This article outlines the instructions for registering as a Financial Institution under FATCA, including the FI’s jurisdiction of residence for tax purposes, FATCA classification, mailing address, and information on designating a Responsible Officer or Point of Contact to handle FATCA-related activities.

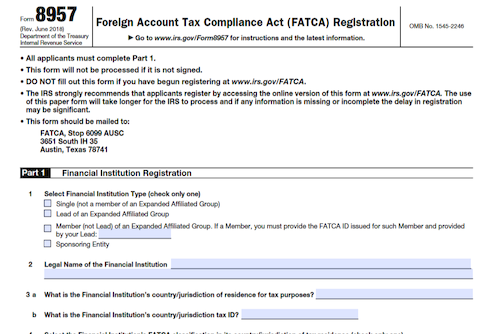

What is Form 8957?

The form must be completed by a Direct Reporting NFFE, a Single FI, a Lead FI, a Sponsoring Entity, or a trustee of a Trustee-Documented Trust when registering for either PFFI or RDCFFI status. It includes specific information such as the FI’s jurisdiction of residence, FATCA classification, mailing address, and the name and contact information of the Responsible Officer and appointed Point of Contact. This form must be fully completed and submitted online in order to be accepted by the IRS.

IRS Form 8957 – Who Needs to Fill It Out?

Form 8957 needs to be filled out by a Financial Institution (“FI”) for purposes of registration as a Participating Foreign Financial Institution, a Registered Deemed-Compliant Foreign Financial Institution, a Reporting Foreign Financial Institution (“Reporting FI”) under a Model 1 IGA, a Sponsoring Entity, a Trustee-Documented Trust, or a Direct Reporting Non-Financial Foreign Entity. Depending on the registration type, the FI will need to provide its personal details, including its jurisdiction of tax residence, FATCA classification in such jurisdiction, mailing address, and details about its branches, if any. Additionally, the FI needs to provide the name, title, address, and contact information of its Responsible Officer (“RO”) – someone with authority to act on behalf of the FI to represent its FATCA status – as well as the option to appoint one or more Point of Contact (“POC”), other than the RO, to receive FATCA related information from the IRS.

Step-by-Step: Form 8957 Instructions For Filling Out the Document

Begin by checking the box applicable to the FI’s status on Line 1, then include its legal name and tax ID on Lines 2 and 3b, respectively. Line 4 is where the FATCA classification is determined; Definitions must be referenced to ensure accuracy. Lines 5-7 ask questions about the FI’s branches, QI Agreement and its status as a Trustee. Line 8 must be checked “Yes” if the FI is a US resident or maintains a branch in the US, while Line 9 provides separate identifications for each jurisdiction with a branch outside the US. The Responsible Officer’s name, title, address, and contact information must be provided on Line 10; an additional POC, if applicable, is identified on Line 11a.

Below, we present a table that will help you understand how to fill out Form 8957.

| Form 8957 | Instructions |

|---|---|

| Instructions for Form 8957 involve providing specific information about the FI’s status, legal name, tax ID, FATCA classification, branches, QI Agreement, and more. |

|

Do You Need to File Form 8957 Each Year?

Yes, every FI must file the Registration Form each year in order to maintain its FATCA classification and keep its registration information up to date. Line 4 of the registration form requires you to select the FATCA classification applicable to your jurisdiction of tax residence. You must provide the legal name, tax ID and mailing address of the FI in the corresponding boxes (Lines 2-5). Additionally, if you are a party to a QI, WP or WT Agreement, you should respond “yes” on line 6 and provide the corresponding EIN. If the FI maintains a branch outside of its jurisdiction of tax residence, you must select “yes” on line 7 and provide the EIN and jurisdiction of the U.S. branch, if applicable, on line 8.

Download the official IRS Form 8957 PDF

On the official IRS website, you will find a link to download Form 8957. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8957

Sources: