Submitting your tax return electronically can save you time, but there are times when you must also submit paper documents to the IRS. To do so, you’ll need to utilize Form 8453: U.S. Individual Income Tax Transmittal for an IRS e-file Return. Learn more about when and why you need to send this form.

What is Form 8453?

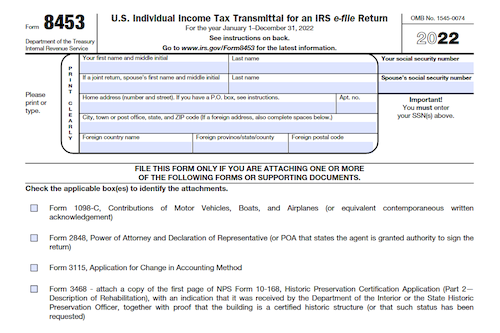

Form 8453, U.S. Individual Income Tax Transmittal, is a document required by the Internal Revenue Service (IRS) when certain forms or documents are needed to complete an e-file tax return. This form is completed online and signed before it is mailed to the IRS along with the appropriate forms and documents. Documents requiring this federal tax signature form include Form 1098-C, Form 2848, Form 3115, Form 3468, Form 4136, Form 5713, Form 8283, Form 8332, Form 8858, Form 8864, Form 8885, Form 8949, and more. It should be mailed within 48 hours of the IRS accepting the return to prevent any delays in processing.

IRS Form 8453 – Who Needs to Fill It Out?

IRS Form 8453 is required for taxpayers attaching certain forms or documents to their tax return when using e-file. These forms and documents include 1098-C, 2848, 3115, 3468, 4136, 5713, 8283, 8332, 8858, 8864, 8885, 8949 and more. The taxpayer should sign and mail Form 8453 at the end of the e-filing process, but within 48 hours of when the IRS accepted the return to ensure that their return is not delayed.

Step-by-Step: Form 8453 Instructions For Filling Out the Document

Filling out Form 8453 is a quick and easy step you need to take if you have accompanying forms and documents, such as Form 1098-C, Form 2848, Form 3115, Form 4136, and other forms, to submit with your return. Once your return is accepted by the IRS, simply print Form 8453, sign it, attach the forms and paperwork, and mail it in within 48 hours – this won’t delay the processing of your return. Following this step-by-step process ensures that your tax return is complete and accurate.

Below, we present a table that will help you understand how to fill out Form 8453.

| Forms and Documents | Instructions |

|---|---|

| Form 8453 | Fill out if you have accompanying forms and documents. |

| Form 1098-C | Submit with your return if applicable. |

| Form 2848 | Include if necessary. |

| Form 3115 | Attach if required. |

| Form 4136 | Complete and include if applicable. |

| Other forms | Check if any additional forms are required. |

Do You Need to File Form 8453 Each Year?

Yes, each year you must file Form 8453: U.S. Individual Income Tax Transmittal for an IRS e-file Return if you are submitting documents with Form 1098-C, Form 2848, Form 3115, Form 3468, Form 4136, Form 5713, Form 8283, Form 8332, Form 8858, Form 8864, Form 8885, Form 8949, or other such supporting paperwork. At the conclusion of your e-file process, sign your federal tax signature form and mail it to the IRS within 48 hours so it doesn’t hold up processing your return.

Download the official IRS Form 8453 PDF

On the official IRS website, you will find a link to download Form 8453. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8453

Sources: