IRS Form W-3 is an important summary transmittal tax form businesses must file with federal agencies along with annual wage and tax forms for employees. It compiles employee salaries and wages, along with federal withholding from their pay, into one full report.

What is Form W-3?

IRS Form W-3 is a summary transmittal tax form completed by businesses for all their employees, which includes totals of information from the accompanying W-2 Forms. Employers must file this form with the Social Security Administration, and it includes information on salaries, wages, commissions, and federal withholdings. To complete Form W-3, businesses must add or transfer information from the employee’s W-2 Forms into the corresponding boxes of the W-3 Form. Businesses paying independent contractors must also file Form 1096 with the IRS for all 1099-MISC forms distributed to non-employees. The due date for both Forms W-3 and 1096 is the last day of January after the tax year they are reporting on, though extensions are available.

IRS Form W-3 – Who Needs to Fill It Out?

IRS Form W-3 and 1096 are mandatory forms for any business that pays employees or non-employees. Form W-3 collects all the information from employee W-2 forms and compiles them into one document, while Form 1096 is a compilation report that totals all of the information from 1099-MISC forms given to non-employees. These forms must be accurately filled out and submitted to the Social Security Administration (W-3 & W-2 forms) or the IRS (1096 & 1099-MISC forms) to report employee pay, including salaries, wages, commissions, and tips. Businesses with over 250 of the same report are required to e-file the forms through the SSA’s Business Services Online, and beginning in 2021, businesses filing over 100 W-2s and 10 or more of any one type of report will also be required to e-file. The due date for these reports falls the year after the tax year, but a 30-day extension may be granted if needed. Consult with a tax professional for all the latest tax advice.

Step-by-Step: Form W-3 Instructions For Filling Out the Document

Filling out Forms W-3 and 1096 can be complicated. All businesses must file Form W-3 with the Social Security Administration if they pay employees and Form 1096, along with 1099-MISC forms, if they pay independent contractors. This requires both paper filing and electronic filing depending on the number of forms one has to submit. The W-3 form is a summary of all the information found on the W-2 forms and 1096 mirrors the details of 1099-MISC forms for non-employees. When filling out the documents, make sure to check the box for the correct type of form, total the information for each box, and enter the information in the corresponding box on the W-3 form. It is important to send in the forms to the correct address and keep copies for yourself. With late filing being fined, always double-check the date on the form and be familiar with the due dates which change year by year. Additionally, be sure to know how to file Form W-2c and W-3c if errors occur.

Below, we present a table that will help you understand how to fill out Form W-3.

| Form | Description |

|---|---|

| Form W-3 | Summary of information from W-2 forms |

| Form 1096 | Summary of information from 1099-MISC forms for non-employees |

| Filing Requirement | Depends on whether you pay employees or independent contractors |

| Filing Methods | Paper filing and electronic filing |

| Checking Correct Type | Check the correct form type |

| Totaling Information | Total the information for each box |

| Entering Information | Enter the information on the corresponding W-3 box |

| Address | Send forms to the correct address and keep copies |

| Due Dates | Be familiar with changing due dates |

| Error Correction | Know how to file Form W-2c and W-3c for errors |

Do You Need to File Form W-3 Each Year?

Each year, businesses that pay employees are required to file IRS Form W-3—a summary transmittal tax form—along with their annual wage and tax forms for each employee. For businesses that pay independent contractors, Form 1096 compiles information from Form 1099-MISC and must be filed as well. Form W-3 provides the IRS and Social Security Administration (SSA) with all employee pay information such as salaries, wages, commissions, and tips, plus federal withholding from their pay. The due date for these forms is January 31 each year and can be filed both electronically or as a paper copy. Filing mistakes are easily fixed with Form W-2c to adjust employee W-2s and W-3c to adjust the summary W-3, and Form 1096 for errors on Form 1099-MISC. It is important to stay aware of changing tax laws and consult a tax professional for advice.

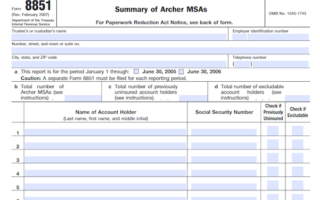

Download the official IRS Form W-3 PDF

Want to get the IRS Form W-3? On the official IRS website, you will find a link to download Form W-3. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form W-3

Sources:

https://www.irs.gov/forms-pubs/about-form-w-3

https://www.irs.gov/instructions/iw2w3