Non-US sellers of US real estate are subject to a withholding tax at the time of sale, but the tax often exceeds the actual federal income tax owed by the foreign seller. With help from experienced tax professionals, non-US sellers may be able to recoup their excess withholding taxes with options such as a normal refund time or an 8288-B option, though careful steps must be taken with either option.

What is Form 8288-B?

Form 8288-B is an application for a withholding certificate available for non-US sellers of US real estate. It enables them to request the early release of extra withholding tax paid on their sale, which is generally 15% of gross sales price but often much larger than the actual federal income tax owed. If completed correctly, foreign sellers can receive their withholding tax back up to four months after sale. Otherwise, the IRS will keep the excess withholding tax, although experienced tax professionals like DIRECTS can help foreign sellers get their refund. Non-US sellers also have around 3-4 years after sale to successfully receive their refund, making refunds for prior year sales still available years after they were sold.

IRS Form 8288-B – Who Needs to Fill It Out?

Non-US sellers of US real estate who have had tax withheld from the sale of their property must fill out this form in order to be eligible for a refund. The form proves to the IRS the seller made only a certain amount of profit and owe only a certain amount of tax. Taking the appropriate steps and filing Form 8288-B correctly can enable a foreign seller to receive their refund much sooner than with the normal refund time process, which can take up to 18 months after sale. Those who do not fill out the form correctly may never receive their refund, so it is important to get help from experienced tax professionals like those at DIRECTS. Finally, non-US sellers have up to 3 to 4 years after the sale to apply for the refund of excess withholding tax.

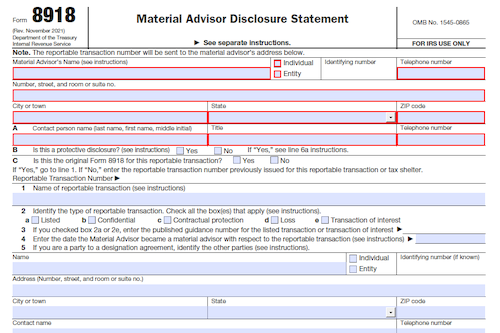

Step-by-Step: Form 8288-B Instructions For Filling Out the Document

Filling out the form for a refund of excess withholding tax (Form 8288-B) could seem tricky to a foreign seller, but it doesn’t have to be. By following the right steps, with help from experienced tax professionals like those at DIRECTS, foreign sellers can receive their funds quickly within 3-4 months after the initial sale. Rest assured, even if the proper steps to obtain a refund weren’t taken at the time of sale, sellers will still have several years after the sale to receive their refund, as long as they have followed the right procedure. Furthermore, having someone experienced in these types of situations and knowledgeable about the IRS’ regulations would increase the chances of a successful withholding tax refund.

Below, we present a table that will help you understand how to fill out Form 8288-B.

| Information Required for Form 8288-B | Details |

|---|---|

| Refund Process | Follow the right steps to obtain a refund |

| Timeframe for Refund | Sellers have several years to receive their refund |

| Expert Assistance | Having experienced tax professionals can help |

Do You Need to File Form 8288-B Each Year?

No, filing Form 8288-B, which is used to apply for a refund of the excess withholding tax, to obtain a withholding certificate from the IRS, is only necessary when you sell US real estate. Taxpayers have 3 to 4 years after a sale to successfully receive their refund, and refunds for prior year’s sales remain available for years after the sale. The refund might take up to 18 months after the sale to arrive if using the normal refund process, but utilizing the 8288-B option and obtaining a withholding certificate is the quickest possible way to receive the refund. To make sure they receive their refund, non-US sellers need the help of experienced tax professionals such as those at DIRECTS.

Download the official IRS Form 8288-B PDF

On the official IRS website, you will find a link to download Form 8288-B. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8288-B

Sources: