Federal executive agencies and their delegates must file Forms 8596 and 8596-A with the IRS each quarter to report federal contracts and increases in contract obligations. Special rules, exceptions, and instructions must be followed when filing.

What is Form 8596?

Form 8596 is a quarterly filing requirement issued by the Internal Revenue Service (IRS) to report Federal Executive Agency contracts. An FEA contract encompasses obligations such as purchases of property, services and other consideration for payments. A head of an FEA, or their delegate, must file Forms 8596 and 8596-A to report these contracts, even if the amount obligated is less than $25,000 or falls under any of the thirteen exceptions listed by the IRS. It is important to note that with some FEA contracts, increases in the amount owed that exceed $25,000 must also be reported separately, requiring a Form 8596 filing. Each quarter, agencies have until the end of the quarter to file these forms.

IRS Form 8596 – Who Needs to Fill It Out?

The head of every Federal executive agency or his or her delegate must file Forms 8596 and 8596-A quarterly to report federal contracts. This includes any executive, military, USPS, or Postal Rate Commission. If a subcontract is entered into by the SBA, the procuring agency needs to file instead. Certain contracts are exempt such as those for $25,000 or less or those lasting no longer than 120 days. There are also FPDC election and exceptions for certain contracts. Forms must be filed on the due dates listed within the form.

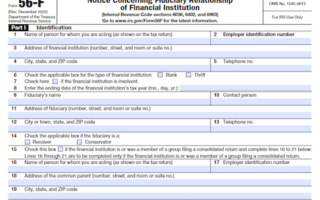

Step-by-Step: Form 8596 Instructions for Filling Out the Document

Filing Forms 8596 and 8596-A is a requirement for head of every Federal executive agency, their delegates, and other Federal executive agencies. All contracts that will take more than 120 days to pay must be reported, as well as contracts exceeding $25,000. The instructions to fill the document consist of entering the contractor and federal executive agency, date of contract action and completion, total amount obligated, and contract number. Forms 8596 and 8596-A must be filed on a quarterly basis, with the due dates ending on June 30, September 30, December 31, and March 31.

Below, we present a table that will help you understand how to fill out Forms 8596 and 8596-A.

| Information Required for Forms 8596 and 8596-A | Details |

|---|---|

| Use | Report contracts that will take more than 120 days to pay and contracts exceeding $25,000 |

| Filing Frequency | Must be filed on a quarterly basis, with due dates ending on June 30, September 30, December 31, and March 31 |

| Information | Enter contractor and federal executive agency, date of contract action and completion, total amount obligated, and contract number |

Do You Need to File Form 8596 Each Year?

Generally speaking, the head of every Federal executive agency or his or her delegate must file Forms 8596 and 8596-A quarterly to report federal contracts. Common exceptions include contracts with a value of less than $25,000, licenses granted by a Federal executive agency, contracts between Federal executive agencies, certain debt instruments, and certain confidential or classified contracts. Furthermore, agencies may elect for the Federal Procurement Data system to file Forms 8596 and 8596-A on their behalf. All due dates for filing are available via the IRS website.

Download the Official IRS Form 8596 PDF

On the official IRS website, you will find a link to download Form 8596. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8596

Sources: