Form 8938 is the form you will have to complete to report specified foreign financial assets, if you are a specified individual or a specified domestic entity. It requires you …

Form 8960: Net Investment Income Tax Individuals, Estates, and Trusts

For U.S. citizens and residents, filing Form 8960 is necessary if their modified adjusted gross income (MAGI) exceeds a certain threshold, in order to determine their Net Investment Income Tax …

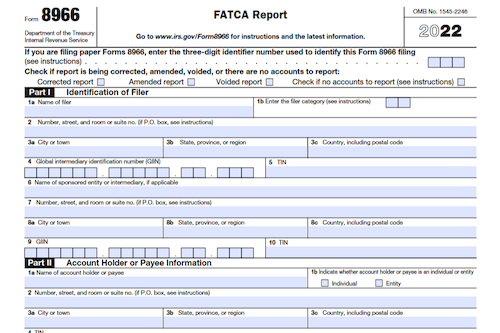

Form 8966: FATCA Report

Form 8966 is required to be filed for the 2022 calendar year by March 31, 2023. The filing requirement applies to a variety of entities such as PFFIs, U.S. branches, …

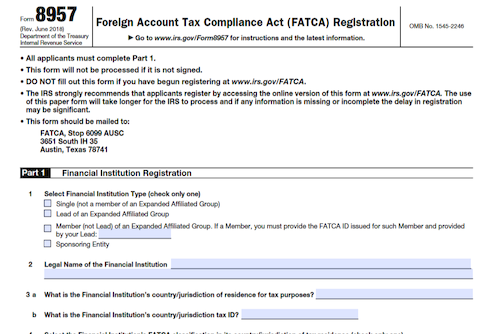

Form 8957: Foreign Account Tax Compliance Act (FATCA) Registration

This article outlines the instructions for registering as a Financial Institution under FATCA, including the FI’s jurisdiction of residence for tax purposes, FATCA classification, mailing address, and information on designating …

Form 8959: Additional Medicare Tax

Form 8959 is used to figure the amount of Additional Medicare Tax owed with any of the six specified returns, which applies to wages, Railroad Retirement Tax Act (RRTA) compensation, …

Form 6069: Return of Excise Tax on Excess Contributions to Black Lung Benefit Trust Under Section 4953 and Computation of Section 192 Deduction

With the Black Lung Benefits Revenue Act of 1977, those responsible for black lung benefit trusts and coal mine operators must file Form 6069 by the 15th day of the …

Form 8621: Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund

A U.S. person may be required to file Form 8621 with the Internal Revenue Service to report information with respect to their ownership of a Passive Foreign Investment Corporation (PFIC), …

Form 8615: Tax for Certain Children Who Have Unearned Income

With unearned income over $2,300, parents must use Form 8615 to figure the child’s taxes if the parent’s rate is higher than the child’s. To do this, parents must understand …

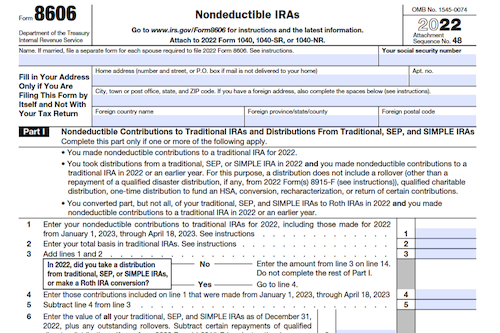

Form 8606: Nondeductible IRAs

Form 8606 is an important document used for reporting nondeductible contributions to traditional IRAs, distributions from IRAs, conversions from IRAs to Roth IRAs, and distributions from Roth IRAs. Learn who …

Form 8582: Passive Activity Loss Limitations

With new Treasury Decisions (T.D.) introduced on March 22, 2021, the IRS has revised certain rules on loss limitation and real property trade or business for noncorporate taxpayers for tax …

Form 8594: Asset Acquisition Statement Under Section 1060

When a trade or business is sold, the transaction must be reported to the IRS by the buyer and seller using Form 8594. This article covers the reporting requirements, penalties, …

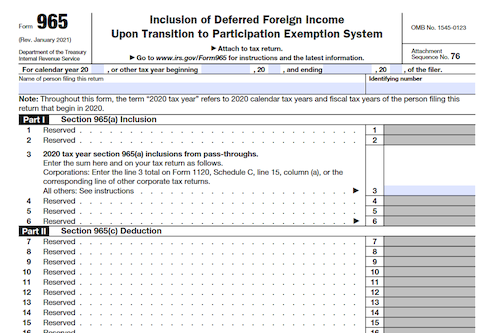

Form 965: Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System

U.S. persons required to report their section 965(a) inclusions, section 965(c) deductions, and applicable percentage for disallowance of foreign taxes for their 2020 tax year must complete Form 965 and, …

Form 8582-CR: Passive Activity Credit Limitations

Lead: Form 8582-CR is used to figure the amount of any passive activity credit, as well as to make the election to increase the basis of credit property, for noncorporate …

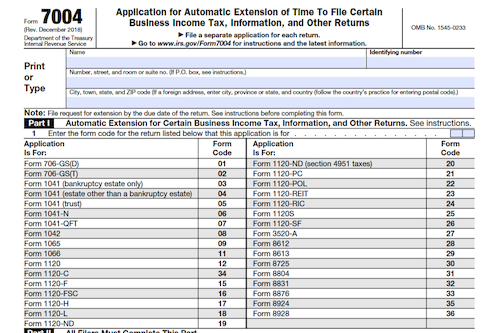

Form 7004: Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns

Form 7004 is used to request an automatic extension of time to file certain business income tax, information, and other returns. Properly filing Form 7004 will give you the maximum …

Form CT-1: Employer’s Annual Railroad Retirement Tax Return

This article provides detailed instructions on Form CT-1, which is used to report taxes imposed by the Railroad Retirement Tax Act (RRTA). It explains who must file Form CT-1, how …

Form 8027: Employer’s Annual Information Return of Tip Income and Allocated Tips

Employers who operate a large food or beverage establishment must file Form 8027 to report annual receipts and tips from customers, as well as allocated tips for tipped employees. This …

Form 943-PR: Employer’s Annual Tax Return for Agricultural Employees (Puerto Rican Version)

For employers with domestic employees, agricultural workers, and/or H-2A visa holders working in Puerto Rico, Form 943-PR, Employer’s Annual Federal Tax Return for Agricultural Employees, must be filed with the …

Form W-8 EXP: Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting

As of January 2017, IRS has updated instructions for Form W-8EXP, regarding foreign Taxpayer Identification Numbers (TINs) and use of electronic signatures. What is Form W-8 EXP? Form W-8EXP is …

Form 944-X: Adjusted Employer’s Annual Federal Tax Return or Claim for Refund

When you discover an error on a previously filed Form 944, use Form 944-X to make corrections on wages, tips, other compensation, tax withheld, tax credits and to request a …

Form 945-X: Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund

This article outlines the requirements for correcting administrative errors on a previously filed Form 945, including when to use the adjustment or claim processes, the applicable deadline, and filing instructions. …