For U.S. citizens and residents, filing Form 8960 is necessary if their modified adjusted gross income (MAGI) exceeds a certain threshold, in order to determine their Net Investment Income Tax (NIIT). Estates and trusts, as well as dual-status and nonresident individuals, may also need to file Form 8960, with various applicable rules and thresholds for each.

What is Form 8960?

Form 8960 is used to figure the amount of your Net Investment Income Tax (NIIT), when your modified adjusted gross income (MAGI) is greater than the applicable threshold amount. For individuals, this tax is 3.8% of the smaller of MAGI or net investment income. MAGI thresholds vary based on filing status. Estates and trusts are subject to the NIIT if content of undistributed net investment income and AGI are over the threshold amount. Nonresidents, dual-residents, and dual-status individuals have special rules to consider. Joint return elections with nonresidents are also an option. Certain trusts and estates are not subject to the NIIT. Special rules apply to qualified funeral trusts (QFTs) and electing small business trusts (ESBTs). Bankruptcy estates of an individual act as a single individual for purposes of the NIIT. Distributions from foreign estates and trusts must be included in net investment income when included in AGI. Recordkeeping is essential for the NIIT, as the tax has different treatment for investment income and investment expenses than the regular tax.

IRS Form 8960 – Who Needs to Fill It Out?

Individuals who have Modified Adjusted Gross Income (MAGI) that is greater than the applicable threshold amount, as well as net investment income, must complete Form 8960 to figure the amount of their Net Investment Income Tax (NIIT). Examples of excluded items include wages, unemployment compensation, Alaska Permanent Fund Dividends, and Social Security benefits. Estates and trusts that have undistributed net investment income and Adjusted Gross Income (AGI) in excess of the threshold must also complete Form 8960. For qualified funerals trusts (QFTs), each beneficiary’s interest in the contract is treated as a separate trust. For electing small business trusts (ESBTs), special computational rules apply. Lastly, distributions of income from foreign estates and foreign trusts, with some exceptions, must also be considered in the net investment income calculation.

Step-by-Step: Form 8960 Instructions For Filling Out the Document

Following the instructions on Form 8960, U.S. citizens and residents with Modified Adjusted Gross Income (MAGI) above the applicable threshold amount and net investment income must file and use the form to figure the amount of their Net Investment Income Tax (NIIT). Examples of excluded items are wages, Alaska Permanent Fund Dividends, annuities, Social Security benefits, income from qualified retirement plan distributions, and income subject to self-employment taxes. Those married to Nonresident Aliens (NRAs) use the filing status of Married Filing Separately to determine thresholds, but can elect to file jointly with an NRA for NIIT purposes. Estates, Trusts, and certain Foreign Entities must also adhere to specific rules. Keep all records and worksheets that show how you calculated the NIIT, as they need to be kept for the entire life of the investment in order to do carrybacks and carryforwards.

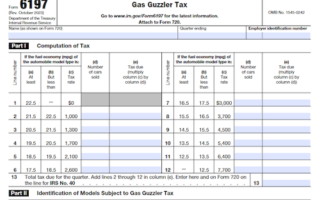

Below, we present a table that will help you understand how to fill out Form 8960.

| Form 8960 | Instructions |

|---|---|

| Following the instructions on Form 8960, U.S. citizens and residents with Modified Adjusted Gross Income (MAGI) above the applicable threshold amount and net investment income must file and use the form to figure the amount of their Net Investment Income Tax (NIIT). |

|

Do You Need to File Form 8960 Each Year?

If you are a U.S. citizen or resident and your modified adjusted gross income (MAGI) is greater than the applicable threshold amount, you must file Form 8960 in order to calculate the amount of your Net Investment Income Tax (NIIT). Depending on your filing status, the applicable threshold amount is $250,000 (if Married Filing Jointly or Qualifying Widow(er)), $125,000 (if Married Filing Separately), or $200,000 (if Single or Head of Household). Nonresidents are not subject to the NIIT, but dual-status individuals are subject only for the portion of the year they are U.S. residents. Certain domestic estates and trusts may also be subject to the NIIT and there are special computational rules depending on the type of trust.

Download the official IRS Form 8960 PDF

On the official IRS website, you will find a link to download Form 8960. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8960

Sources: