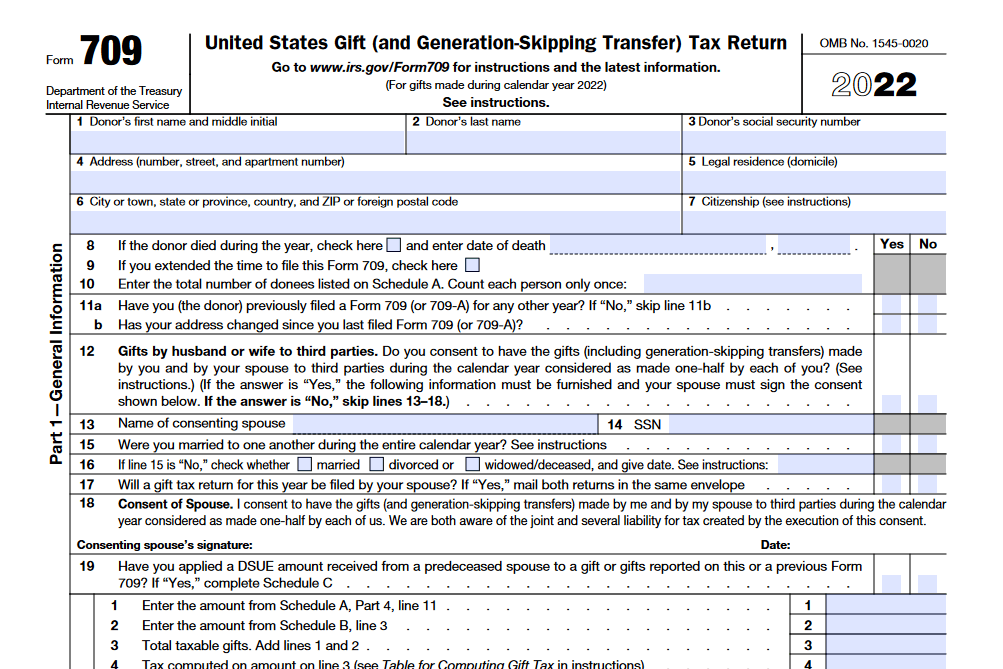

Form 709 is an IRS form required when transferring assets that may be subject to federal gift or generation-skipping transfer taxes. Filing this form does not necessarily mean there is …

Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return

Form 706 is an Internal Revenue Service form used by an executor of a decedent’s estate to calculate the estate tax and generation-skipping transfer tax owed when the estate surpasses …

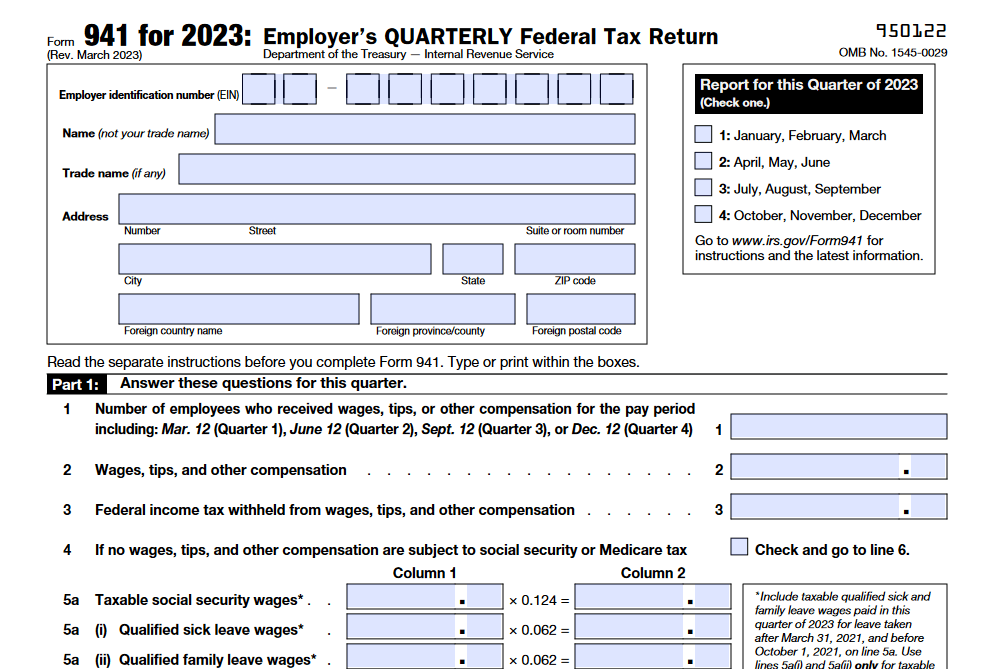

Form 941: Employer’s Quarterly Federal Tax Return

IRS Form 941 is the quarterly federal tax return for employers, who need to report withheld taxes such as federal income tax, and the employer and employee share of Social …

Form 1120S: U.S. Income Tax Return for an S Corporation

Form 1120-S is the annual tax return for businesses that are registered as S corporations. It is used to report income, gains, losses, credits, deductions, and other information to the …

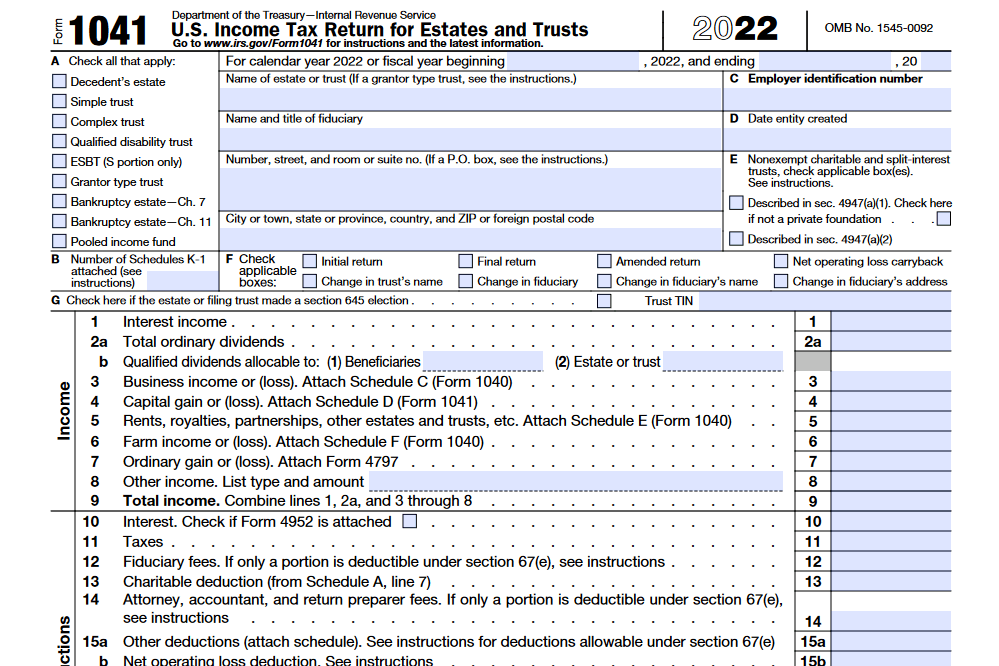

Form 1041: U.S. Income Tax Return for Estates and Trusts

Form 1041 is an IRS income tax return filed by the trustee or representative of a deceased individual’s estate or trust to declare any taxable income earned before assets are …

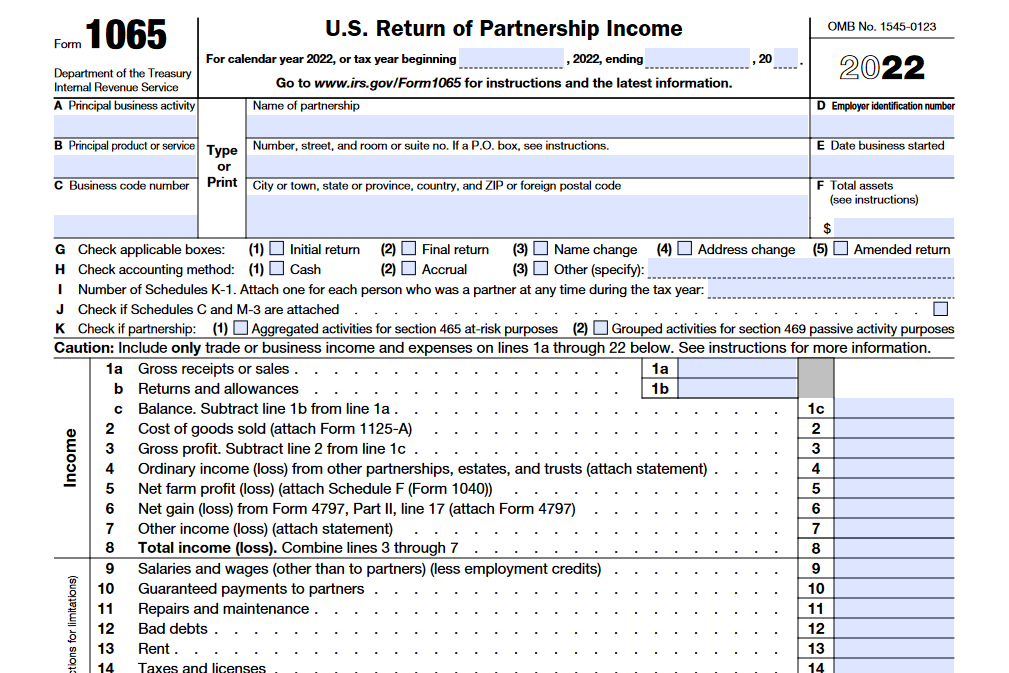

Form 1065: U.S. Return of Partnership Income

All domestic partnerships must file IRS Form 1065: U.S. Return of Partnership Income to declare profits, losses, deductions and credits of the business for tax filing purposes. Partner’s share of …

Form 1040-NR: Nonresident Alien Income Tax Return

Non-citizen US residents and those earning income in the US must file Form 1040-NR, the US Nonresident Alien Income Tax Return. This article explains who needs to file such a …

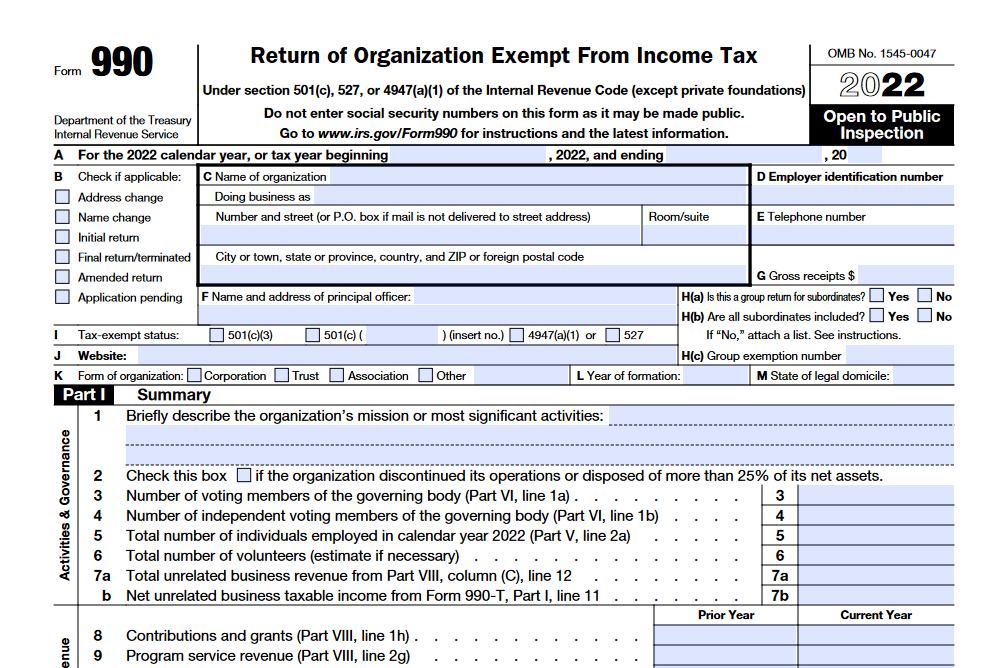

Form 990: Return of Organization Exempt From Income Tax

The Form 990 is a detailed financial document mandated by the U.S. Internal Revenue Service (IRS) for tax-exempt organizations. It’s the public’s window into an organization’s finances, providing transparency of …

Form 1040: U.S. Individual Income Tax Return

Filing taxes can be a tricky process, but it’s important to get it right. With Form 1040, individuals can easily report their income and calculate their expected tax liability. What …

Form 8820: Orphan Drug Credit

Form 8820 is used to figure and claim the orphan drug credit, which is 25% of qualified clinical testing expenses paid or incurred. The credit is available to taxpayers for …

Form 8717: User Fee for Employee Plan Determination Letter Request

Employers who are eligible for an exemption from user fees when applying for a determination letter can now take advantage of the new rules regarding the exemption. This exemption applies …

Form 4461-C: Occupational Tax and Registration Return for Wagering

Form 4461 is an IRS form used to request approval for tax-deductible contributions of conservation easements, qualified conservation contributions, or public properties. Upon completion of the form, accompanied by a …

Personal Income Taxes for Small Business Owners

As a small business owner, it is important to understand the implications of personal income taxes. Regardless of the type of business structure you have chosen, you are still responsible …

Calculating Overpaid Tax: A Step-by-Step Guide

Calculating overpaid tax can be a complex process, especially considering the different corporate configurations that businesses can have. However, by following a few simple steps, you can determine if you …

Form 6088: Distributable Benefits From Employee Pension Benefit Plans

Form 6088 is a form used by the Department of the Treasury and the Internal Revenue Service for analyzing an application for a determination letter on the qualification of a …

A Beginner’s Guide to Filing Your Taxes

Filing your taxes for the first time can be a daunting task. However, by following a few simple steps, you can navigate tax season with ease and take advantage of …

Form 1127: Application for Extension of Time for Payment of Tax Due to Undue Hardship

Struggling to pay taxes on time? Form 1127 can help; it’s used to apply for an extension of time if paying taxes on the due date will cause undue hardship. …

Reporting Freelance Work on a Tax Return

Reporting freelance work on a tax return can be a straightforward process if you follow the necessary steps. By keeping proper records of your income and expenses, filling out the …

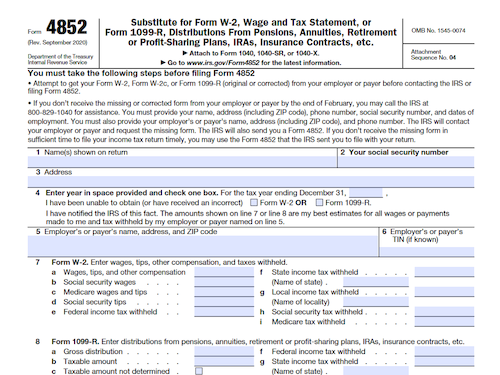

Form 4852: Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Form 4852 is a document designed to report substitute payments for wages, compensation for services, and other income when the taxpayer’s employer does not have the necessary information to report …

Form W-10: Dependent Care Provider’s Identification and Certification

IRS Form W-10 is an important resource for individuals claiming the Child or Dependent Care Tax Credit on their federal tax returns. It captures information about nannies, daycare facilities, and …