Form 8950 is used to request written approval from the IRS for correcting a qualified plan, 403(b) plan, SEP, SARSEP, or SIMPLE IRA that failed to follow applicable requirements of the IRC. It is part of the Employee Plans Compliance Resolution System (EPCRS) set forth in Rev. Proc. 2021-30. Representatives may also use the form to request a pre-submission conference with the IRS regarding a potential VCP submission.

What is Form 8950?

Form 8950 is an application for requesting written approval from the IRS for correction of a qualified plan, 403(b) plan, SEP, SARSEP, or SIMPLE IRA that has failed to comply with the applicable requirements of the IRC. Eligible parties may include a plan sponsor, an eligible organization, or an authorized representative, and must comply with specific requirements such as completing Form 2848 to provide authorization for the VCP submission to be filed. To submit, use Pay.gov, along with selecting any applicable fees, and only non-paper forms or documents are accepted. Additionally, new for 2022, representatives may request a pre-submission conference with the IRS regarding a potential VCP submission.

IRS Form 8950- Who Needs to Fill It Out?

Form 8950 must be filled out and submitted through Pay.gov as part of a VCP submission in order to receive written approval from the IRS to correct a qualified plan, 403(b) plan, SEP, SARSEP, or SIMPLE IRA that has failed to comply with the applicable IRC requirements. Generally, the VCP is open to eligible parties such as employers, plan administrators, and court-appointed representatives and is not available for the diversion or misuse of plan assets. Representatives of plan sponsors may file with proper authorization including Form 2848. Beginning January 1, 2022, representatives may make a written request for a pre-submission conference with the IRS to discuss a potential VCP submission on an anonymous basis. Anonymous submissions are otherwise not permitted. Eligible organizations can make group submissions under certain circumstances too. All Forms 8950 and related VCP submission documents must be filed electronically with Pay.gov and a user fee must be paid at the time of filing.

Step-by-Step: Form 8950 Instructions For Filling Out the Document

Form 8950 is part of a VCP submission required for requesting written approval from the IRS for correcting a qualified plan, 403(b) plan, SEP, SARSEP, or SIMPLE IRA that has failed to comply with the applicable IRC requirements. The VCP is open to certain tax-favored retirement plans, with sole proprietors, partnerships, or corporations authorized to file. Additionally, pre-submission conferences can be scheduled and an authorized representative may submit a signed Form 2848 with the VCP submission if requested. VCP user fees must be paid via Pay.gov, and it is important to follow the instructions provided in the form and related VCP submission documents in order to ensure that make a successful submission.

Below, we present a table that will help you understand how to fill out Form 8950.

| Key Information for Form 8950 | Details |

|---|---|

| Purpose | For requesting IRS approval to correct certain retirement plan compliance failures |

| Eligibility | Open to certain tax-favored retirement plans, including sole proprietors, partnerships, and corporations |

| Submission | File via Pay.gov, follow form and submission instructions |

Do You Need to File Form 8950 Each Year?

Form 8950 must be filed in order to use the Voluntary Correction Program (VCP) for eligible retirement plans. This form should be filed using Pay.gov along with all accompanying documents as outlined in Rev. Proc. 2021-30. In order to file, employers and plan sponsors must provide a declaration and authorization form, and in certain cases a representative of the plan sponsor may be authorized to submit the form. For large groupings of individual plans, an eligible organization may make a group submission, but user fees still apply. Form 8950 and all related documents must be filed electronically via IRS.gov/Form8950 or Pay.gov and pre-submission conferences can be requested as of January 1, 2022.

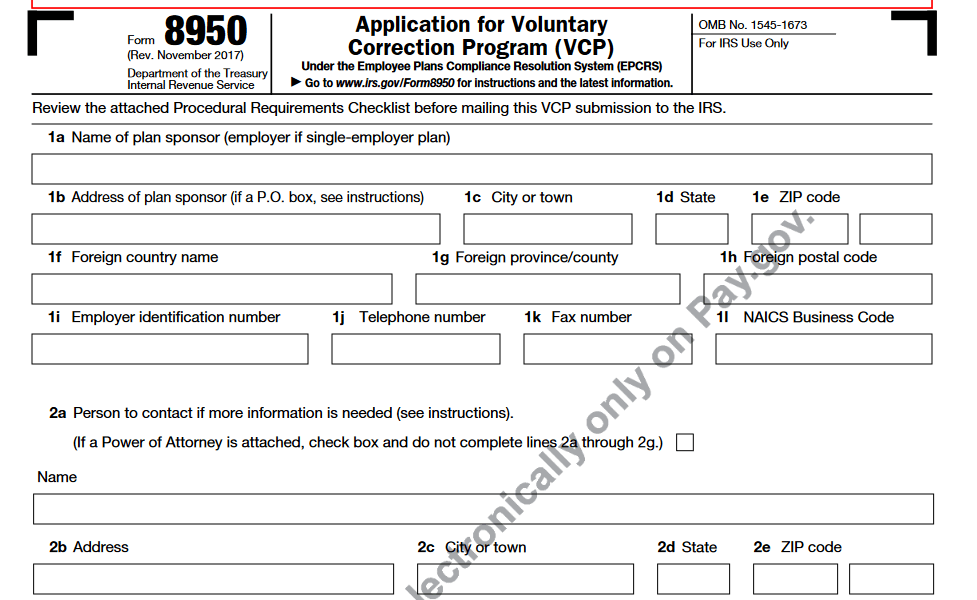

Official IRS Form 8950

Form 8950 can only be submitted electronically through Pay.gov.

Sources: