For businesses with long-term contracts of certain types, Form 8697 is used to determine the amount of interest due or refundable under the look-back method of taxation. Learn who must …

Form 8609: Low-Income Housing Credit Allocation and Certification

Owners of low-income rental buildings can get a low-income housing credit for each building over a 10-year period, with Form 8609 being used to claim allocations from the housing credit …

Form 1097-BTC: Bond Tax Credit

For recipients of Form 1097-BTC from a bond issuer or their agent, such as brokers, nominees, mutual funds, or partnerships, who are further distributing tax credits from New Clean Renewable …

Form T (Timber): Forest Activities Schedule

Are you a business dealing in timber-related activities? If so, you must file Form T (Timber) with your income tax return, and maintain certain records, to stay in accordance with …

Form 1139: Corporation Application for Tentative Refund

Corporations can apply for a quick refund of taxes through Form 1139, including those from a Net Operating Loss, a capital loss, an unused general business credit, or more. Qualified …

Form 6627: Environmental Taxes

This article provides an overview of the Environmental Tax on Petroleum and Imported Products, Chemicals (other than ODCs), Imported Chemical Substances, ODCs, and Floor Stocks Tax on ODCs as outlined …

Form 5498-QA: ABLE Account Contribution Information

States, agencies, and instrumentalities that establish and maintain a qualified ABLE program are required to file Form 1099-QA with the IRS, detailing each ABLE account’s distributions and terminations during the …

Form 1099-QA: Distributions from ABLE Accounts

States, agencies, and instrumentalities that establish and maintain a qualified ABLE program are required to file Form 1099-QA with the IRS, detailing each ABLE account’s distributions and terminations during the …

Form 1024: Application for Recognition of Exemption Under Section 501(a) or Section 521 of the Internal Revenue Code

Organizations applying for recognition of tax-exempt status under section 501(a) or section 521 of the IRS code can use Form 1024 to submit their application. However, some organizations may use …

Form 1098-E: Student Loan Interest Statement (Info Copy Only)

Are you a financial institution, educational institution, or any other person who has received student loan interest of $600 or more from an individual? Learn how to file Form 1098-E …

Form 1094-B: Transmittal of Health Coverage Information Returns

This article will provide an overview of General Instructions for Forms 1094-B and 1095-B, including who must file, eligibility for certain types of minimum essential coverage, and information about reporting …

Form 1120-ND: Return for Nuclear Decommissioning Funds and Certain Related Persons

Form 1120-ND offers nuclear decommissioning funds the opportunity to report contributions, income, administrative expenses, and taxes related to self-dealing. All section 468A funds and disqualified persons engaging in self-dealing must …

Form 1120-REIT: U.S. Income Tax Return for Real Estate Investment Trusts

Are you an organization that meets certain conditions and is interested in electing to be treated as a REIT for the tax year? Learn about the form requirements and general …

Form 1042-S: Foreign Person’s U.S. Source Income Subject to Withholding

Withholding agents are required to report income described under “Amounts Subject to Reporting on Form 1042-S” on Form 1042-S, and should not use other forms (such as W-2, 1099, 8288-A, …

Form W-3 PR: Transmittal of Corrected Wage and Tax Statements (Info Copy Only) (Puerto Rico Version)

For Puerto Rican employers, the Social Security Administration (SSA) provides guidance on reporting employee wages, as well as some COVID-19-related tax relief. Learn more about form submission details, Additional Medicare …

Form SS-4-PR: Application for Employer Identification Number (Puerto Rico Version)

What is Form SS-4-PR? Form SS-4PR is used to request an Employer Identification Number (EIN). The EIN is a nine-digit number assigned to sole proprietors, corporations, heirs, trusts, and other …

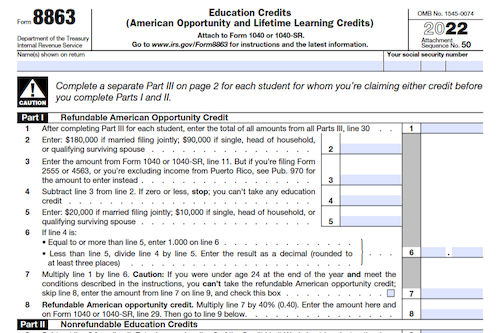

Form 8863: Education Credits (American Opportunity and Lifetime Learning Credits)

Brushing up on your taxes for 2022? It’s important to be aware of the differences between the two education credits the American opportunity credit and the lifetime learning credit. Both …

Form 8865: Return of U.S. Persons With Respect to Certain Foreign Partnerships

U.S. persons filing Form 8865 must provide information about the entity’s Controlled Foreign Partnership (CFP) activities, as required under sections 6038, 6038B, and 6046A. Depending on the category of which …

Form 8854: Initial and Annual Expatriation Statement

Expatriates must file Form 8854 to comply with their initial and annual information reporting obligations and taxation requirements when relinquishing or terminating their U.S. citizenship or residency on or after …

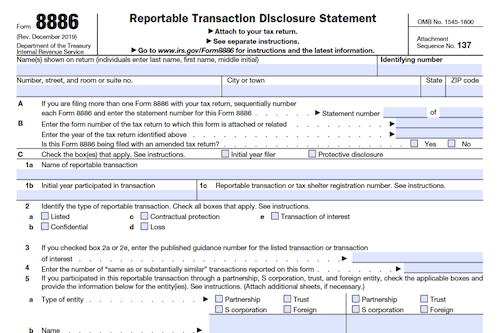

Form 8886: Reportable Transaction Disclosure Statement

Individuals, trusts, estates, partnerships, S corporations, and other corporations that participate in reportable transactions for federal tax purposes must file Form 8886. This form helps disclose information regarding the tax …