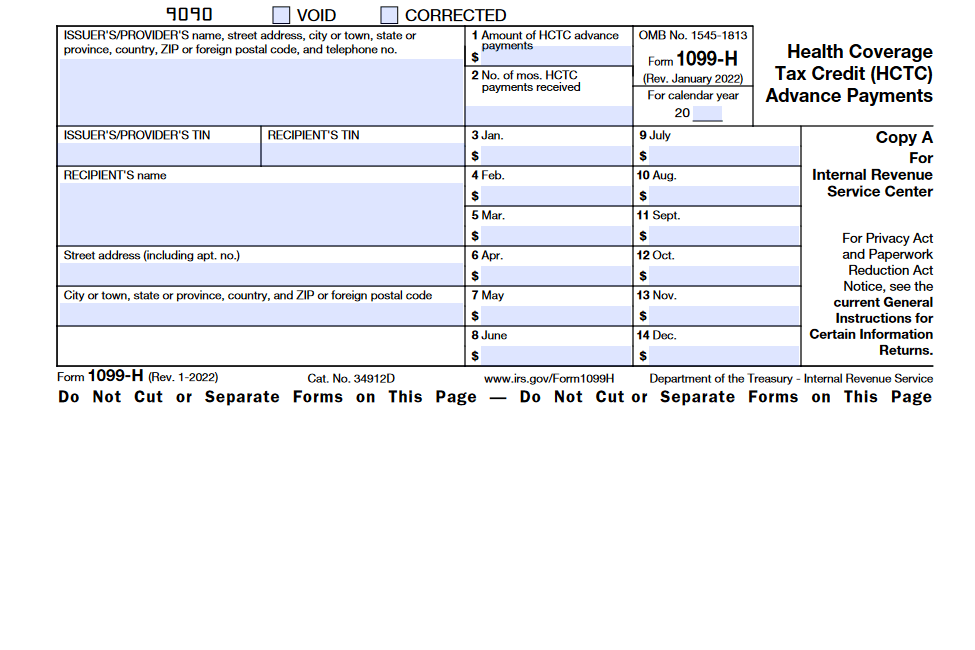

Form 1099-H: Health Coverage Tax Credit Advance Payments is a U.S. federal income tax form used to report health insurance payments made to recipients of Trade Adjustment (TAA), Alternative TAA (ATAA), Reemployment TAA (RTAA) or Pension Benefit Guaranty Corporation (PBGC) payees and their qualifying family members. Filed by health insurance providers, the form is used to track the total amount, number of months, and amount paid for each month of the year.

What is Form 1099-H?

Form 1099-H: Health Coverage Tax Credit Advance Payments is an IRS form used to report advance payments of qualified health costs for individuals eligible for trade adjustment assistance, alternative TAA, RTAA, or PBGC. Insurance providers send a copy to the IRS, and another to the taxpayer, along with 14 boxes. Box 1 shows the total payments made to the taxpayer. Other boxes show the number and amount of HCTC advance payments paid to the taxpayer for the year, up to 72.5% of their total premiums. Taxpayers who received Form 1099-H in 2021 must report some required information on IRS Form 8885 and attach it to their tax return. It is not required to submit a copy of Form 1099-H, and taxpayers should keep copies of the form for their records.

IRS Form 1099-H – Who Needs to Fill It Out?

Eligible taxpayers and members of their families are issued Form 1099-H: Health Coverage Tax Credit Advance Payments by health insurance providers to report the advance credit payments made to them on behalf of the Department of the Treasury. Recipients may be eligible for the program if they qualify for TAA, ATAA, RTAA, or PBGC, and are between ages 55 and 64 and have a defined-benefit pension plan taken over by the PBGC. To complete the form, the issuer will file a copy to the IRS, one to the taxpayer, and retain one for their records. Beyond reporting the total advanced payment in Box 1, the form contains boxes for the number of months of coverage and up to fourteen boxes for a month-by-month breakdown of those payments. Form 8885, when included with the taxpayer’s annual tax return, will take into account the information from Form 1099-H. The form should be received by the taxpayer by January 31 of the following year.

Step-by-Step: Form 1099-H Instructions For Filling Out the Document

To fill out Form 1099-H, health insurance providers who have received advance payments on behalf of eligible recipients from the Department of the Treasury must file a copy to the IRS and one to the taxpayer. The left side of the form includes details about the provider and recipient, and the right side of the form contains 14 boxes. The first box (1) shows the total amount of qualified health insurance costs advanced, and box 2 shows the number of months the payments were issued to the taxpayer; boxes 3 through 14 provide the amount of advancement for each month. For those eligible for the HCTC, they should receive Form 1099-H by January 31, 2022, and do not need to submit the form with their annual tax return, only the information provided on Form 8885. However, they should still keep their copy with their tax records.

Below, we present a table that will help you understand how to fill out Form 1099-H.

| Information Required for Form 1099-H | Details |

|---|---|

| Provider Details | Recipient Details |

| Provider Name | Recipient Name |

| Provider Address | Recipient Address |

| Provider Taxpayer Identification Number | Recipient Social Security Number |

| Advance Payment Details | Form 8885 Information |

| Total Advanced Health Insurance Costs (Box 1) | N/A |

| Number of Months Payments Issued (Box 2) | N/A |

| Monthly Advancements (Boxes 3-14) | N/A |

Do You Need to File Form 1099-H Each Year?

Do You Need to File Form 1099-H Each Year? Form 1099-H: Health Coverage Tax Credit Advance Payments is an IRS form used to report advance payments of qualified health insurance made to eligible taxpayers through the Department of the Treasury. The program ended in 2021, so you only need to file if you received HCTC payments that year. Qualified providers will submit Form 1099-H to the IRS and recipients, with information including names, addresses, TINs, and amount of payments in boxes 1 and 3-14. Taxpayers should include any info from Form 1099-H on Form 8885 when filing their annual tax return. The form must be issued to taxpayers by Jan 31, 2022, so be sure to stay on top of it!

Download the official IRS Form 1099-H PDF

On the official IRS website, you will find a link to download Form 1099-H: Health Coverage Tax Credit Advance Payments. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1099-H

Sources:

https://www.irs.gov/forms-pubs/about-form-1099-h

https://www.irs.gov/instructions/i1099h