Form 8991 is used to determine an applicable taxpayer’s base erosion minimum tax amount based on their base erosion percentage, modified taxable income, and regular tax liability. Taxpayers must consider definitions of base erosion payments, base erosion tax benefits, and applicable section 38 credits when determining the amount.

What is Form 8991?

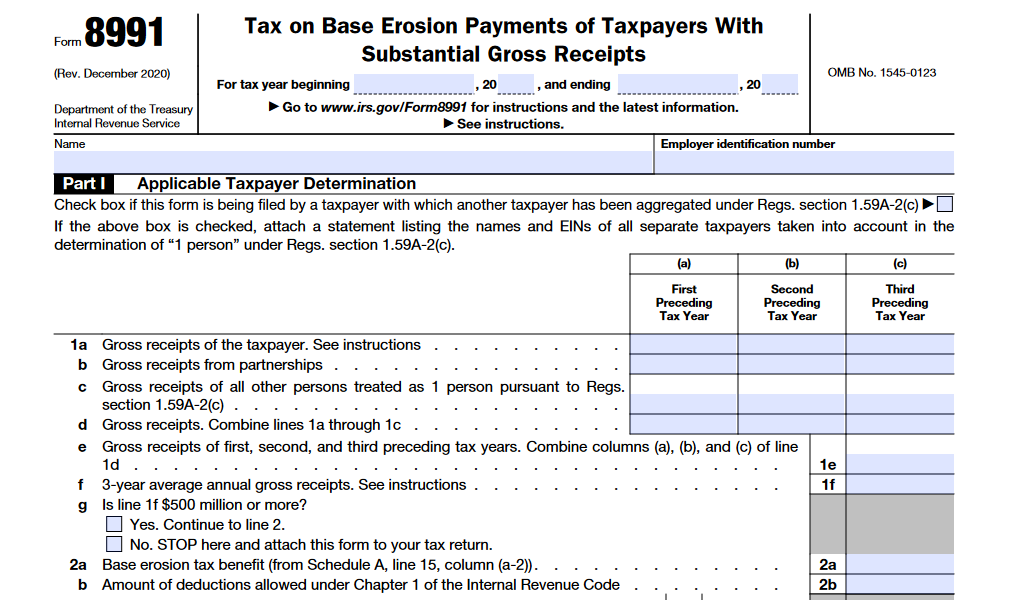

Form 8991 is used to determine a taxpayer’s base erosion minimum tax amount for the year. The form comprises of Schedules A, B, and C to determine the amount of base erosion payments, taxpayer’s base erosion percentage, and credits that reduce regular tax liability respectively. It also applies definitions like applicable taxpayer, base erosion minimum tax amount, base erosion payment etc. Any corporation that has aggregate gross receipts of at least $500 million in 1 or more of the 3 preceding tax years ending with the preceding tax year must file Form 8991. Schedules A, B, and C must be filled out in order to calculate the amount and Form 8991 should be attached to your income tax return and by the due date (including extensions) for that return.

IRS Form 8991 – Who Needs to Fill It Out?

Form 8991 is required to be filled out by any corporation, other than a RIC, REIT, or an S corporation, that has had a total of $500 million or more in gross receipts in the preceding 3 tax years ending with the preceding tax year. It is used to determine one’s base erosion minimum tax amount, determine base erosion payments and tax benefits, report deductions that are being waived, and determine credits that will reduce regular tax liability in computing the base erosion minimum tax amount. This form should be attached to one’s income tax return and filed by the due date (including extensions).

Step-by-Step: Form 8991 Instructions For Filling Out the Document

Completing Form 8991, used to determine a taxpayer’s base erosion minimum tax amount for the year, requires several steps. First, use Schedule A to determine the amount of base erosion payments and base erosion tax benefits. Then, use Schedule B to report the amount of deductions waived for the tax year. Third, use Schedule C to determine credits that reduce regular tax liability. It’s important to know applicable provisions, such as definitions for an applicable taxpayer, base erosion minimum tax amount, base erosion payment, related party, and base erosion tax benefit. Finally, base erosion percentage and modified taxable income must also be determined, as well as understanding the aggregation rules and filing requirements for those with $500 million or more in aggregate gross receipts.

Below, we present a table that will help you understand how to fill out Form 8991.

| Form 8991 | Instructions |

|---|---|

| Completing Form 8991, used to determine a taxpayer’s base erosion minimum tax amount for the year, requires several steps. First, use Schedule A to determine the amount of base erosion payments and base erosion tax benefits. Then, use Schedule B to report the amount of deductions waived for the tax year. Third, use Schedule C to determine credits that reduce regular tax liability. It’s important to know applicable provisions, such as definitions for an applicable taxpayer, base erosion minimum tax amount, base erosion payment, related party, and base erosion tax benefit. Finally, base erosion percentage and modified taxable income must also be determined, as well as understanding the aggregation rules and filing requirements for those with $500 million or more in aggregate gross receipts. |

|

Do You Need to File Form 8991 Each Year?

Any corporation, other than a RIC, a REIT, or an S corporation, with aggregate gross receipts of at least $500 million in 1 or more of the 3 preceding tax years ending with the preceding tax year must file Form 8991 each year. It is attached to the income tax return (or, if applicable, exempt organization business income tax return) and filed by the due date (including extensions). Questions/items in Schedule K, Form 1120, Form 1120-F, Schedule M, Form 1120-L, Schedule I, Form 1120-PC, and Schedule K, Form 1120-C can be used to determine if gross receipts are at least $500 million.

Download the official IRS Form 8991 PDF

On the official IRS website, you will find a link to download Form 8991. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8991

Sources: