IRS Form 4835 is a tax form used to report income and expenses for rental real estate, royalties, partnerships, S corporations, trusts, estates, and certain qualified joint ventures. It is an essential document for taxpayers to file accurate tax returns and can lead to reduced or eliminated taxes.

What is Form 4835?

Form 4835 is an important document used to report income and expense data for a variety of different entities. This form is an IRS requirement for partnerships, S corporations, trusts, estates, royalties, and rental real estate activities. Additionally, certain qualified joint ventures also use this document. All of the financial data is entered on the form to accurately report income and expense information to the IRS. With this form, businesses and individuals can ensure they are meeting their IRS tax requirements for these various types of entities.

IRS Form 4835 – Who Needs to Fill It Out?

IRS Form 4835 is necessary for anyone reporting income or expenses from rental real estate activities, royalties, partnerships, S corporations, trusts, and estates, and certain qualified joint ventures. All individuals, businesses, sole proprietorships, and other entities filling out the form should use the latest updated version to ensure accurate filing. Additionally, the form can also be used by estates, trusts, and S corporations to report their taxes due. Whether an entity is filing for the first time or needs to report new information, IRS Form 4835 is essential when reporting their financial activity.

Step-by-Step: Form 4835 Instructions For Filling Out the Document

Filing out Form 4835 is a multi-step process that requires you to accurately report income and expense from various sources, including rental real estate activities, royalties, partnerships, S corporations, trusts, and estates. Additionally, it includes income and expenses from certain qualified joint ventures. Be sure to take note of what type of income and expenses you need to include and provide all relevant information so that you can successfully complete the form. Make sure that everything you provide is accurate and up-to-date in order to avoid potential issues related to the form. Also, be sure to read any instructions provided by an individual state or the IRS if you are filing for taxes in different states so that you are compliant with their rules.

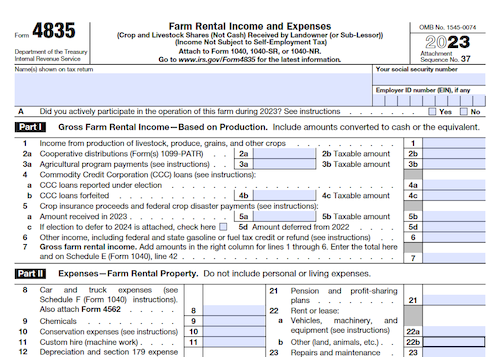

Below, we present a table that will help you understand how to fill out Form 4835.

| Information Required for Form 4835 | Details |

|---|---|

| Purpose of Form | Report income and expenses from various sources including rental real estate activities, royalties, partnerships, S corporations, trusts, estates, and certain joint ventures |

| Income and Expenses | Include income and expenses from specified sources, provide accurate and up-to-date information |

| State-Specific Rules | Read state and IRS instructions for compliance with relevant rules |

Do You Need to File Form 4835 Each Year?

FORM 4835 is required to file income and expenses from rental real estate activities, royalties, partnerships, S corporations, trusts, and estates. It is also used to report income and expenses from certain qualified joint ventures. Therefore, if you have earned or received income from any of the aforementioned sources, you must file FORM 4835 every year in order to report your income and expenses. Failure to do so may lead to penalties, so make sure to file your form each year to stay compliant with the IRS.

Download the official IRS Form 4835 PDF

On the official IRS website, you will find a link to download Form 4835. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 4835

Sources: