Learn how to correctly file Form 6251 to calculate the alternative minimum tax (AMT) liability for taxpayers with higher economic incomes. Find out the latest on exemption amounts, tax brackets, deductions, credits, and more.

What is Form 6251?

Form 6251 is a form used to calculate Alternative Minimum Tax (AMT), which is a separate tax imposed on taxpayers with certain types of income that receive special treatment or deductions under tax law. Form 6251 also figures tentative minimum tax for certain credits listed in the form, and may need to be added to tax return in such cases. Taxpayers must also keep records that show how they figured income or deductions for the AMT, and refigure items for AMT by completing AMT version of forms or worksheets. Additionally, Non-resident Aliens may need to make special computation on Form 6251 if they disposed of US real property interests.

IRS Form 6251 – Who Needs to Fill It Out?

IRS Form 6251 must be filled out by taxpayers claiming certain general business credits, qualified electric vehicle credits, alternative fuel vehicle refueling credits, or credits for prior year minimum taxes, as well as by taxpayers for whom Form 6251 Line 7 is greater than 10, or whose total of lines 2c-3 is negative and line 7 is greater than 10 without those lines. The form is used to calculate one’s alternative minimum tax amount, which applies to higher income taxpayers who receive sizable tax benefits and deductions.

Step-by-Step: Form 6251 Instructions For Filling Out the Document

Form 6251 is used to figure the amount, if any, of the Alternative Minimum Tax (AMT). Requirements for filing, items to be refigured for AMT, tax benefits, recordkeeping, adjustments or preferences from partnerships or S-corporations, and optional write-offs for certain expenditures must all be taken into account. In order to complete the form correctly and in full, consult its instructions, accompanying documents, and the latest developments from IRS.gov/Form6251. Be sure to keep accurate records to support all items reported on your return.

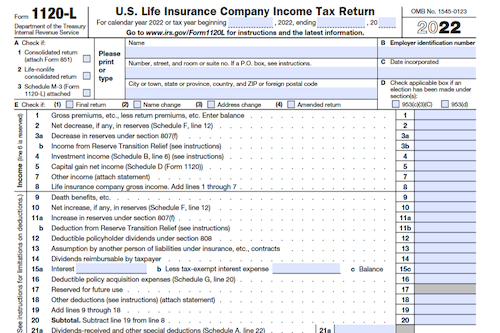

Below, we present a table that will help you understand how to fill out Form 6251.

| Form 6251 | Instructions |

|---|---|

| Form 6251 is used to figure the amount, if any, of the Alternative Minimum Tax (AMT). Requirements for filing, items to be refigured for AMT, tax benefits, recordkeeping, adjustments or preferences from partnerships or S-corporations, and optional write-offs for certain expenditures must all be taken into account. In order to complete the form correctly and in full, consult its instructions, accompanying documents, and the latest developments from IRS.gov/Form6251. Be sure to keep accurate records to support all items reported on your return. |

|

Do You Need to File Form 6251 Each Year?

Yes, Form 6251 must be included with your annual tax return if any of the specified criteria are true, such as needing to take an alternative minimum tax credit or having to use a special computation for nonresident aliens. You should also keep track of any items that differ between the AMT and the regular tax, where you may have to refigure an item for AMT or complete an additional AMT version of a form or worksheet to figure items correctly. Keeping accurate records of these items will help to ensure your correct AMT is figured.

Download the official IRS Form 6251 PDF

On the official IRS website, you will find a link to download Form 6251. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 6251

Sources: