Non-citizen US residents and those earning income in the US must file Form 1040-NR, the US Nonresident Alien Income Tax Return. This article explains who needs to file such a form, who is considered a nonresident alien, taxes non-citizens pay in the US, and filing timelines.

What is Form 1040-NR?

Form 1040-NR is an IRS income tax return that nonresident aliens must file if they earned income during the tax year from U.S. sources. It is also required for representatives of estates or trusts as well as representatives of deceased persons. This form is particularly important for nonresidents who wish to modify visa terms. It is used to calculate taxes owed or refunds issued, depending on the amount of taxes withheld from the nonresident alien’s income. Qualifying nonresident aliens must meet either the green card test or the substantial presence test to determine their residency status for the tax year. File Form 1040-NR by June 15th each year, and e-filing is an option.

IRS Form 1040-NR – Who Needs to Fill It Out?

Form 1040-NR is a tax return required by nonresident aliens from the IRS who have earned taxable income in the United States and/or have special taxes due, such as alternative minimum tax or employment taxes. Generally, nonresidents are non-U.S. citizens who fail to meet the green card test or the substantial presence test. Factors such as engaging in a business in the U.S. or having income from U.S. sources may make this form necessary, and it is important for those who plan to reenter the U.S. to complete this form. E-filing for 1040-NR became available in 2017 and the form must be filed by June 15th of each year.

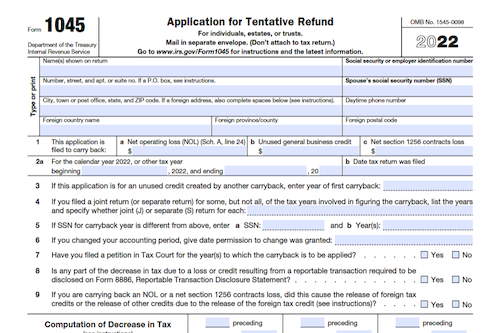

Step-by-Step: Form 1040-NR Instructions For Filling Out the Document

Filing Form 1040-NR is essential for nonresident aliens engaged in business in the United States or otherwise earning income from U.S. sources. It is also important for anyone who needs to modify their visa terms upon reentry to the United States. To know if you need to file Form 1040-NR, determine if you meet the criteria for being a nonresident alien—which typically involves passing either the green card test or the substantial presence test. If you do need to file Form 1040-NR, you can do so online. Generally, it must be submitted by June 15th of each year.

Below, we present a table that will help you understand how to fill out Form 1040-NR.

| Information | Details |

|---|---|

| Purpose of Filing Form 1040-NR | – For nonresident aliens doing business in the U.S. or earning income from U.S. sources. |

| – Required for visa modification upon reentry to the U.S. | |

| Criteria for Filing Form 1040-NR | – Determine nonresident alien status by: |

| – Passing the green card test. | |

| – Meeting the substantial presence test. | |

| Filing Deadline | – Generally, Form 1040-NR must be submitted by June 15th each year. |

| Filing Method | – Can be filed online. |

Do You Need to File Form 1040-NR Each Year?

Do You Need to File Form 1040-NR Each Year? Generally, nonresident aliens who fail to meet either the green card test or the substantial presence test must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return, each year if they have income subject to tax in the United States, such as wages, dividends, and so on. Depending on your status, you may also need to file Form 1040-NR if you owe special taxes, received distributions from an HSA, or are a representative of a deceased person. Form 1040-NR is usually due by June 15th of each year and can be e-filed if necessary.

Download the official IRS Form 1040-NR PDF

On the official IRS website, you will find a link to download Form 1040-NR: U.S. Nonresident Alien Income Tax Return. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1040-NR

Sources:

https://www.irs.gov/forms-pubs/about-form-1040-nr

https://www.irs.gov/instructions/i1040nr