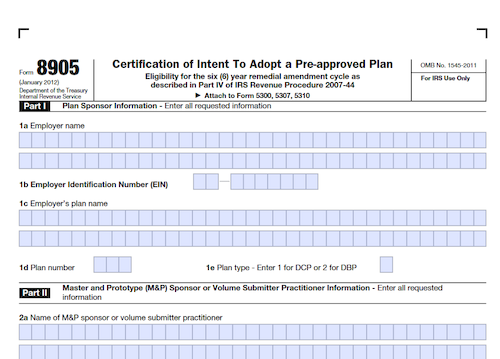

Form 8905 is used by an adopter of an individually designed or pre-approved plan to request that their 5-year remedial amendment cycle be converted to the 6-year cycle, as described in Rev. Proc. 2007-44. This form must be completed before the end of the employer’s applicable 5-year remedial amendment cycle.

What is Form 8905?

Form 8905 allows employers to take advantage of a 6-year remedial amendment cycle for pre-approved plans or individually designed plans, when they would otherwise be stuck with a 5-year remedial amendment cycle. The form must be filed before the end of the employer’s 5-year cycle, and must contain the employer’s plan name, EIN, the M&P sponsor or volume submitter practitioner’s name and EIN, and the name of the plan being adopted. Additionally, both the employer and M&P sponsor or volume submitter practitioner must sign and date the certification before the end of the 5-year cycle, using their respective forms of manual or electronic signature.

IRS Form 8905 – Who Needs to Fill It Out?

The IRS Form 8905 must be completed by any adopter of an individually designed plan or pre-approved plan that wishes to convert their current 5-year remedial amendment cycle to a 6-year cycle as described under Rev. Proc. 2007-44. Before completing the form, the employer should identify their 9-digit EIN and plan information pon Line 1. On Line 2, the M&P sponsor of the volume submitter practitioner must include their name, EIN, and the name of the M&P plan or specimen plan being adopted. The employer and M&P sponsor or practitioner must then certify their information and sign and date the form before the end of the employer’s 5-year remedial amendment cycle (as shown on Line 4). Scanned or stamped signatures are unacceptable for the employer certification; however, the M&P sponsor and the volume submitter practitioner may use a stamped, scanned, or electronic signature.

Step-by-Step: Form 8905 Instructions For Filling Out the Document

Form 8905 allows employers to receive the 6-year remedial amendment cycle benefit under Part IV of Rev.Proc. 2007-44, providing the employer is not entitled to the 6-year cycle under another provision. To file, employers must complete the form before the end of their 5-year remedial amendment cycle as determined under Part III of Rev. Proc. 2007-44. The completed form must be attached to one of three applications – Form 5300, Form 5307, or Form 5310 – and the employer must have the form manually signed and dated. Furthermore, the M&P sponsor or volume submitter practitioner must have their signature stamped, scanned, or electronically authorized. Lastly, the employer must enter the date by which the opinion or advisory letter application for the M&P plan or volume submitter specimen plan was or must be submitted as determined by Rev. Proc. 2007-44.

Below, we present a table that will help you understand how to fill out Form 8905.

| Information Required for Form 8905 | Details |

|---|---|

| Filing Deadline | File before the end of the 5-year remedial amendment cycle |

| Attachment | Attach to Form 5300, Form 5307, or Form 5310 |

| Signature | Must be manually signed and dated |

| Date Requirement | Enter the date for the M&P plan or volume submitter application |

| Further Instructions | Refer to Form 8905 and Rev. Proc. 2007-44 for more details |

Do You Need to File Form 8905 Each Year?

No, you only need to file Form 8905 once, at the end of your 5-year remedial amendment cycle, as determined by Part III of Rev. Proc. 2007-44. The form must be signed and dated by both the employer and the pre-approved plan sponsor or practitioner before submission. The employer must manually sign the form, while signatures from the M&P sponsor or volume submitter practitioner may be stamped, scanned, or electronic. Attach and submit the completed Form 8905 to one of the applications listed in the instructions (Form 5300, Form 5307, or Form 5310). If no application is made, the employer should keep the Form 8905 in their records and not file it with the IRS.

Download the official IRS Form 8905 PDF

On the official IRS website, you will find a link to download Form 8905. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8905

Sources: