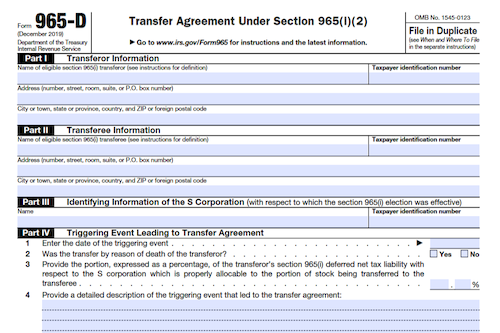

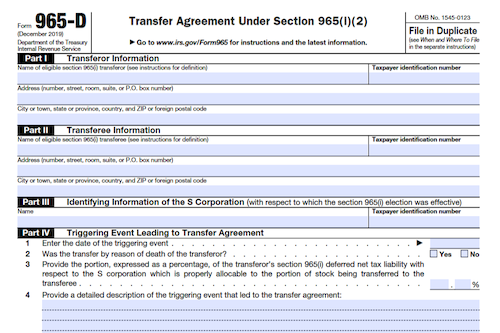

Form 965-D establishes the information and representations necessary to enter into a transfer agreement under section 965(i)(2) of the IRS when an S corporation’s shareholder has a section 965(i) net …

Form 965-D establishes the information and representations necessary to enter into a transfer agreement under section 965(i)(2) of the IRS when an S corporation’s shareholder has a section 965(i) net …

From determining the interest due for depreciated property to figuring the interest refunded to individuals, businesses, and pass-through entities, Form 8866 is a necessary tool for taxpayers. Learn more about …

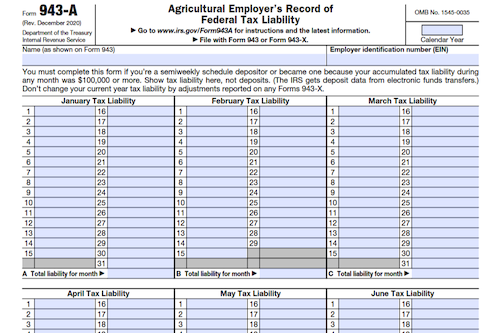

Form 943-A is used to report the federal tax liability of semiweekly schedule depositors based on the dates wages were paid. It must be filed along with Form 943, and …

Form 965-C is used by eligible section 965(h) transferors and transferees to enter into a transfer agreement under section 965(h)(3) of the US Tax Code. This form requires specified information …

Form 8867 must be filed with the taxpayer’s return or amended return claiming the EIC, the CTC/ACTC/ODC, the AOTC, and/or HOH filing status. As a paid tax return preparer, you …

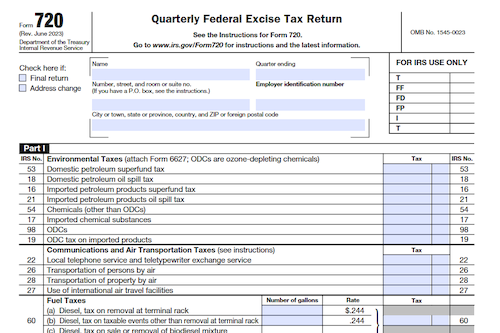

Form 720 is used by individuals liable for federal excise taxes to report quarterly obligations, who also have the option of claiming a credit via Schedule C. Those who receive …

U.S. citizens or residents living or working abroad must adhere to the same U.S. income tax laws that apply to citizens and residents living in the U.S. Foreign earned income, …

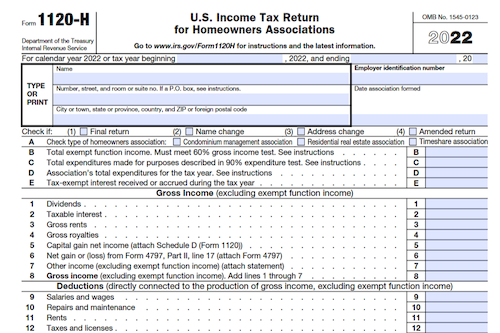

A homeowners association can take advantage of certain tax benefits by filing Form 1120-H, which provides a flat tax rate of 30%-32% (depending on the type of association) and excludes …

Parent S corporations use Form 8869 to elect to treat eligible subsidiaries as a qualified subchapter S subsidiary (QSub), resulting in a deemed liquidation of the subsidiary into the parent. …

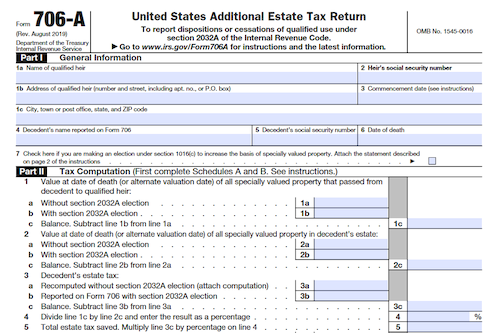

Qualified heirs must file Form 706-A to report the additional estate tax imposed for an early disposition of specially valued property or for an early cessation of a qualified use. …

Form 1125-E is used by entities with total receipts of $500,000 or more to provide a detailed report of deductions for compensation of officers, and must be attached to the …

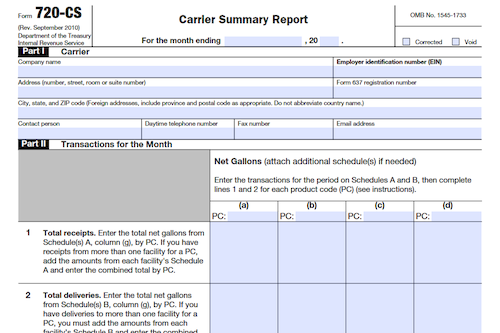

Bulk transport carriers must file Form 720-CS with the IRS to report monthly receipts and disbursements of liquid products at a designated storage location. Filing rules and requirements are outlined …

The Tax Cuts and Jobs Act has limited the amount of annual losses from the trades or businesses of noncorporate taxpayers that can be claimed. Form 461 aims to calculate …

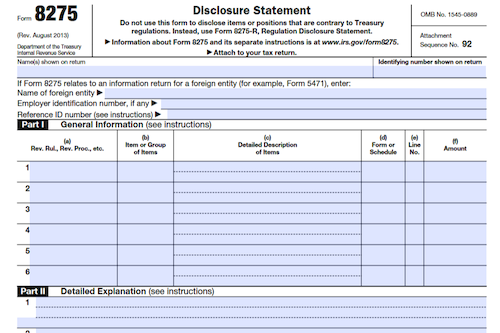

Form 8275 is used to disclose items or positions on a tax return to avoid certain penalties, including the accuracy-related penalty due to disregarding of rules, the economic substance penalty, …

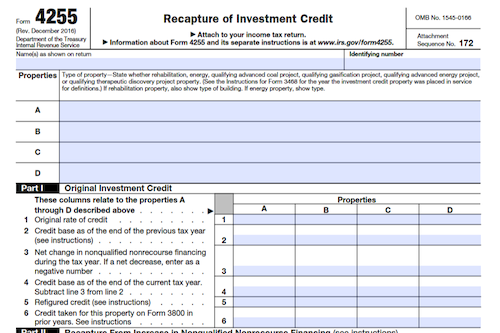

Form 4255 is used to calculate the tax increase for investment credit and a qualifying therapeutic discovery project grant when certain conditions apply. Learn about exceptions, adjustments, and regulations to …

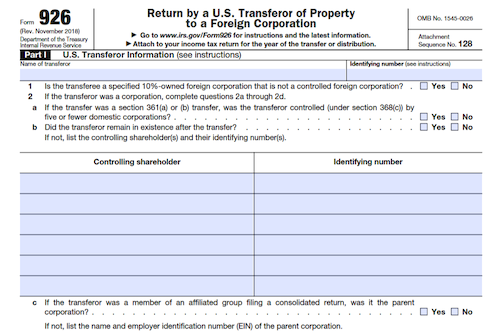

U.S. citizens, domestic corporations, and domestic estates or trusts must complete and file Form 926 with the IRS to report certain transfers of tangible or intangible property to a foreign …

This article focuses on providing information about the form 8621-A, which is used by U.S. persons to make a late purging election with respect to a former or Section 1297(e) …

Partnerships that have taxable income allocable to foreign partners are mandated to make estimated section 1446 tax payments of $500 or more, due by specific dates throughout the year. Penalties …

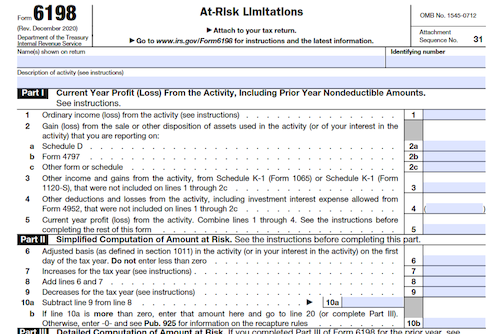

Form 6198 should be filed by those engaged in an activity listed in the At-Risk Activities section of the source text. The form helps individuals, estates, trusts, and certain closely …

Form 8275-R is used to disclose positions taken on a tax return that are contrary to Treasury regulations in order to avoid the accuracy-related penalty. Common uses of the form …