Individuals adversely affected by a 2017 disaster who received a qualifying distribution may need to file Form 8915-B to report repayments of qualified 2017 disaster distributions made in 2021.

What is Form 8915-B?

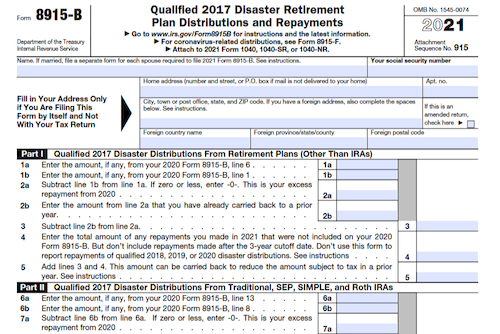

Form 8915-B is used to report repayments of qualified 2017 disaster distributions made in 2021, which cannot be made in 2021. Part I of the form is used for repayments from retirement plans not including IRAs, and Part II is used for repayments from IRAs. It should be filed with the 2021 Form 1040, 1040-SR, or 1040-NR or, if not required to file an income tax return, sent to the IRS at the same time and place as if filing a 1040, 1040-SR, or 1040-NR. Further details on what qualifies as a qualified 2017 disaster can be found in the 2018 Instructions for Form 8915-B.

IRS Form 8915-B – Who Needs to Fill It Out?

IRS Form 8915-B needs to be filled out by any individual who made a repayment of a qualified 2017 disaster distribution in 2021 that was not included on their 2020 Form 8915-B. This form should be filed with their 2021 Form 1040, 1040-SR, or 1040-NR or sent to the IRS at the same time and place they would normally file. Anyone seeking more details on this qualified 2017 disaster distributions should see the 2018 Instructions for Form 8915B.

Step-by-Step: Form 8915-B Instructions For Filling Out the Document

Filling out Form 8915-B is the first step for those who were negatively impacted by a 2017 disaster listed in the form and received a distribution that qualifies for favorable tax treatment. It is to be used to report repayments of qualified 2017 disaster distributions made in 2021 that were not included on the 2020 Form 8915-B. It must be filed for the 2021 tax year with your Form 1040, 1040-SR, or 1040-NR and contains two parts (I & II) for reporting repayments of distributions from retirement plans (other than IRAs) or IRAs, respectively. Instructions for completing the form can be found in the 2018 Instructions for Form 8915-B.

Below, we present a table that will help you understand how to fill out Form 8915-B.

| Information for Form 8915-B | Details |

|---|---|

| Report Qualified 2017 Disaster Distributions | Repayments of distributions made in 2021 |

| Disaster Affected | Check form for listed disasters |

| Parts I & II | For retirement plans and IRAs |

| Instructions | Refer to 2018 Instructions for Form 8915-B |

| Filing | With 2021 Form 1040, 1040-SR, or 1040-NR |

Do You Need to File Form 8915-B Each Year?

Yes! Individuals who made repayments of qualified 2017 disaster distributions in 2021 that were not included on their 2020 Form 8915-B must file Form 8915-B along with their 2021 Form 1040, 1040-SR, or 1040-NR. This form is also necessary for those who are not required to file a return, as Form 8915-B must be sent to the IRS at the same time one would have otherwise filed a 2021 tax return.

Download the official IRS Form 8915-B PDF

On the official IRS website, you will find a link to download Form 8915-B. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8915-B

Sources: